Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 13, 2026

February 13, 2026

March 28, 2014

Find out what the IRS is doing to combat identity theft and the first steps victims should take.

March 28, 2014

With about two weeks to go in tax filing season, the procrastinators are finally starting to contact your office. Usually, they’ve postponed the inevitable because they fear they’ll be entitled to only a miniscule refund or they will have to ante up to Uncle Sam.

March 28, 2014

The new IRS "Repair" regulations too effect on January 2014, but many businesses and accounting professionals may still need some guidance on how the new changes effect them or their clients. The national tax, consulting and forensic accounting firm Gettry Marcus has issued its interpretation and made the information available.

March 28, 2014

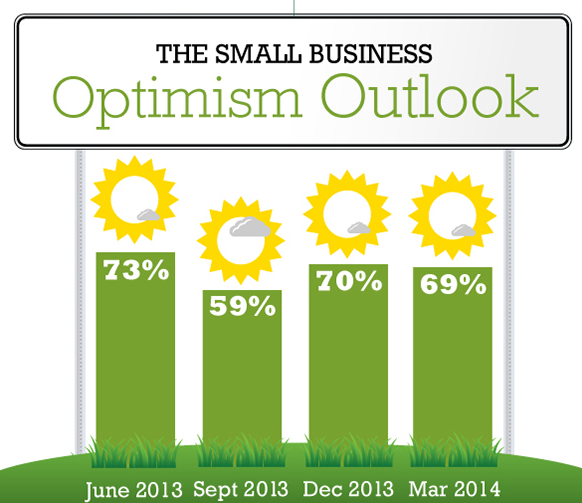

The first quarter of 2014 is looking strong for small businesses, according to the March 2014 Small Business Scorecard, a monthly survey conducted by payroll and human resources technology provider SurePayroll. According to the survey, 87 percent of business respondents expect a strong or steady end to the first quarter.

March 28, 2014

Some brands are iconic, like Coca Cola, Disney, Microsoft and Google. Others are just as well-known, but perhaps less respected, like some fast food or alcohol and tobacco companies. While others have an even lower impression... think Enron? But which brands do small businesses trust the most?

March 28, 2014

New research shows that cloud computing is viewed by 80 percent of U.S. small businesses as a solution that contributes to business growth. Conducted by Techaisle, the SMB Cloud Computing Adoption Trend survey shows a significant departure in the views of small businesses from previous years, when reducing cost used to be the overarching objective.

March 28, 2014

One could say that the automatic tax filing extension is the taxpayer’s best friend – besides being a bosom buddy to tax return preparers – as the tax filing season rushes to a close. And this BFF may be able to do more for you than you think. However, just like most good friends, it’s…

March 28, 2014

The Internal Revenue Service today reminded taxpayers who turned 70½ during 2013 that in most cases they must start receiving required minimum distributions (RMDs) from Individual Retirement Accounts (IRAs) and workplace retirement plans by Tuesday, April 1, 2014.

March 28, 2014

Despite recent claims that the deadline for signing up for Obamacare would not be postponed beyond the initial March 31 deadline – the day before April Fool’s Day – the White House has finally caved into the pressure. According to a report in the Washington Post on March 25, the Obama administration is extending the…

March 27, 2014

Created by AccountantsWorld, the pioneer of Accountant-Centric solutions, web-based Payroll Relief lets you process payrolls faster and easier than any other payroll system. We have radically simplified payroll processing and eliminated compliance headaches for you by automating the entire payroll process. Payroll Relief offers you the same capabilities that have enabled payroll service bureaus to…

March 27, 2014

Live at 2013 LAUNCH Festival, Kym McNicholas talks to Mayor Ed Lee about how to attract and maintain start-ups in San Francisco and California.

March 27, 2014

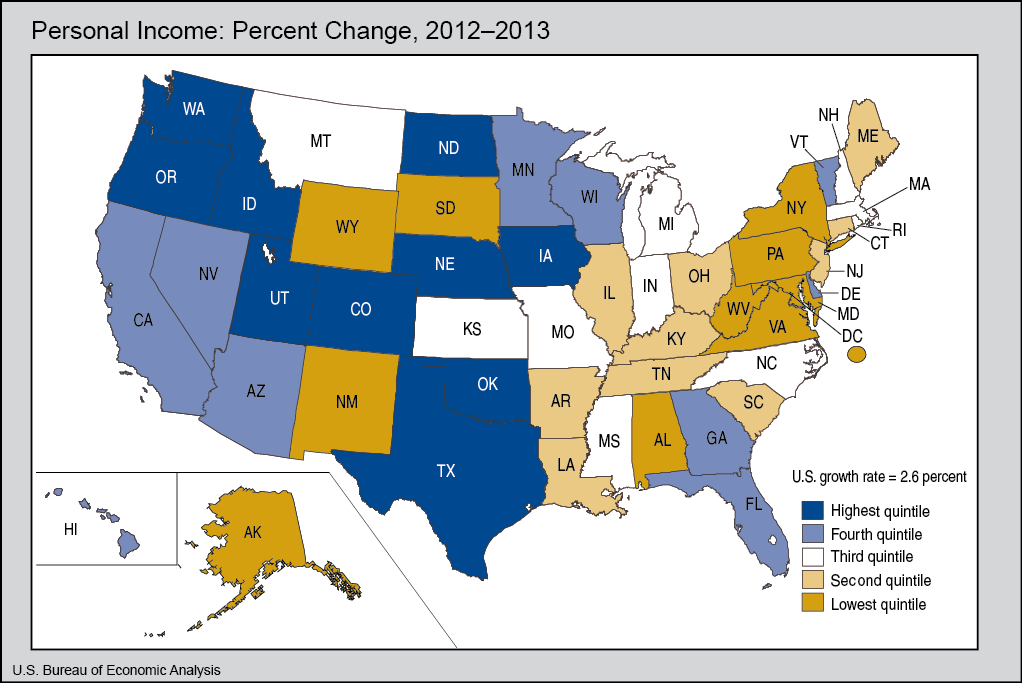

Average personal income in the United States grew by 2.6 percent in 2013, which is mixed news since that reflects a slowing of income growth from 4.2 percent in 2012. All 50 states and the District of Columbia realized gains in average personal income during the year, according to data from the Bureau of Economic…