A top midtier accounting firm ended 2023 by having the most new initial public offering (IPO) audit clients in the fourth quarter, as the number of companies going public dropped compared to the previous quarter, according to an analysis by Ideagen Audit Analytics.

The final quarter of 2023 saw 40 new IPOs, raising a total of $4.2 billion—down in total IPOs from Q3 (45) and total proceeds ($9.2 billion). However, compared to Q4 2022, IPOs doubled (20) while the total amount raised increased by 127% ($1.9 billion). Overall, 2023 had 164 IPOs with nearly $24 billion raised.

Of the 40 IPOs in the fourth quarter, 31 were traditional IPOs that raised an average of $105.5 million per company. Eight of the 40 went public via special-purpose acquisition company (SPAC), which raised an average of $106.4 million per company, and there was one direct listing IPO.

Birkenstock Holding PLC was the only company in Q4 to raise more than $1 billion for its IPO. The international footwear brand completed its traditional IPO in October and raised over $1.4 billion in gross proceeds. The company’s auditor is EY.

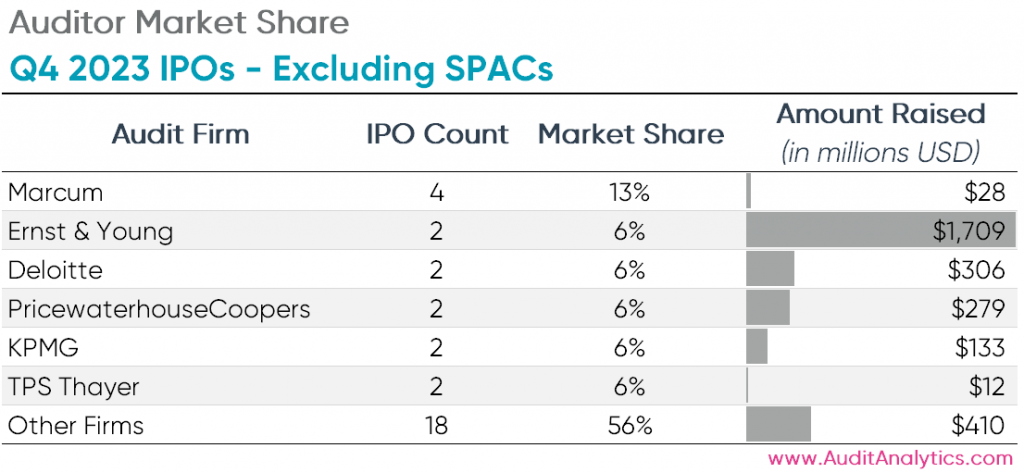

But the Big Four firm didn’t lead in IPO auditor market share in Q4. Coming in first was New York-based top 15 firm Marcum with six IPO clients, according to Audit Analytics. EY, which audited two IPOs in Q4, did lead in terms of gross proceeds ($1.7 billion) thanks to the Birkenstock IPO. Excluding SPACs, Marcum led the field with four IPO clients.

Four different accounting firms audited the eight SPAC IPOs completed during the quarter. Houston-based top 200 firm MaloneBailey had the most SPAC IPO clients, auditing three newly listed companies that raised a combined total of $181 million, followed by Marcum and Withum with two and UHY with one.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs