The women’s movement is taking an unexpected turn in some parts of the country.

According to reports from the New York Daily News, CNN and other media sources, five female Manhattan dwellers have launched a class action lawsuit against the taxing authority of New York. The plaintiffs—Margo Seibert, Jennifer Moore, Catherine O’Neil, Natalie Brasington and Taja-Nia Henderson— allege that the state discriminates against females by taxing certain items used only by women. Court papers note that the state doesn’t tax items like Rogaine, foot powder, dandruff shampoo, ChapStick, facial wash, adult diapers and incontinence pads, but tampons and sanitary pads are subject to sales tax.

Besides seeking a permanent tax exemption for feminine hygiene products, the lawsuit demands a full tax refund for all women who have purchased tampons or sanitary pads in New York during the last two years. “It is a vestige of another era, and now is the time to end it,” the lawsuit says.

The lawsuit names the Department of Taxation and Finance as defendant. “The department’s double standard for men and women finds no support in the tax law and serves no purpose other than to discriminate,” the plaintiffs say. “It is . . . undisputable that tampons and sanitary pads serve multiple medical purposes. They are not luxury items, but a necessity for women’s health.”

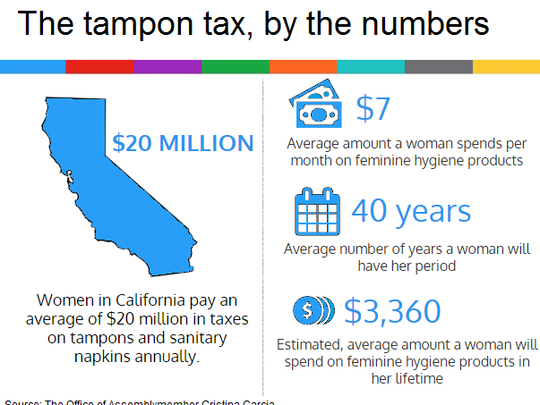

The average woman spends at least $70 per year on tampons and pads, resulting in sales taxes of $14 million for the Empire State each year. Assemblywoman Linda Rosenthal (D-Manhattan) recently introduced legislation that would exempt those products from the 4 percent sales tax and Governor Cuomo (D-NY) has already announced he’s on board.

Most states impose sales taxes that apply to feminine hygiene products. Currently, only five states have passed laws specifically exempting tampons from sales tax – Maryland, Massachusetts, Minnesota, New Jersey and Pennsylvania.

However, a bill in California exempting tampons and sanitary pads from state sales tax was recently endorsed by the board in charge of administering the tax. Several other states – including Utah and Virginia — have introduced similar bills. But detractors point out that a wide variety of other personal hygiene products – including soap and shampoo – aren’t exempt from sales tax either. If new exemptions are carved out, the states will have to find other ways of dredging up more tax revenue.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs