By Gus Burns

mlive.com

(TNS)

The lawsuit filed by opponents of Michigan’s 24% wholesale marijuana tax that took effect Jan. 1 may continue, a Court of Claims judge ruled Monday, Jan. 5.

The Michigan Cannabis Industry Association, the largest marijuana lobbying group in the state, along with marijuana businesses, including Lansing-based PG Manufacturing, challenged the constitutionality of the new tax last year.

The tax was passed with bipartisan support to balance the state budget and generate a projected $420 million in new revenue for road projects being pushed by Gov. Gretchen Whitmer.

Court of Claims Judge Sima G. Patel said the court must still determine if the new tax violates the intent of the 2018 voter-passed marijuana legalization law, known as the Michigan Regulation and Taxation of Marihuana Act (MRTMA).

The law’s stated intent includes curbing black-market production and sales by replacing them with licensed, tested commercial product.

The remaining issue for the court to rule on is whether there is evidence the new tax will drive customers back to the black market.

Recommended Articles

“It is not certain on this record whether the 24% wholesale excise tax will impact prices to the extent purchasers will be driven to the illicit marijuana market,” Patel wrote in her order. “Discovery is required to examine how the tax will impact the purposes of the MRTMA.”

Patel’s ruling is “a win for Michigan voters and our industry,” said Rose Tantraphol, a spokesperson for the Michigan Cannabis Industry Association.

“In issuing this order, the court recognizes the serious questions about whether this discriminatory tax violates the intent of the cannabis legalization that Michigan voters approved in 2018,” Tantraphol said. “We’re looking forward to making our case that this tax will push Michiganders, who are already feeling stretched financially, into the illicit market.”

Patel previously dismissed two key claims made in the lawsuit and sided with the state.

The marijuana law includes language designating a 10% excise tax on sales, “in addition to all other taxes.” It also outlines how that tax revenue should be distributed.

Opponents of the new tax argued that a three-fourths supermajority in the state House and Senate is required to implement any change to the taxation of marijuana.

Patel in her previous ruling disagreed with the notion that the existing marijuana law “is the sole method by which to tax regulated marijuana in Michigan and that the 24% wholesale excise tax could only be enacted through … a supermajority.”

The new tax was created as part of the Comprehensive Road Funding Tax Act (CRFTA), which is separate from marijuana law.

Opponents also claimed the manner in which the tax was passed violated the state constitution.

Initially, legislators introduced the act with a stated intent to raise taxes for road funding but didn’t mention new marijuana taxes. A later substitute included the 24% wholesale tax on marijuana.

“And by the time the public, including the (Michigan Cannabis Industry Association) and PG Manufacturing, became aware of what (the bill) had become, it was, ultimately, too late to stop the bill’s passage,” the lawsuit said.

Patel dismissed the argument that the substitute substantially altered the intent of the original language.

The judge previously denied a motion requesting implementation of the new tax be blocked until the lawsuit is resolved.

A scheduling conference in the case is set for 10 a.m. on Jan. 13.

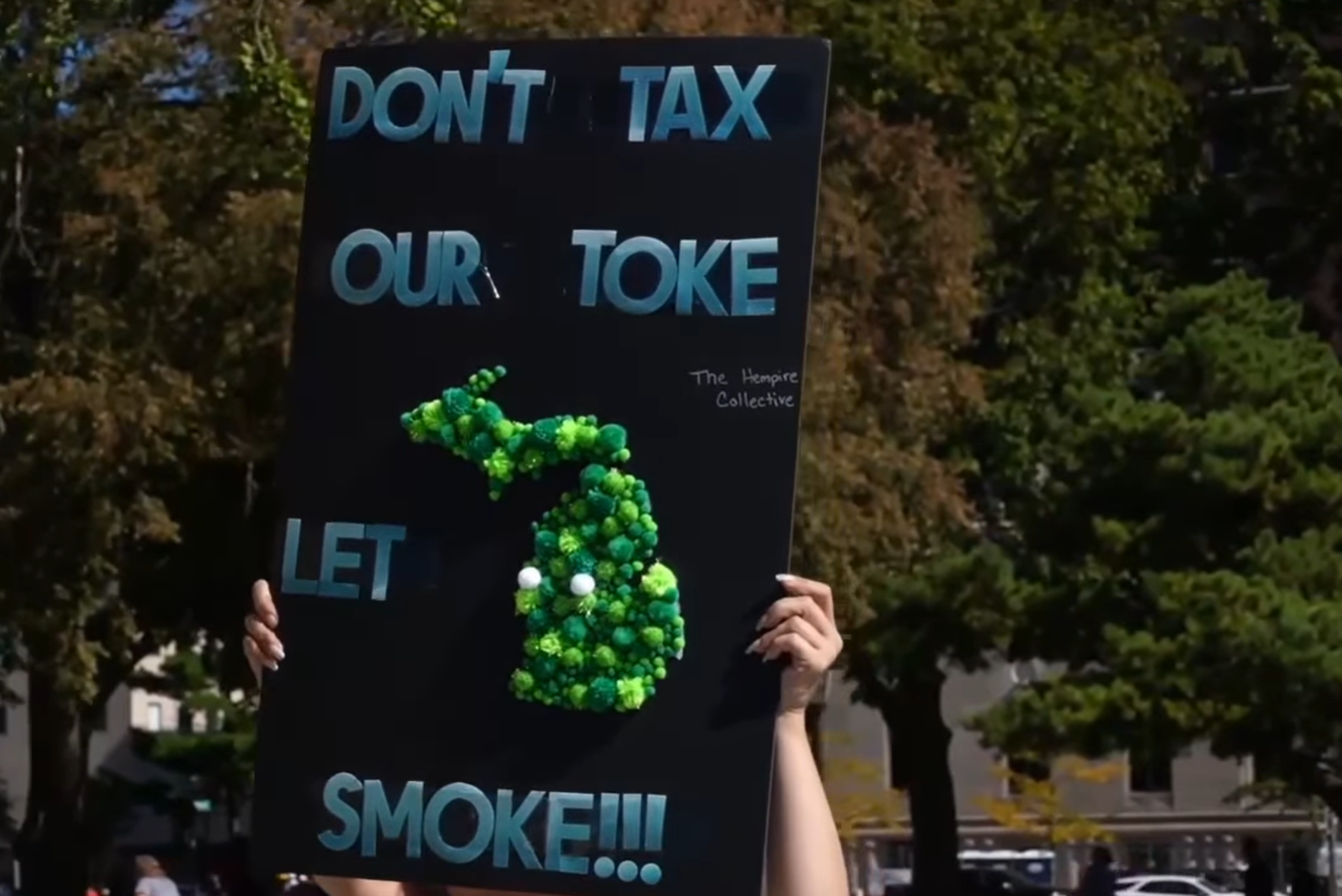

Photo caption: Crunch berries cannabis flower inside the newly renovated Lake Effect medical marijuana dispensary in Portage, Michigan on March 26, 2019. (Joel Bissell/MLive.com/TNS)

_______

©2026 Advance Local Media LLC. Visit mlive.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs