By Erik Larson

Bloomberg News

(TNS)

President Donald Trump sued the U.S. Treasury and IRS for at least $10 billion over an unauthorized disclosure of his tax returns to the press during his first term in office, potentially putting American taxpayers on the hook for a massive payout.

The suit was filed Thursday in Miami federal court by Trump, his sons Donald Jr. and Eric, and the Trump Organization, which manages the president’s real estate holdings. Trump had long criticized the IRS for allegedly working to undermine him for political purposes.

Trump’s lawsuit revisits a clash that took center stage weeks before the 2020 election, when The New York Times published an explosive report on Trump’s tax records that was based on leaked IRS data. Former IRS contractor Charles Littlejohn pleaded guilty to stealing Trump’s tax data and leaking it to the Times. He also stole tax records for thousands of other wealthy Americans, including Ken Griffin, Elon Musk, and Jeff Bezos, which he leaked to ProPublica.

Recommended Articles

The IRS and Treasury “had a duty to safeguard and protect plaintiffs’ confidential tax returns and related tax return information from such unauthorized inspection and public disclosure,” Trump’s lawyer, Alejandro Brito, said in the suit. “Accordingly, defendants were obligated to have appropriate technical, employee screening, security, and monitoring systems to prevent Littlejohn’s unlawful conduct.”

The Treasury did not immediately respond to a message seeking comment. Neither The New York Times nor ProPublica immediately responded to messages seeking comment. The news outlets are not accused of wrongdoing.

Other lawsuits

The filing adds to a series of lawsuits brought by Trump or his sprawling real estate empire over the past year that have targeted news outlets and banks, including JPMorgan Chase & Co., which he sued last week. Total damages being sought in all the cases now tops $50 billion.

According to The New York Times report, the IRS records showed that Trump, who lost the election to Joe Biden in 2020, had paid $750 in federal income taxes in 2016 and 2017, and no taxes in 10 of the previous 15 years, because of large losses that offset any profits.

The Times report said that many of Trump’s businesses were struggling, with the president putting more money into the firms than he was taking out, and that he earned millions abroad during his first term in the White House.

At the time, Trump dismissed the reporting as “totally fake news.”

The report also led to a multiyear saga in which Democratic lawmakers sought to make Trump’s closely held tax information public.

Littlejohn was sentenced to five years in prison in January 2024, after admitting he’d gone to work at the IRS with the goal of accessing Trump’s tax data. His lawyer told the judge at the sentencing hearing that Littlejohn acted out of a “deep, moral belief” that Americans had a right to the information.

The case is Trump v. Internal Revenue Service, 26-cv-20609, US District Court, District of Southern Florida (Miami).

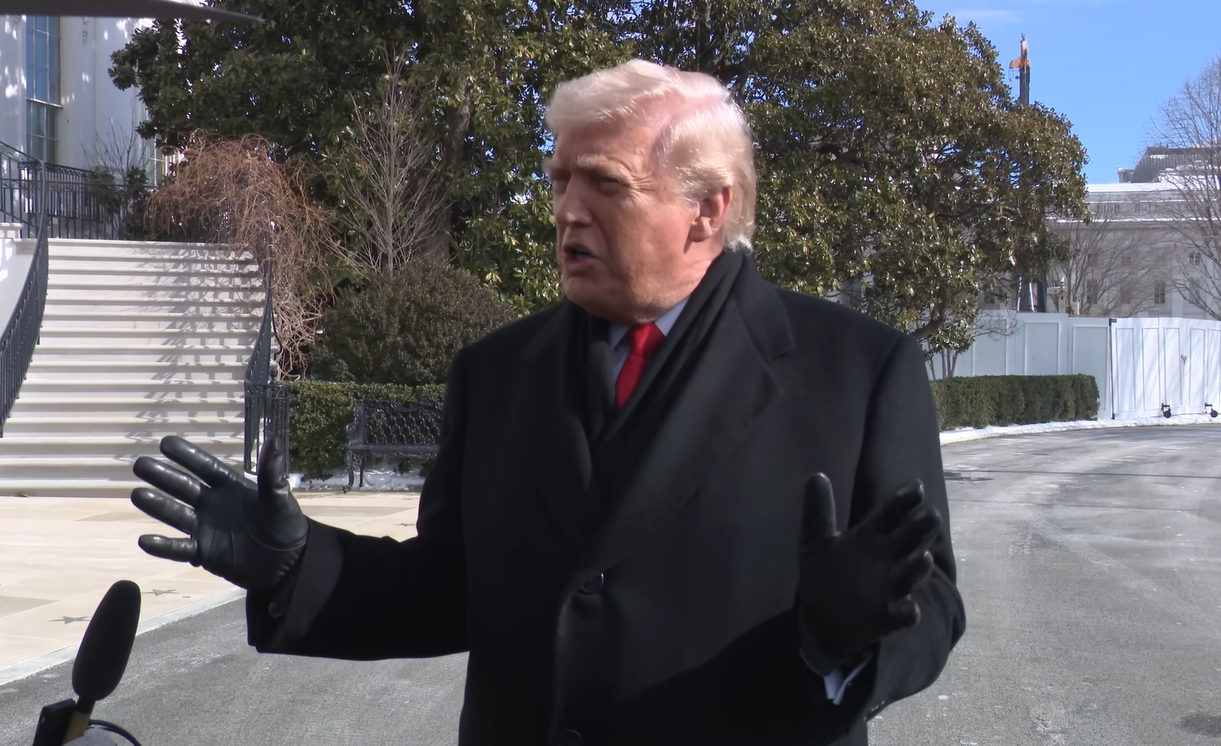

Photo caption: President Donald Trump talks to reporters before departing the White House on Jan. 27, 2026.

_______

©2026 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Christopher F Chestnut January 30 2026 at 6:10 pm

I was a victim of this data breach brief also. I received a letter from the Department of Justice and IRS about my tax return being one that was illegally obtained by Little John. Why should I not be compensated for this breach? Christopher F Chestnut CPA 910-844-9863 ext. 1