Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

March 17, 2016

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

March 16, 2016

Empower your organization with a full range of financial capabilities, relevant analytics and reporting, and fully auditable process management.

March 16, 2016

Accountants pride themselves on their role as protectors of their clients -- using their continuing education; vast resources from the IRS and industry; and even the audit process to help business owners and investors to side-step the worst of the ...

March 16, 2016

Tax accountants have always been the white knights. Auditors were viewed by clients as necessary, consultants the fascinating innovators, but tax accountants were there to save the day.

March 16, 2016

The IRS seized more than $150,00 from a convenience store owner’s bank account in 2014 – virtually all the money he had in the world – even though he did absolutely nothing wrong. It has taken the taxpayer nearly two years to get the money bank and ...

March 15, 2016

Thomson Reuters Checkpoint has just released a special report, European Commission Presents Anti-Tax Avoidance (ATA) Package, summarizing the ATA Package to help businesses plan for the latest developments in advance of implementation.

March 15, 2016

The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) may be the last significant tax bill of the Obama administration. With the 2016 presidential election looming, tax directors are closely watching how America’s choice will impact the tax ...

March 15, 2016

In cases where a tax return was not filed, the tax law provides most taxpayers with a three-year window of opportunity for claiming a refund. However, if no return is fled in time, the money becomes the property of Uncle Sam. For 2012 tax returns, the ...

March 14, 2016

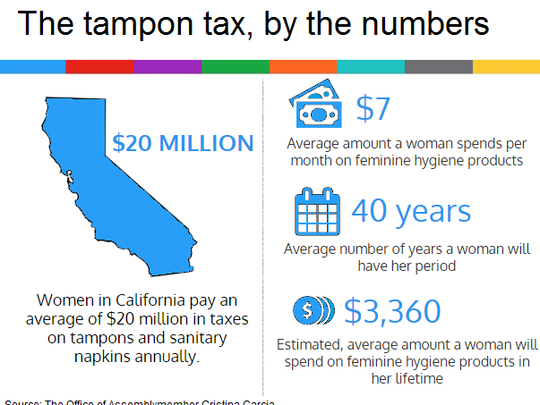

Court papers note that the state doesn’t tax other hygiene items like Rogaine, foot powder, dandruff shampoo, ChapStick, facial wash, adult diapers and incontinence pads, but tampons and sanitary pads are subject to sales tax.

March 14, 2016

Four years from now, Generation Z will represent more than 20 percent of the workforce. Undoubtedly, this cohort of employees — born in the 1990s — will affect your approach to staff management.

March 14, 2016

New Web Series Highlights the Transformation of a Small Business Using QuickBooks Online Ecosystem

March 14, 2016

Optimally designed for retailers with that require more comprehensive inventory management and distribution capability, Keystroke is an easily navigated product that offers scalability and excellent reporting capability.