February 26, 2019

February 26, 2019

February 26, 2019

February 26, 2019

December 18, 2012

September 10, 2012

September 7, 2012

November 16, 2011

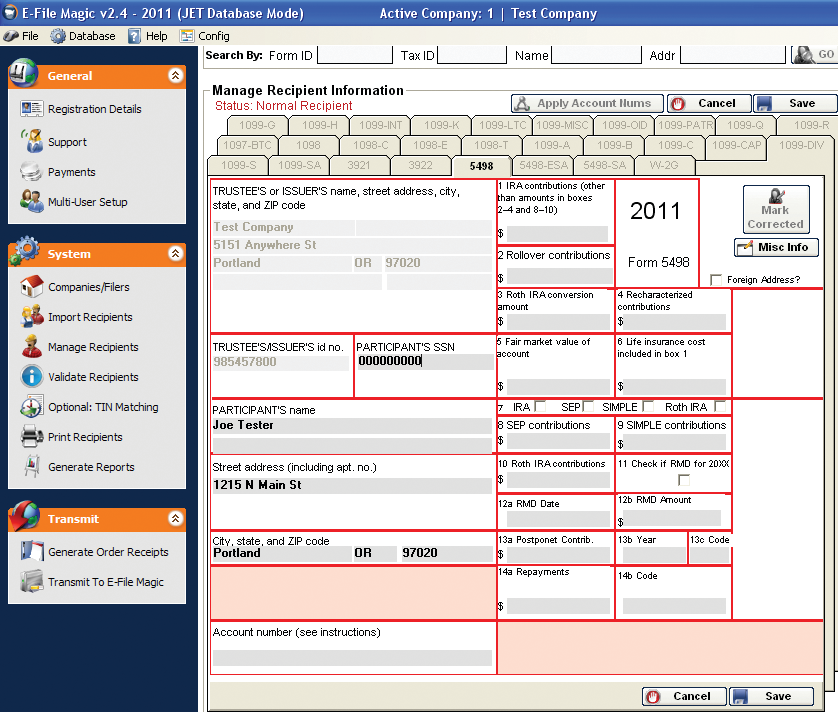

Using the E-File Magic 5498 software you can print, mail, and e-File your 5498 forms with ease. You pay only for e-File Services(required), and optionally print and mail services. This makes your year end reporting requirements even simpler than ever. Just import or manually enter your data into our software program, validate, and transmit your...…

September 9, 2011

Personal Property Pro is downloadable software that automates, calculates and prints business personal property tax returns for use in all 398 counties in Texas, Florida and Oklahoma. Personal Property Pro provides you: Affordability, starting at just $195 An intuitive and easy-to-use interface Superior product performance Powerful reports State-approved forms where applicable Free and outstanding technical...…

August 15, 2011

Drake Software, one of the largest independent developers of tax and practice management software for professional accountants and tax professionals, announced today that they've acquired Copanion, which is most notable for its GruntWorx paperless workflow solution. Financial details regarding the deal between the two privately-held concerns were not disclosed.

May 5, 2011

Less than half automate indirect tax workflow processes, a recommended best practice by leading analyst firm

April 19, 2011

Changes how firms handle IRS issues and notices after filing deadline

January 25, 2011

Taxpayers Can Check Refunds, Get Tax Information

December 7, 2010

NEW YORK— The 2010 Small Business Jobs Act, enacted on September 27, 2010, provides a new opportunity for Roth 401(k) plan participants to convert their existing 401(k) plan balances into Roth 401(k)s. “The Act also allows participants making the conversion in 2010 to spread the tax hit over a two-year period,” said Richard O’Donnell, a...…

September 27, 2010

Projects taxable income and calculates required withholding allowances, helping you to adjust payroll withholding throughout the year.

September 27, 2010

Over 300 tax and financial planning letters, attachments, and handouts — easily customized and mail-merged with a customer database.

September 27, 2010

Calculates and prints Maryland personal property returns.

September 27, 2010

Track clients’ cost basis and generate reports, including Realized Gains and Losses and fileable Schedule D-1 Continuation Sheet.