Finance departments continually develop rigorous expense reporting guidelines, but that hasn’t stemmed the flow of eyebrow-raising requests by some employees, new research suggests. In a new survey, 56% of CFOs cited an increase in the number of inappropriate reimbursement submissions over the last three years. Some of the more egregious infractions included a cow, Super Bowl tickets and invoices for another company.

CFOs were asked, “Have you seen inappropriate expense report requests increase or decrease in the past three years?” Their responses:

- Significantly increase: 27%

- Somewhat increase: 29%

- No change: 29%

- Somewhat decrease: 11%

- Significantly decrease: 4%

[Click to view larger infographic.]

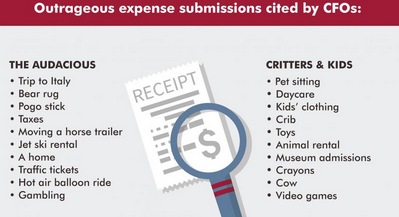

CFOs also shared additional examples of audacious expense report requests:

- Trip to Italy

- Bear rug

- Pogo stick

- Taxes

- Moving a horse trailer

Expenditures for children and pets, like the following, were commonly flagged:

- Daycare

- Pet sitting

- Kids’ clothing

- Cat litter

- Toys

Household items and expenses were also popular reimbursement submissions:

- Chandeliers

- Tractor

- Tree

- Plunger

- Bed bug removal

There were even a few requests that verged on the incredulous:

- Chicken statue with a top hat

- Yacht

- Pearls

- Motorcycle

- Lamborghini

“Some of the more absurd expense report submissions may seem laughable, but they can be an expensive problem for businesses,” said Tim Hird, an executive vice president with Robert Half, which conducted the survey. “Companies must have effective review systems, policies and processes in place, or they risk losses in profits and employee productivity.”

Additional research also found most companies utilize technology-based solutions in their expense-reporting process: 44% use internally developed software and 41% employ third-party systems. Overall, only 14% of organizations use manual processes, though this jumps to 31% for firms with 20 to 49 employees.

Hird added that implementing new technology can help streamline the expense-reporting process, but communication to staff is essential. “Do everything possible to make sure there is no ambiguity among employees about what constitutes a valid business expense. Regularly share your policies and include examples of past tricky situations to clarify gray areas.”

Robert Half Management Resources offers managers three ways to address and reduce inappropriate expense report submissions:

- Overcommunicate guidelines. Make company policy easily accessible and provide regular reminders through the employee newsletter, company intranet or staff email.

- Discuss expense report issues with employees. Improper submissions may be the result of staff members’ lapse in judgment or attempt to push boundaries. Whatever the reason, follow up with employees so that mistakes can be avoided in the future.

- Review new requests carefully. Keep an eye on future submissions when a significant problem has occurred. If you spot a red flag, address it immediately and reinforce company policies.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs