This document contains final regulations that provide guidance under section 274 of the Internal Revenue Code (Code) regarding certain recent amendments made to that section. Specifically, the final regulations address the elimination of the deduction under section 274 for expenditures related to entertainment, amusement, or recreation activities, and provide guidance to determine whether an activity is of a type generally considered to be entertainment.

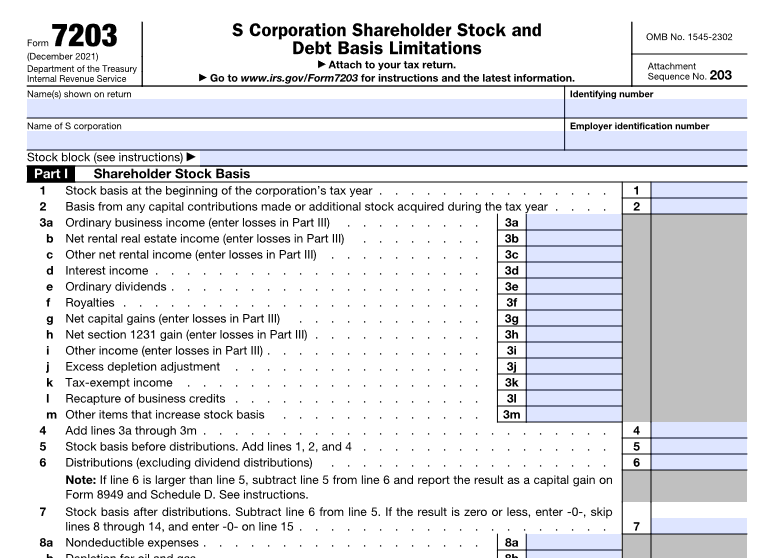

The final regulations also address the limitation on the deduction of food and beverage expenses under section 274(k) and (n), including the applicability of the exceptions under section 274(e)(2), (3), (4), (7), (8), and (9). The final regulations affect taxpayers who pay or incur expenses for meals or entertainment.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs