Technology February 9, 2026

Botkeeper is Closing Its Doors

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

Technology February 9, 2026

In a statement posted on the Botkeeper website over the weekend, Enrico Palmerino wrote that the automated bookkeeping platform he founded in 2015 is shutting down.

February 9, 2026

February 8, 2026

May 3, 2022

Rewind protects over 74 billion data points in widely used SaaS tools, such as BigCommerce, GitHub, Jira, QuickBooks Online, Shopify, Shopify Plus, and Trello, for customers across 100 countries.

![Lease-Query-Lease-Accounting-for-Net-Suite_marketing[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/05/Lease_Query_Lease_Accounting_for_Net_Suite_marketing_1_.62716c621b5e1.png)

May 3, 2022

Crowe will continue to support the Crowe Lease Accounting Optimizer for its existing customers and provide other digital accounting solutions that complement NetSuite. Crowe is also uniquely positioned to help LeaseQuery’s client base utilize the new ...

May 3, 2022

Startups have unique needs and requirements, and startup founders face complex accounting and tax situations such as venture capital due diligence, cash flow management, compensation issues, and more. As CPAs it’s an exciting opportunity to provide ...

May 3, 2022

The all-in-one practice management system is built on a completely modern technology stack and boasts a robust suite of practice management solutions and expands traditional practice management to include client onboarding, e-signature, and a unique ...

May 2, 2022

The tax season is often measured by the revenues a CPA firm generates, so this time period is make-or-break for the whole year. Adopting a reliable, secure cloud-based platform designed especially for CPA firms will help reduce stress for tax preparers...

May 2, 2022

This year, corporate tax departments should expect more transaction tax complexity as those taxes are now and will continue to be an increasingly convenient and effective way for state and local tax jurisdictions to raise revenue.

May 2, 2022

Sandbox AQ, an enterprise SaaS company delivering the compound effects of AI and quantum tech (AQ), has partnered with Ernst & Young LLP and Deloitte, two of the world’s largest professional services firms.

May 2, 2022

Stress will always be around, it’s up to you and how you deal with it, which will affect your mental and even physical health. Now is the perfect time to clear your mind, do some strategic planning, and begin making process improvements to find ways to...

May 2, 2022

These entrepreneurs have applied their tech and data expertise to COVID-related philanthropic ventures. They say government must dramatically increase its investments in the crumbling public health system considering how ...

May 2, 2022

Late last year, the Kansas City-based tax giant sued Twitter founder Jack Dorsey's company Square Inc., which changed its name to Block Inc. Leaders at H&R Block said that move co-opted their brand name, confused consumers and infringed on the ...

May 2, 2022

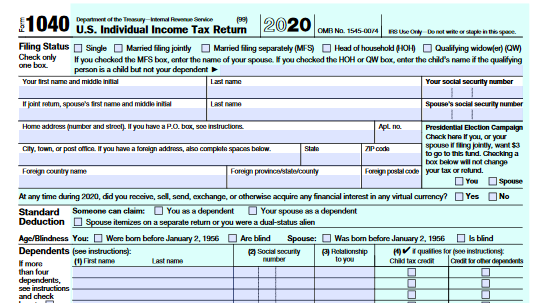

Among numerous other changes, the Tax Cuts and Jobs Act (TCJA) chipped away at several tax breaks for individuals, including the deduction for mortgage interest. But the fall-out isn’t as bad as it first seems. Most taxpayers can continue to deduct ...

May 2, 2022

Despite a common perception, the Tax Cuts and Jobs Act (TCJA) didn’t permanently eliminate the deduction for personal casualty and theft losses. For one thing, the TCJA crackdown is temporary, spanning 2018 through 2025.