Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 8, 2026

February 13, 2014

At the risk of being criticized as unromantic (a label often used for us male CPAs), I want to offer one tip for those about to say “I do” this Valentine’s Day

February 13, 2014

Sales tax may be inevitable, but the hassle is not. With AvaTax, never again research taxing jurisdictions that apply to a location, and never again manually assign nexus, taxability or sourcing rules to ensure a correct calculation - all of that is done behind the scenes within your accounting application, automatically.

February 13, 2014

New final regulations issued on February 10, 2014 by the Treasury Department have postponed the employer mandate another year – until January 1, 2016 – for certain mid-sized employers.

February 13, 2014

A push to boost tax credits for the working poor could see success in states this year, echoing a key proposal from the White House.

February 13, 2014

The Internal Revenue Service is reminding taxpayers that phone calls to the agency's support center usually start to dramatically increase following the President's Day holiday, which is this weekend. There are other options for taxpayers who have questions, of course, starting with using a tax professional such as a CPA or Enrolled Agent.

February 13, 2014

As an IRS contact representative, Sherelle Pratt was tasked with tackling confused tax filers' most complicated questions.

February 13, 2014

New York Governor Andrew Cuomo said Tuesday that local control of minimum wage could lead to cannibalistic competition among New York communities that would hold back economic growth.

February 13, 2014

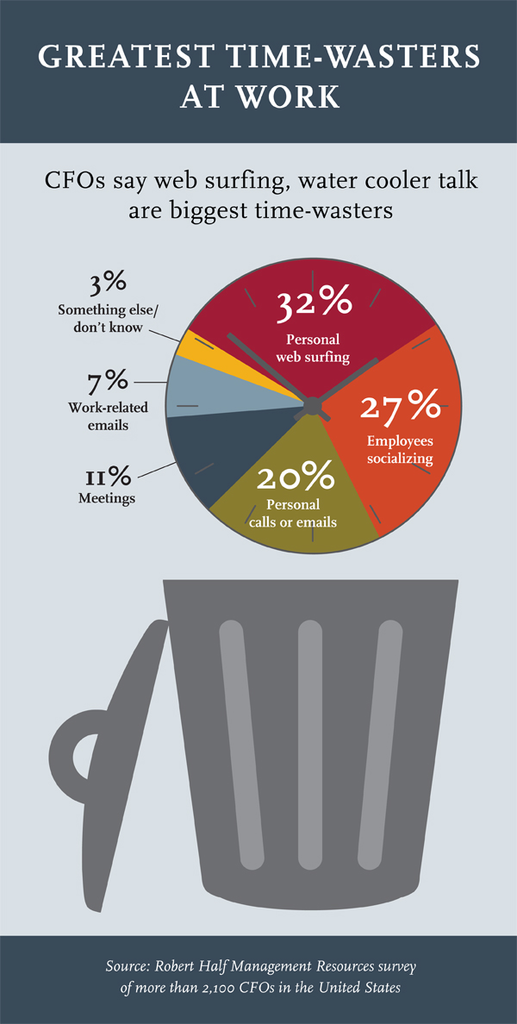

A new study by executive staffing firm Robert Half International shows that web surfing and water cooler chatter top the list when it comes to non-productive employee time at work.

February 13, 2014

A commission charged with reforming Washington, D.C.'s tax code will present recommendations to the D.C. Council that include cutting the income tax rate for middle-class earners and levying a fee on businesses that amounts to $100 per employee annually.

February 13, 2014

In the wake of a new report from the Congressional Budget Office (CBO) assessing the impact of Obamacare on employment, Republicans in Congress are renewing some objections to the controversial legislation and modifying others.

February 13, 2014

The specter of the dreaded new surtax on “net investment income” (NII) has turned into reality. For the first time ever, some upper-income taxpayers will have to pay the 3.8% surtax on their 2013 income tax returns. This could be a harrowing experience for some of your clients.

February 13, 2014

Partnering with CompuPay complements the services you already provide by giving your clients access to a trusted payroll provider to professionally manage the payroll process as well as a variety of related products such as Section 125, health plans and workers’ compensation insurance.