A majority of Americans (53%) carry credit card debt, with an average balance of $7,719, according to a new report from Clever Real Estate, a St. Louis-based real estate company.

More than a third (39%) of Americans couldn’t cover a $2,000 emergency without relying on a credit card, and 29% say they couldn’t afford basic living expenses without one.

Half of Americans (50%) report spending more when using credit cards compared to other payment methods.

Although 59% of Americans view credit card debt as the worst kind of debt — and 40% say it’s never acceptable — 54% of Americans make at least one purchase per year that they can’t immediately pay off.

Just 50% of Americans review their credit card statements monthly for accuracy, and a quarter (24%) discover “forgotten” subscriptions each month.

Even more, 31% have gone so far as to open a new card to cover something they couldn’t otherwise afford.

However, a shocking 75% believe they’re more responsible than the average cardholder, including nearly two-thirds of those with credit card debt (64%).

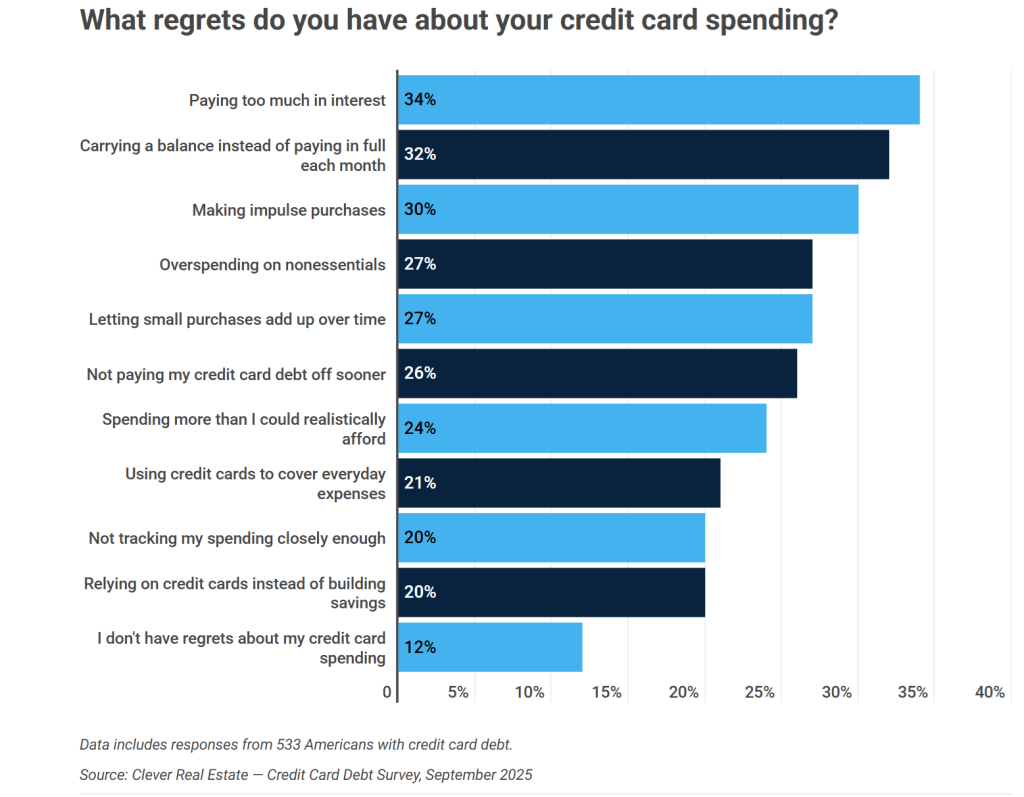

Unsurprisingly, 88% of those with credit card debt have regrets about their spending, citing paying too much in interest (34%) and impulse purchases (30%).

Meanwhile, 44% say their debt has prevented them from living the life they want, and one-third of those in credit card debt (33%) struggle to make even the minimum monthly payment.

More than a third (36%) of those with credit card debt have paid one card’s bill with another, and 27% fall deeper into debt every month.

Over half (53%) of Americans want to reduce their credit card usage, including 71% of those in debt, though 36% say rising housing costs are forcing them to rely more on credit cards.

Among Americans without credit card debt, 25% worry they could fall into it within the next five years.

About 70% of Americans would support a law to lower or cap credit card interest rates, even if it meant issuers reduced or eliminated rewards to compensate.

Read the full report at: https://listwithclever.com/research/average-american-credit-card-debt-2025

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs