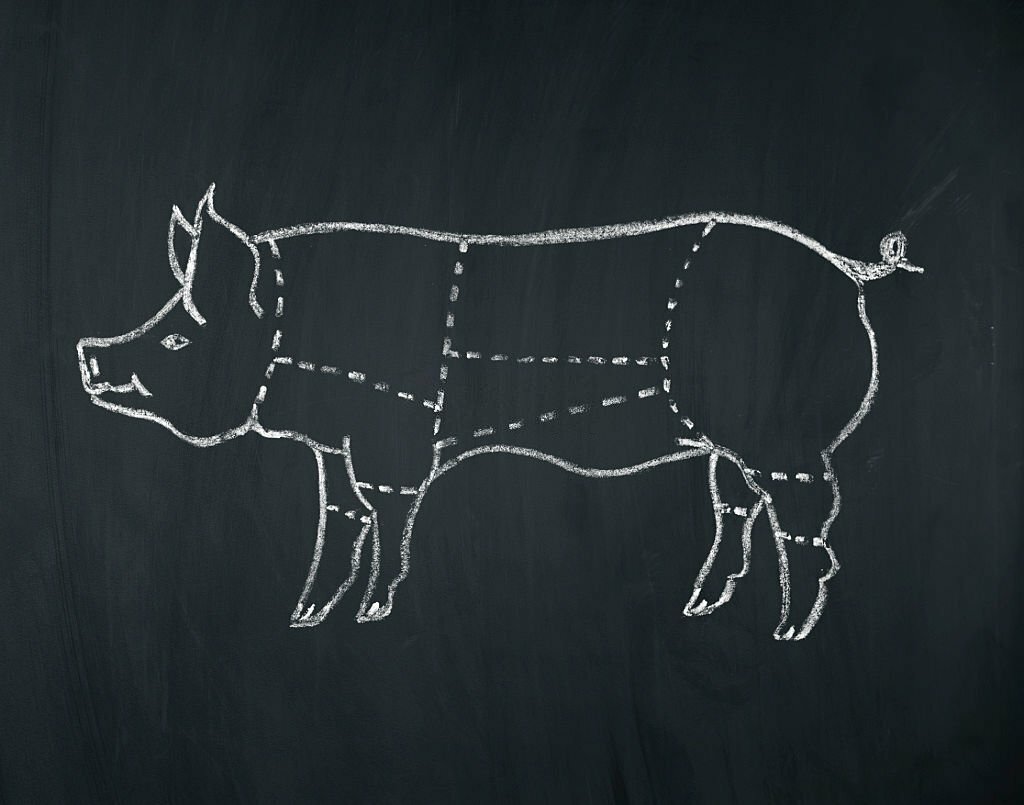

IRS Criminal Investigation special agents have seen an uptick in a specific type of scheme that couples cryptocurrency with romance, and they have a message for taxpayers: Don’t get butchered.

The scam is known as “pig butchering”—flirtatious strangers use social media to lure unsuspecting romantic partners, who serve as the “pigs,” to invest in crypto trading platforms. When victims attempt to cash out, criminals seize their funds.

“Cryptocurrency scammers have become more sophisticated with their schemes. It’s a shame to watch people hopelessly invest their savings in crypto and earn returns on their deposits, to never see the money again,” IRS-CI Chief Jim Lee said in a statement.

IRS-CI investigators say U.S. taxpayers are currently the most targeted population for pig butchering schemes. So far, the highest identified loss in one of these schemes is $2 million, but average losses are in the hundreds of thousands of dollars. If you meet someone on a dating website or app and they urge you to invest in crypto, it is likely a scam, the IRS said.

Individuals should be aware of these red flags:

- A long-lost contact or stranger sends you a message on social media.

- You are urged to send money to an investment platform that is similar but does not match the platform’s official website address. This is called typo-squatting.

- You have an online romantic interest who asks you to send payment to them or an investment platform in cryptocurrency.

- You embark on an online romantic relationship, and your love interest guarantees profits or big returns if you invest with them.

- A romantic interest reaches out to you through an online messaging application like WhatsApp with account numbers so you can transfer of funds.

If you or someone you know is a victim of pig butchering, contact local law enforcement or one of IRS-CI’s 20 field offices in the U.S.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs