Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 8, 2026

May 2, 2018

"The Anticipatory Organization: Accounting and Finance Edition" (AO) is a training program to arm CPAs and financial advisors with anticipatory skills crucial to anticipating disruptions, problems, and their related solutions. AO teaches professionals ...

May 2, 2018

I have a client that owns three rental properties. She has a full-time job as a physician, and she did some side work before her second kid was born. When I did the tax return, she had $45,000 in passive losses from the rentals, and $35,000 in income ...

May 1, 2018

The new proposed legislation builds on the foundation proposed by Jenkins and Lewis in March. The duo requested comments from other lawmakers as well as influential groups like the American Institute of CPAs (AICPA) and the National Association of Tax ...

May 1, 2018

The convenience and all-in-one experience that your clients get from Amazon has come to be their new expectation in other facets of their lives, including their finances. More and more clients are looking for a single solution for all of ...

May 1, 2018

Thomson Reuters Checkpoint Catalyst has released a comprehensive analysis of the one-time U.S. transition tax on undistributed and non-previously taxed foreign earnings of deferred foreign income corporations owned by U.S. persons.

May 1, 2018

Since January of 2017, after more than a decade of discussion and debate, a new regulation from the U.S. Public Company Oversight Accounting Board has required the annual report of each public corporation not only to identify the firm responsible for ...

May 1, 2018

The CGMA guide, “The role of the accountant in implementing the Sustainable Development Goals,” details the business advantage of the SDGs and provides direction to help organizations achieve some of their social and socio-economic objectives.

May 1, 2018

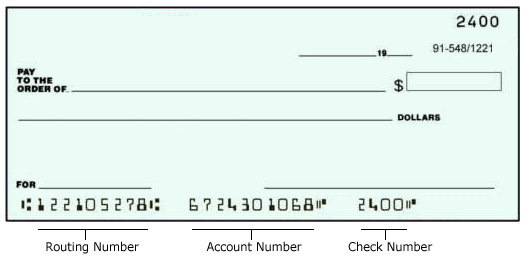

Accountants, whether in a larger organization or advisors to small businessowners, still love writing checks. In fact, the latest data from the Association for Financial Professionals (AFP) shows that B2B payments by check actually increased between ...

May 1, 2018

When the IRS finds an applicable large employer (ALE) in violation of the ACA’s requirements, the ALE is issued Letter 226-J, which outlines penalties and fines for noncompliance and gives the ALE 30 days to respond. Whether the issue is improper ...

May 1, 2018

The Maryland Association of CPAs and the Business Learning Institute have launched a weekly podcast as part of their continuing bid to make accounting and finance professionals more future-ready.

May 1, 2018

BlueVine, a provider of working capital financing to small and medium-sized businesses, also said it is raising its business line of credit limit to $250,000. Earlier this year, the company doubled its invoice factoring credit limit to $5 million.

May 1, 2018

Canopy, a provider of cloud-based practice efficiency platforms for tax and accounting professionals, has unveiled its Notices solution , giving practitioners a streamlined option for efficiently managing and resolving IRS and state notices for their ...