Over the last few months, there have been a number of new features and improvements in QuickBooks Online Payroll, all designed to make it easier for you to help your clients manage the payroll process in QuickBooks Online. Here’s a summary of what you need to know.

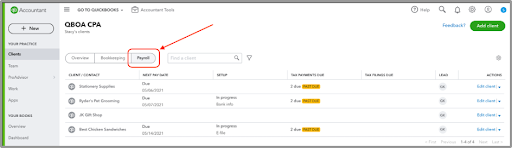

Check your clients’ payroll status on the new QuickBooks Online dashboard

A new payroll dashboard in QuickBooks Online Accountant shows all of your clients’ payroll status on one screen. The payroll dashboard is a new tab in the Client list when you log into QuickBooks Online Accountant.

“While the addition of the payroll dashboard may seem like a simple thing, I believe it will have a pretty noticeable impact on how it will help you and your team manage payroll setup, processing and reporting,” said Stacy Kildal, founder of Kildal Services LLC, and a member of Intuit’s Trainer/Writer Network. “Seeing everything in one place can save you time, give you more control over payroll tasks, and allow you to access more information in one place.”

According to Kildal, the new dashboard offers a view of the most important payroll activities, including when payroll needs to be processed, what taxes and filings are coming up, and where the client is in the setup process – her favorite feature she uses in her own firm.

“With these views, you can stay on top of the payroll services you provide or be proactive on important matters impacting your clients if they are processing their own payroll,” she said. “For example, my firm recently had some changes in team members as well as added new clients. Having one place to check the status of all-things payroll is a great way to make sure we stay on top of getting our clients set up in a timely manner, while also making sure payroll is processed on time.”

Additionally, Kildal shared that the dashboard has also been especially helpful with her conversions when she has moved clients from Intuit® Online Payroll to QuickBooks Online Payroll. Check out this video (https://www.youtube.com/watch?v=l1KvFrrVwSg) Kildal put together for the Firm of the Future blog (https://www.firmofthefuture.com).

QuickBooks Online Payroll employee onboarding and flexible setup

Acclimating clients to QuickBooks Online Payroll is now much easier. As most accountants know, simple employee onboarding and flexible payroll setup are key requirements when considering a payroll service, either in your firm or when you manage the process for your clients.

QuickBooks Online Payroll now gives you increased flexibility with:

- Employee self-onboarding: You can invite your clients or employees to enter their personal and tax information, saving you time and making it easier to get started.

- Flexible self-paced setup: You can set up payroll in the order that makes the most sense to you, and still get your clients and employees paid on time. You no longer need to enter employee information before connecting a bank account to payroll or completing other payroll tasks.

Improvements to the Payroll Tax Center

Another improvement is the ability to track and complete upcoming tax payments and filings from a dedicated payroll tax section.

If you need to view the status of filings, or act on a tax item, you can get an early heads-up with the improved Payroll Tax Center, available in the U.S. to all Core, Premium, and Elite users. This unified experience will make key pieces of payroll tax information more readily available, so that you’ll be able to see all information necessary to complete outstanding payroll tax tasks in time.

Expanded Auto Payroll in QuickBooks Online Payroll

The Auto Payroll workflow has also been improved and expanded to allow you and your clients to choose which eligible employees can enroll in Auto Payroll. The enhanced flexibility is designed to meet the needs of clients who prefer to have only a subset of their employees on auto pay, rather than all of them. This enhancement is available for anyone with QuickBooks Online Payroll Core, Premium, or Elite.

Another key enhancement is that Auto Payroll now comes with an employee selection table, where you can see and manage Auto Payroll details, such as eligibility and enrollment at an employee level, so you no longer have to worry about a single employee profile change affecting Auto Payroll for all other employees.

Visit this page (https://tinyurl.com/nuu7ee9e) for more information on QuickBooks Online Payroll.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs