Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 9, 2026

February 9, 2026

September 3, 2018

Although the IRS and its Security Summit partners are making progress against tax-related identity theft, cybercriminals continue to evolve, and data thefts at tax professionals’ offices are on the rise. Thieves use stolen data from tax practitioners ...

September 3, 2018

At least one-quarter of small businesses (27%) do not keep their personal and business finances in separate bank accounts. While this works for some businesses, it's typically not recommended and potentially is risky, experts said.

September 1, 2018

Dustin Hostetler Lean Six Sigma Master Black Belt Chief Innovation Officer, ShareholderBoomer Consultingwww.Boomer.com Twitter: @FlowtivityLinkedIn: https://www.linkedin.com/in/dustinhostetler/ Career Highlights: After graduating from Ohio State with a degree in Finance, I began my professional career at Cardinal Health. I had the great fortune to be part of their financial leadership development program and rotated through several different...…

September 1, 2018

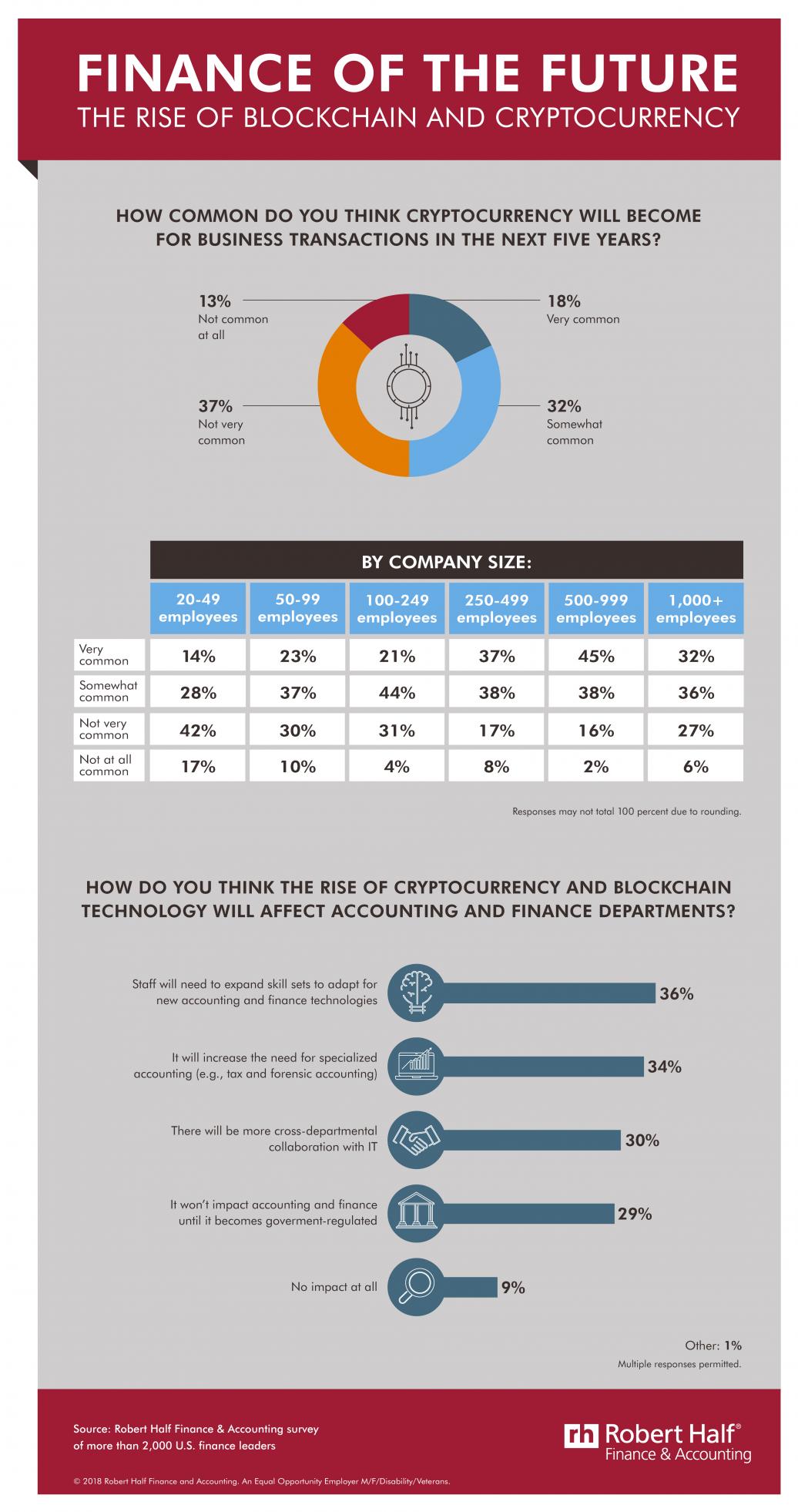

Blockchain isn't just disrupting how business is conducted, it's disrupting the demands on accounting and finance functions. One of the most well-known ways is cryptocurrency, which, according to 50 percent of financial leaders in a Robert Half ...

September 1, 2018

Leaders in CPA firms across the country agree that Client Accounting Services (CAS) is an emerging, growing and profitable opportunity. In fact, it is one of the fastest growing new revenue segments of many Top 100 Firms, but it is relevant and ...

August 31, 2018

Tax reporting and compliance has proven difficult to keep up with in recent years, and these changes just throw more fuel onto the fire. For CPAs focused on tax, these new changes will usher in even more complexity into their day to day jobs.

August 31, 2018

Two-thirds (66%) of college-educated Americans took out some form of student loans — college graduates these days end up with an average of more than $37,000 in student loan debt — and the vast majority (85%) will be paying them off without help from ...

August 30, 2018

All medical marijuana growers and dispensaries have very specific accounting requirements and are need of qualified Accountants and Bookkeepers to help them stay compliant as well as stay on top of their cash flow, inventory management, and ...

August 30, 2018

Survey showed that financial stress causes nearly 1 in 5 couples of all ages (19 percent) to delay buying a home, with millennials leading the pack at 42 percent.

August 30, 2018

At first blush, payroll fraud might seem difficult to pull off – after all, shouldn’t it be obvious? But a well-hidden fraud is not obvious to most business owners. And, unfortunately, by the time most payroll frauds are discovered, months (or, years) ...

August 30, 2018

New proposed regulations just issued by the IRS throw a roadblock into efforts by governments in several “blue” states to sidestep new tax law limits for state and local tax (SALT) deductions ((Prop. Reg. REG-112176-18, 8/23/18). However, the proposed ...

August 30, 2018

Lindsey Curley, CPA, CGMA Senior Manager, Firm ServicesAICPAwww.AICPA.org Professional Associations/Memberships: Association of International Certified Professional Accountants NCACPA Career highlights: Worked for three years in a small tax firm Currently working in my seventh year with AICPA’s PCPS 2016, 2017, 2018, “40 under 40,” CPA Practice Advisor Author of Journal of Accountancy article Gaining (from) your...…