Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 8, 2026

August 18, 2017

Each year during tax time the “most overlooked” tax deductions get a lot of press. And every year the lists include the same deductions, such as state sales tax, student loan interest, job hunting costs, and moving expenses.

August 18, 2017

Years ago, I trained and raced a six “man” outrigger canoe as a member of a local club. A few mornings each week, our team would meet at the boat and train for several hours to ensure each team member set his paddle into the water simultaneously ...

August 18, 2017

Recent news and alerts from the American Institute of Certified Public Accountants.

August 18, 2017

Are any of your clients up to their ears in debt to the IRS? Tell them to listen carefully: You don’t have to flee the country or pull off a bank heist to get out from under. There are a couple of ways to resolve a tax debt in a reasonable manner ...

August 18, 2017

Listen to the radio or the TV – many vehicle retailers are offering fixed price servicing. Why… because their customers are tired of being quoted an hourly rate but not knowing how many hours are needed, or worse how many were consumed.

August 18, 2017

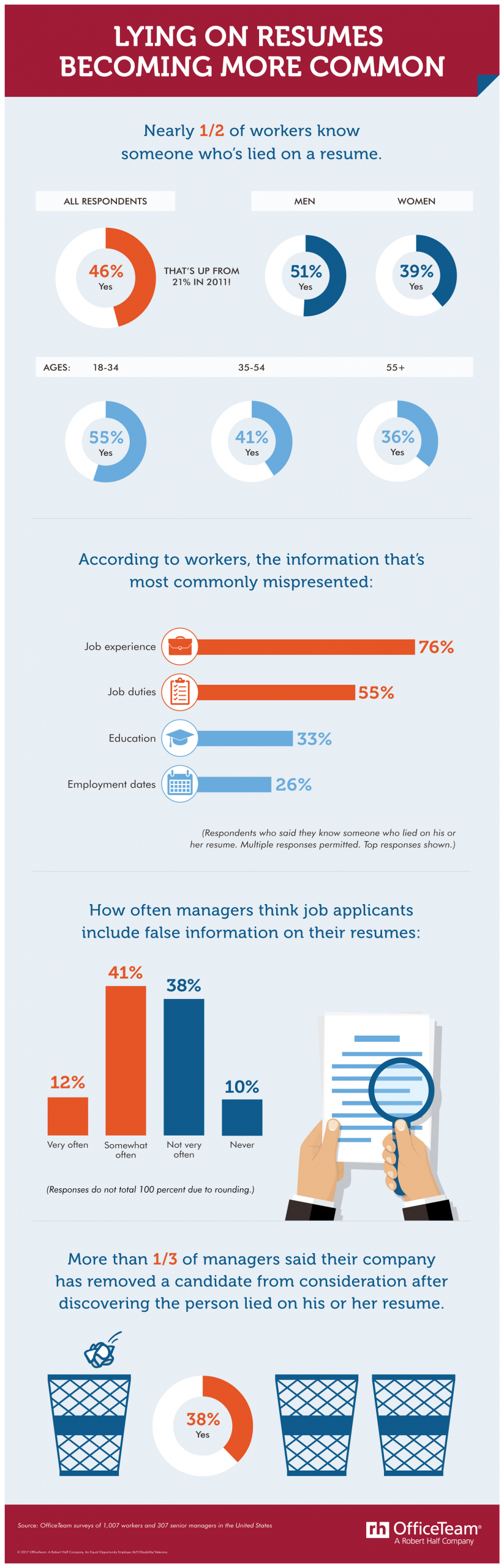

Fifty-three percent of senior managers suspect candidates often stretch the truth on resumes, and 38 percent said their company has removed an applicant from consideration for a position after discovering he or she lied.

August 18, 2017

If an employee comes to you with a request for employment verification, access to his or her personnel file, a job accommodation, or someone else to pick up his or her paycheck, will you know how to respond? Here are some guidelines for handling these ...

August 18, 2017

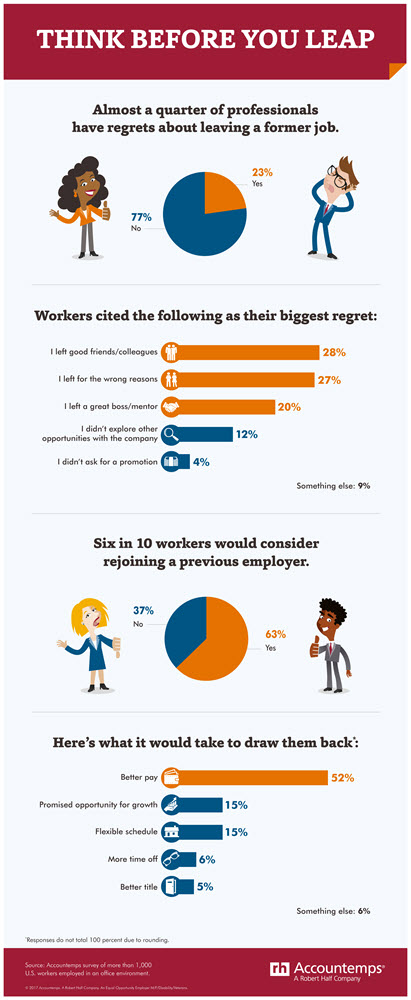

There are no regrets in life, they say, just lessons learned. But does that adage ring true when it comes to your career? In a recent survey from staffing firm Accountemps, 23 percent of workers polled said they have regrets about leaving their former ...

August 18, 2017

CCH Axcess Tax is completely cloud-based, so users will have complete access to the system from any location. CCH Axcess Tax also offers users free mobile apps for both iOS and Android tablets and smart phones which offers access to client management, ...

August 18, 2017

CCH ProSystem fx Tax is part of the comprehensive CCH ProSystem fx Suite of products from Wolters Kluwer Tax & Accounting. The product is well suited for accounting firms of all sizes, and is best utilized in an environment where other Wolters Kluwer ...

August 18, 2017

Drake Tax from Drake Software is well suited for small to mid-sized accounting firms that primarily process 1040 returns for clients. Drake Tax also works well for small businesses as well.

August 18, 2017

GoSystem Tax RS from Thomson Reuters is best suited for mid-sized to larger firms that process complex returns for larger organizations and individuals. One of the earliest tax compliance solutions to offer a web-based solution, GoSystem Tax RS has ...