By Mark Ballard

The Advocate, Baton Rouge, La.

(TNS)

WASHINGTON — Whether the federal government shuts down operations in two weeks could hinge on Republicans agreeing to extend an Obamacare tax credit that helps about 300,000 working people in Louisiana buy health insurance.

If the Affordable Care Act’s “premium tax credit” expires Dec. 31, as it will without congressional action, health insurance policies will become so expensive that about 22 million Americans likely will drop their coverage, according to KFF, a nonpartisan organization focused on health policy research, in an analysis released Wednesday.

Premium prices vary depending on income levels, policies sought and myriad complex stipulations. As private insurance starts sending out bills in October for next year, policyholders on average are going to have to come out of pocket about $900 per month, 18% more if the tax credits no longer exist, KFF estimates.

That means about 92,000 people in Louisiana, probably more, will lose their health care coverage because they simply can no longer afford it, said Jan Moller, executive director of Invest in Louisiana, Baton Rouge-based public policy analysts.

These are workers and small businesses that earn too much to qualify for Medicaid insurance but not enough to buy policies on the regular market.

“We’re talking about most of Tiger Stadium on a Saturday night who have insurance now but who would no longer have insurance,” Moller said. “The premium tax credits are a critical component of keeping coverage affordable for working Louisianans with low and moderate incomes.”

Recommended Articles

This whole extension issue, though, is difficult for Republicans.

Premium tax credits expanded greatly as a COVID pandemic measure during the first administration of President Donald Trump.

President Joe Biden added more funding to the credit to provide options for lower-income people being forced off Medicaid as the pandemic wound down.

As a result, the number of people buying health insurance policies subsidized by the premium tax credits nearly doubled.

The Congressional Budget Office says extending the tax credit will cost about $383 billion over the next 10 years.

The extension proved too divisive, so it was set aside as Republicans negotiated among themselves over what would be included in Trump’s One Big Beautiful Bill Act. OBBBA features tax cuts that are going into effect now and changes that are expected to reduce Medicaid rolls after the 2026 congressional midterm elections.

The pressure of having to pass annual budget bills before Oct. 1 or seeing the government shut down appears to be too good an opportunity for congressional Democrats to pass up.

Republicans are seeking a resolution to continue government operations from Oct. 1 to Nov. 20, thereby pushing off a government shutdown until Thanksgiving.

The House may vote on a “continuing resolution” to that effect as early as later this week.

Republican majorities in the House and Senate won’t get any help from Democrats unless the GOP agrees to include health care policy revisions, said Senate Minority Leader Chuck Schumer, D-New York, and House Minority Leader Hakeem Jeffries, D-New York.

Schumer and Jeffries want to alter the changes that led to deep Medicaid funding cuts in the One Big Beautiful Bill Act, which passed into law without a single Democratic vote. And they want to extend the Obamacare premium tax credits.

“Republicans have to come to meet with us in a true bipartisan negotiation to satisfy the American people’s needs on health care or they won’t get our votes, plain and simple,” Schumer said at a news conference.

Senate Majority Leader John Thune, R-South Dakota, who has heard from a couple of his GOP members that they want an extension, early last week said that’s not going to happen as part of the budget negotiations.

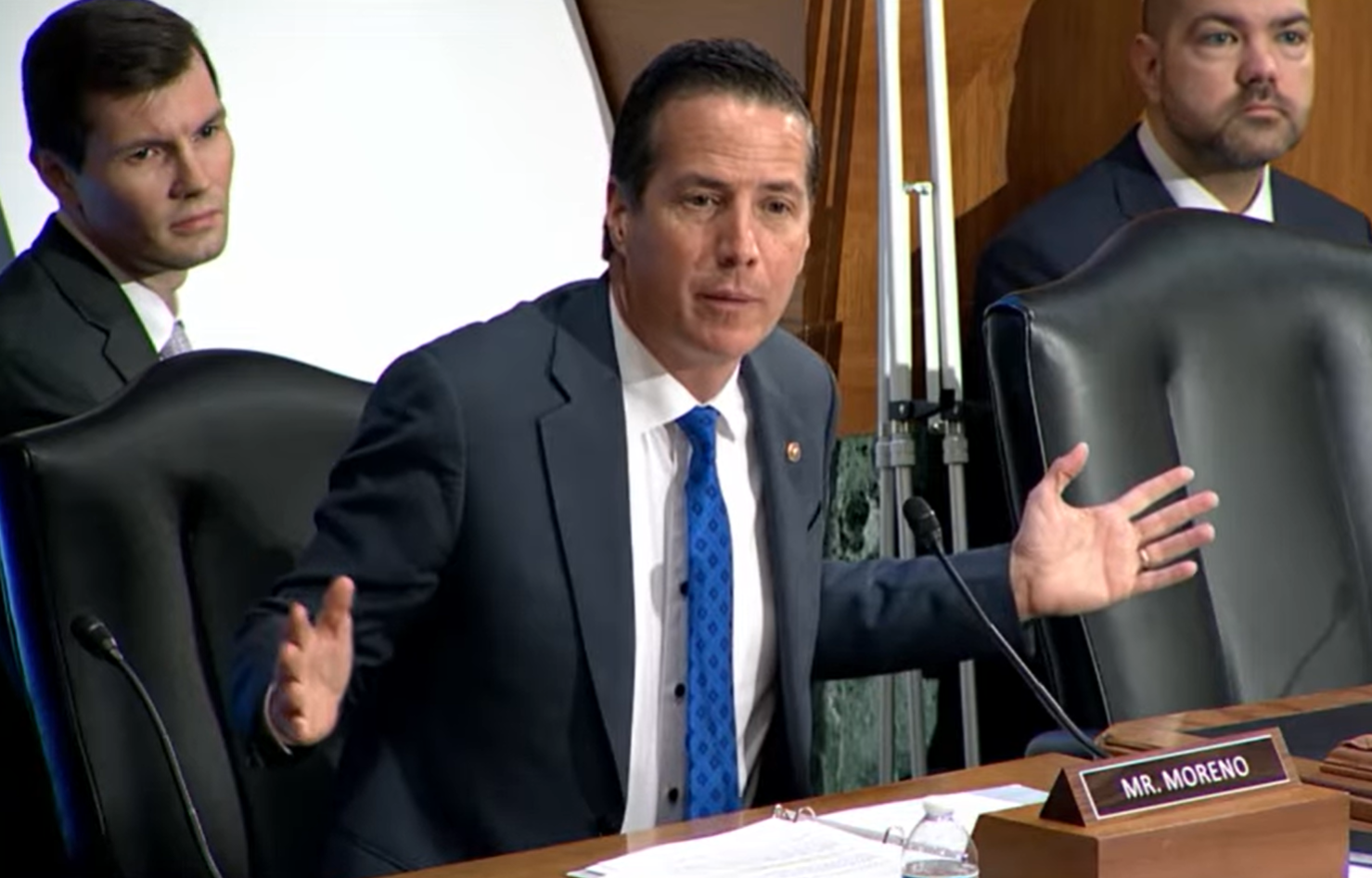

Louisiana’s Republican congressional delegation has remained moot on extending the credits. Sen. Bill Cassidy, of Baton Rouge, and Rep. Julia Letlow, of Baton Rouge, for example, say they are still studying the issue.

Once again, House Speaker Mike Johnson, R-Benton, finds himself between Republican factions.

On the one hand, 11 vulnerable House Republicans filed a bill to extend the premium tax credits for another year.

On the other, fiscal hawks are loudly against the idea.

Johnson told reporters Monday that “thoughtful conversations” were being had. On Tuesday, he acknowledged “a lot of opposition.” On Wednesday, he was saying the House needed to approve a continuing resolution.

By the end of the week, Johnson noted for reporters that the extension doesn’t expire for three more months. “We have time to figure it out,” he said.

_______

© 2025 The Advocate, Baton Rouge, La. Visit www.theadvocate.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs