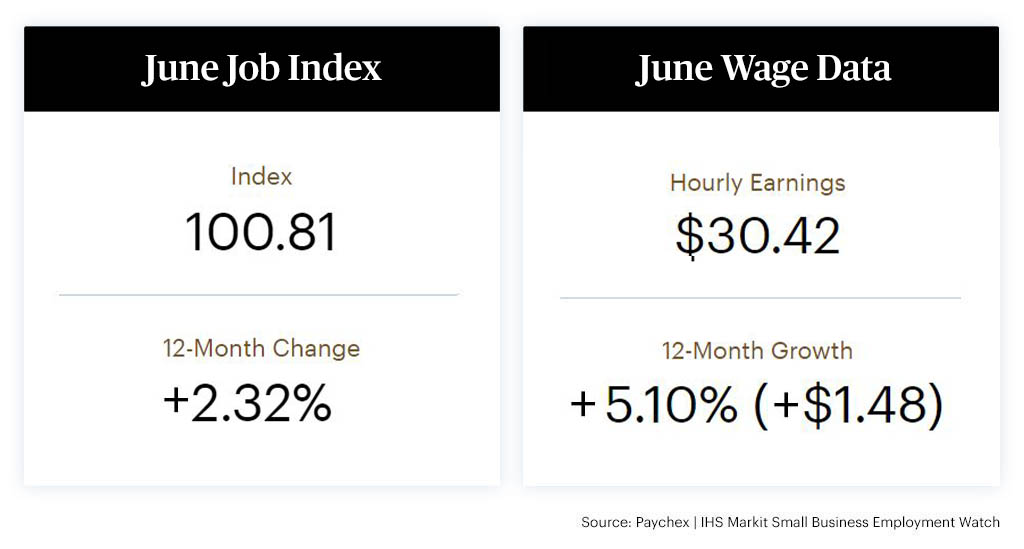

Small businesses continued to add jobs in June and worker wages continued to grow at a strong rate, but the pace of growth moderated slightly from previous month. These insights are according to the latest Paychex | IHS Markit Small Business Employment Watch. The Small Business Jobs Index for June was 100.81, up 2.32 percent from over a year ago and -0.06 percent from the previous month. Average hourly earnings growth for the month stood at 5.10 percent, compared to 5.16 percent from May 2022.

“The small business economy still is in recovery phase with continued job gains, and, surprisingly, moderating wage gains,” said James Diffley, chief regional economist at IHS Markit.

“Our June report shows continued job growth for small businesses. The pace of that growth slowed slightly from the previous month, however,” said Martin Mucci, Paychex CEO. “This month’s data also showed a slight decline in hourly earnings growth, the first decrease in 13 months. Despite this, growth remains strong, above five percent.”

In further detail, the June report showed:

- At 100.81, the national jobs index is up 2.32 percent over a year ago.

- Hourly earnings have increased $1.48 during the past year, now reaching $30.42.

- The South continued as the top region for small business job growth, with Texas and Dallas leading among states and metros, respectively.

- The South was also the top region for hourly earnings growth.

- Ohio was the top state for hourly earnings growth, followed closely by Arizona and Florida.

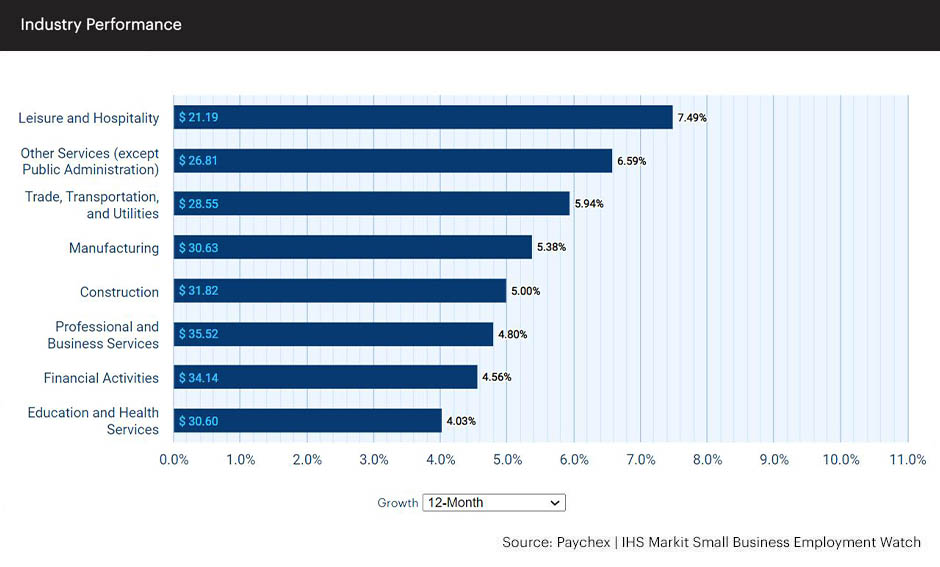

- Leisure and hospitality reported the strongest hourly earnings growth among industry sectors for the 16th consecutive month.

- Hourly earnings growth in the Construction sector hit 5.00 percent and again posted a new record level since reporting began in 2011.

Paychex solutions reach 1 in 12 American private-sector employees, making the Small Business Employment Watch an industry benchmark. Drawing from the payroll data of approximately 350,000 Paychex clients with fewer than 50 employees, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity.

The complete results for June, including interactive charts detailing all data, are available at www.paychex.com/watch. Highlights are available below.

June 2022 Paychex | IHS Markit Small Business Employment Watch

National Jobs Index

- At 100.81, the national index moderated -0.06 percent in June, but has increased 2.32 percent from June 2021.

- Small business job growth remains at its highest pre-pandemic level since June 2016, despite slowing for the fourth consecutive month to 100.81.

- June’s one-month change rate (-0.06 percent) was modest compared to the 0.15 percent and 0.27 percent declines in April and May.

National Wage Report

- At 5.10 percent in June, hourly earnings growth slowed for the first time since May 2021.

- Weekly earnings growth improved for the fourth straight month to 4.47 percent in June, though the month-to-month gains are diminishing.

- At -0.46 percent, year-over-year weekly earnings worked growth has been negative for the past 14 months.

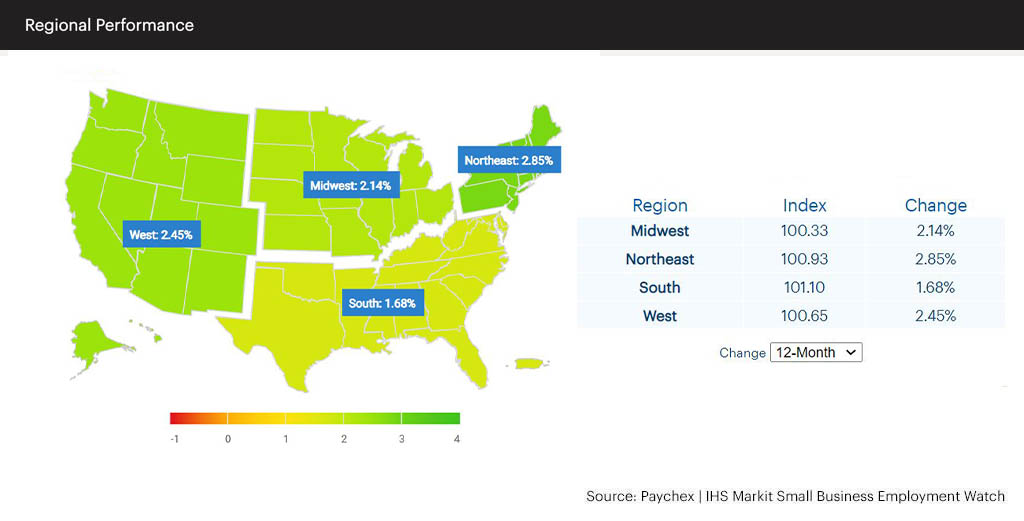

Regional Jobs Index

- At 101.10, the South slowed 0.07 percent in June, but continues as the strongest region for small business employment growth for the third consecutive month.

- The Midwest gained 0.28 percent in June to bring its index to 100.33. The Midwest has been last among regions for the past year, but the gap is closing.

- Down 0.37 percent in June and 1.10 percent since February, the West had its weakest one-month change in nearly two years as the pace of small business employment growth has quickly decelerated in the region.

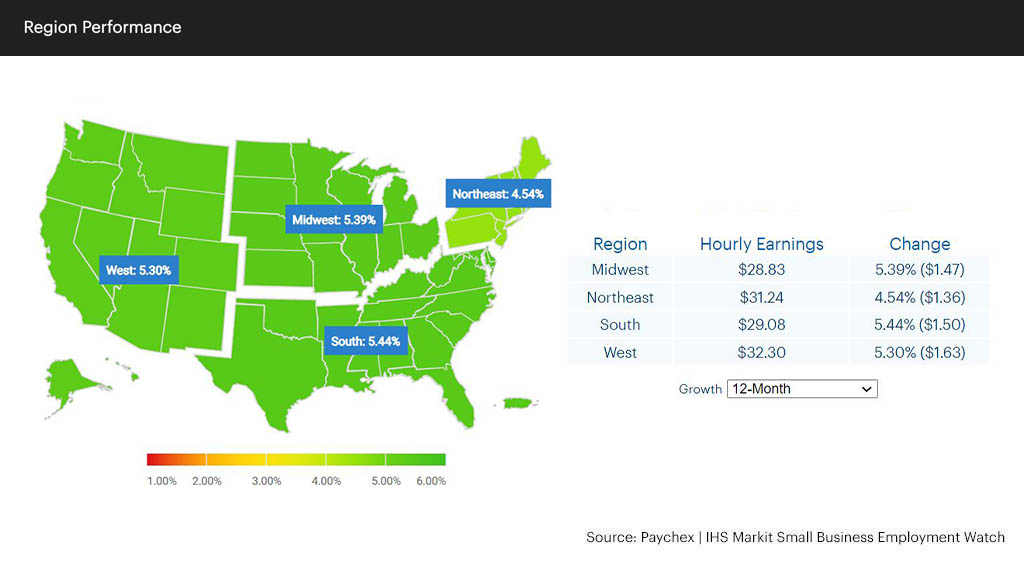

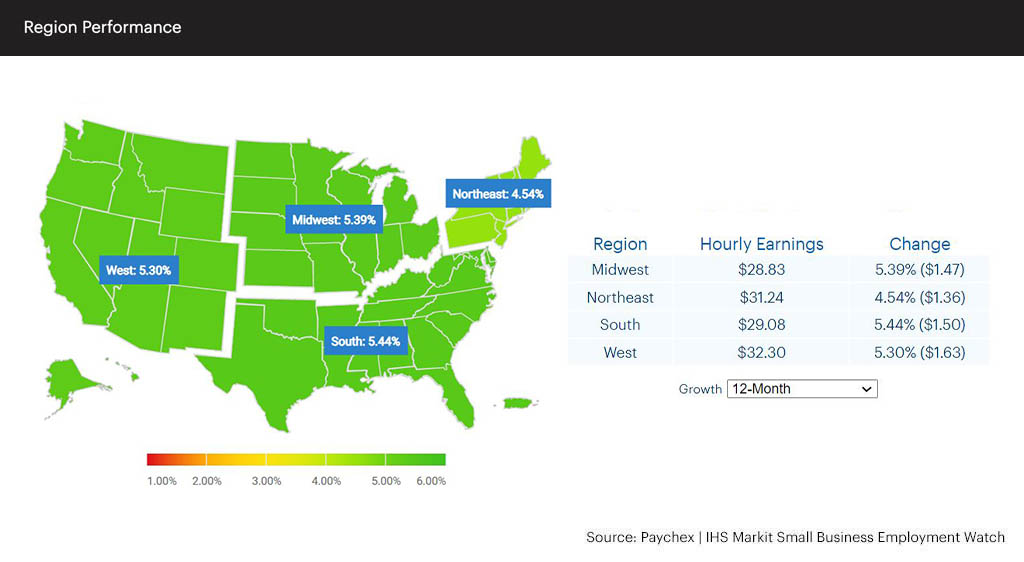

Regional Wage Report

- The South leads regions in hourly earnings growth (5.44 percent) and weekly earnings growth (4.86 percent), though not by a wide margin.

- The Northeast is the only region with hourly earnings growth below five percent (4.54 percent) and weekly earnings growth below four percent (3.85 percent).

- Weekly hours worked growth is similarly negative across all regions, ranging from -0.45 percent in the Midwest to -0.61 percent in the West.

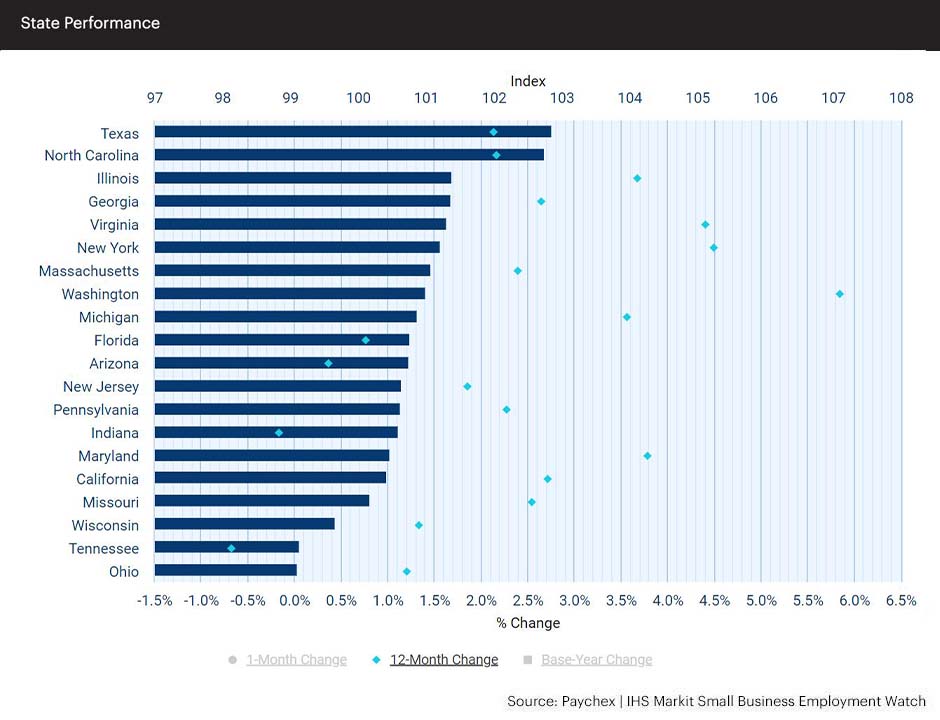

State Jobs Index

- Texas (102.85), followed closely by North Carolina (102.75), led states in the rate of small business employment growth in June.

- Midwest states’ Indiana and Illinois had the sharpest gains in June, 0.91 percent and 0.69 percent, respectively.

- Ranked fifth among states in April, the California index fell 0.21 percent in May and 0.65 percent in June to 100.43 and now ranks 16th.

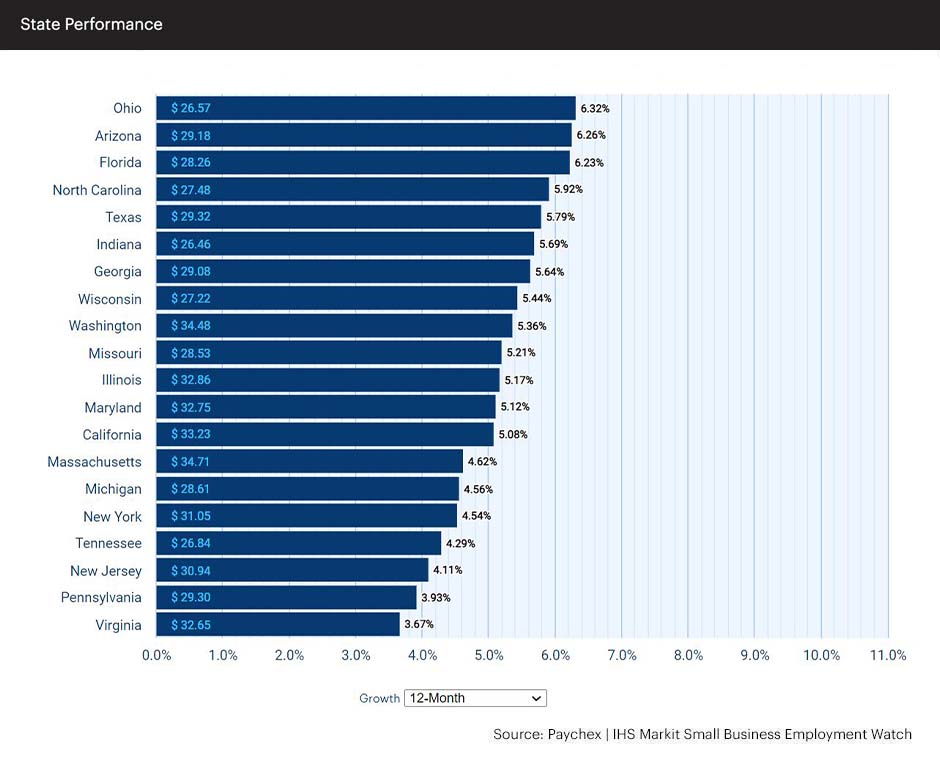

State Wage Report

- Ohio, trailed by Arizona and Florida, leads states in hourly earnings growth, above six percent. Virginia and Pennsylvania trail with growth below four percent.

- Tennessee ranks last among states in weekly earnings growth (3.27 percent) and weekly hours worked growth (-1.01 percent).

- Texas is again the only state with positive weekly hours worked growth, at a modest 0.07 percent.

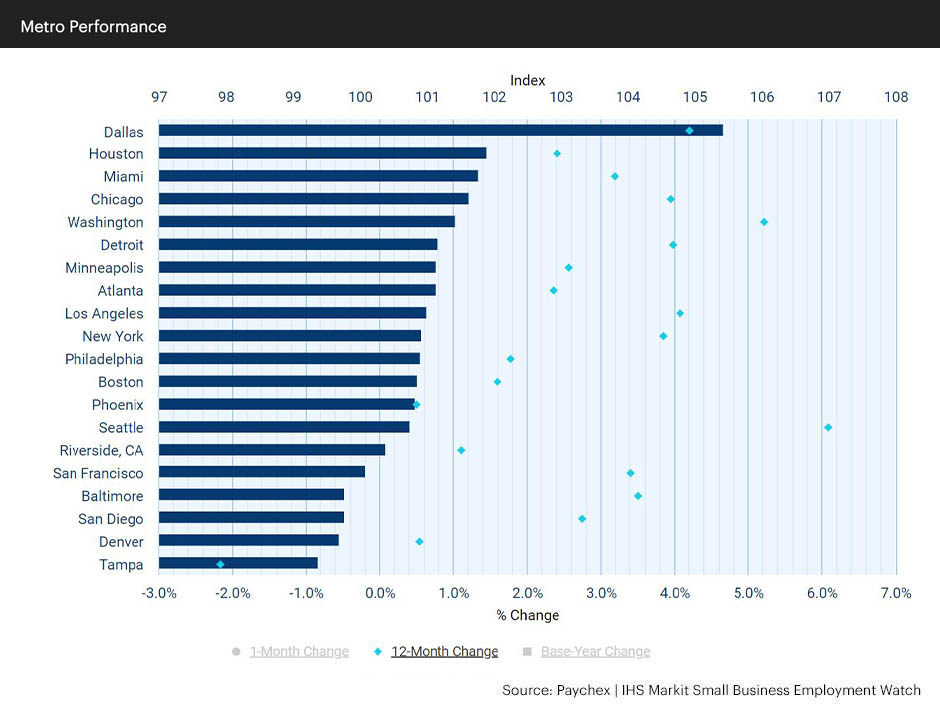

Metropolitan Jobs Index

- Texas metros Dallas (105.43) and Houston (101.90) are the top two metros for small business employment growth in June.

- All of the Pacific metros analyzed fell sizably in June, with San Diego falling the most (-1.26 percent). Seattle (-0.87 percent), Riverside (-0.83 percent), San Francisco (-0.70 percent), and Los Angeles (-0.36 percent) also slowed.

- Chicago jumped 0.83 percent in June, best among metros. At 101.64, Chicago has improved 3.94 percent from last year and now ranks fourth among metros.

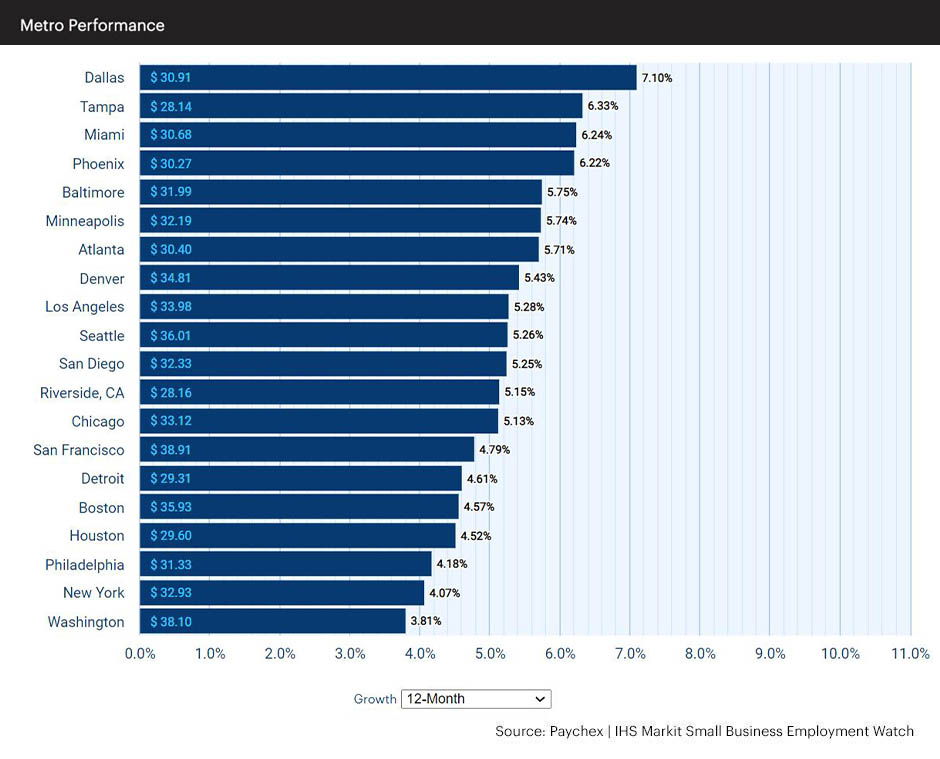

Metropolitan Wage Report

- At 7.10 percent, Dallas leads metros in hourly earnings growth.

- Florida metros Tampa and Miami lead metros in weekly earnings growth, 6.10 percent and 5.97 percent, respectively.

- Washington is the only metro with hourly earnings growth below four percent (3.81 percent).

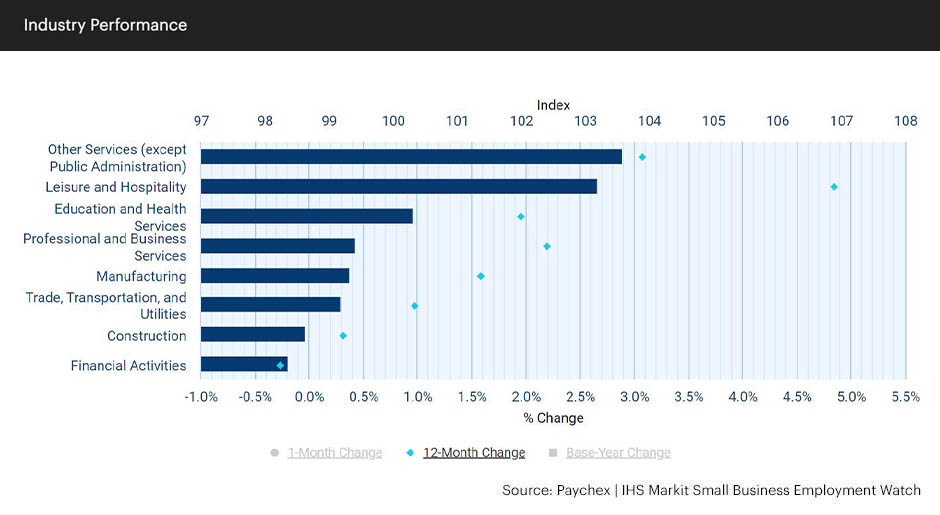

Industry Jobs Index

- With its index decelerating 0.78 percent to 103.20 in June, the pace of small business employment growth slowed the most in the leisure and hospitality sector for the fifth consecutive month.

- Professional and business services improved to 99.42 in June, its highest index level since October 2018. Professional and business services gained 0.44 percent in June, best among sectors, and improved to fourth among sectors, its highest ranking since before the pandemic.

Industry Wage Report

- All sectors analyzed have hourly earnings growth above four percent in June, with education and health services finally reaching that level as well as a new record level for the eighth consecutive month.

- For the third consecutive month, leisure and hospitality has the strongest hourly earnings growth (7.49 percent) and the weakest weekly hours worked growth (-1.93 percent) among sectors.

- At 6.26 percent, other services (except public administration) topped weekly earnings growth among sectors in June, quickly accelerating from last place in February 2022 (2.67 percent).

Note: Analysis is provided for seven major industry sectors. Definitions of each industry sector can be found here. The other services (except public administration) industry category includes religious, civic, and social organizations, as well as personal services, including automotive and household repair, salons, drycleaners, and other businesses.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs