New research shows a direct link between finance digital transformation and agile business practices, better decision-making, and more efficient reporting, planning, and financial operations—all of which organizations will need to thrive in the new COVID-19 normal. Those were among the findings of the global Chief Financial Officer (CFO) Indicator Survey, “Finance Digital Transformation,” commissioned by finance and human resources application developer Workday, Inc.

The research, conducted during the period that COVID-19 was declared a pandemic and many companies were forced to rapidly shift to remote work, reveals that while nearly half of CFOs have not completed any digital transformation initiatives in finance, 34 percent expect to prioritize it in one year—during recovery from COVID-19. The study shows that those who do will reap benefits. The 54 percent of CFOs who have implemented some or many digital transformation initiatives pre-pandemic consistently perform better on agility, enhanced insights, and improved efficacy.

“CFOs were thrust into uncharted territory when the pandemic hit, underscoring the need for them to be able to make data-driven decisions to adjust, plan, and then continuously re-plan as conditions rapidly changed,” says Michael Magaro, senior vice president, business finance and investor relations, Workday. “This survey validates CFOs’ shifting priorities as they look to a combination of new skills and technologies to give them greater visibility and agility. And, while finance has been slower to embrace digital transformation, it’s clear the pandemic has become both a catalyst and imperative for change.”

The new CFO indicator report was done in partnership with Longitude Research and includes responses from 225 global CFOs on key challenges and priorities as they manage through the pandemic. Key survey findings show that:

- Digital finance transformation yields greater agility, efficacy, and confidence for CFOs. Digital accelerators, companies that have implemented some digital transformation initiatives in finance, are more agile and proficient at efficient reporting, planning, and financial close than digital novices, companies that have yet to implement digital transformation into the finance function. The accelerators are also more confident in the accuracy of their two-year profit and loss (P&L) forecast (73 percent) vs. digital novices (43 percent).

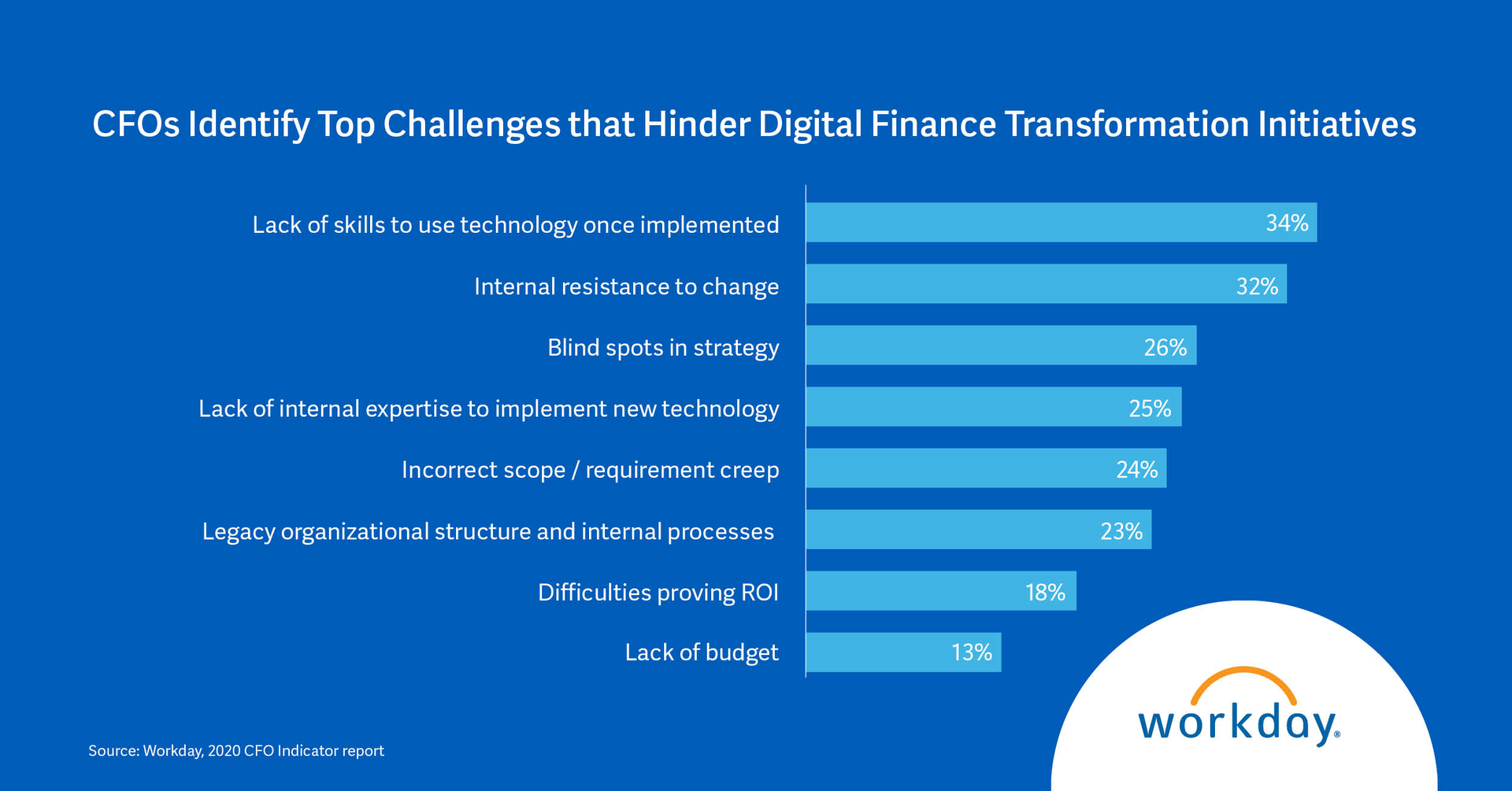

- Roadblocks to finance digital transformation are within the CFO’s control. Lack of technology skills and internal resistance to change are the two greatest challenges to digital transformation in finance. Lack of budget was the lowest rated challenge.

- Finance teams are challenged to deliver insights to the wider business at a time when it is needed most. Nearly half of CFOs surveyed believe that critical business decisions are delayed because finance is not proficient in delivering meaningful insights from data. More than a third (34 percent) of CFOs cite a shortage of skills needed to work with emerging technology as a key challenge to generating these insights.

- CFOs prioritize visibility and risk mitigation skills in today’s challenging environment. Top skills that CFOs need to urgently add to their team, through both hiring and reskilling, are predictive modeling/scenario planning and the ability to identify and manage risk. The lowest ranked skill is spreadsheet proficiency.

Overcoming Obstacles to Transformation

Digital transformation in finance can help transform the entire organization, the report notes. Steps CFOs can take are to prioritize technology investments that provide greater forward-looking visibility, identify and address technology skills gaps, incorporate key performance indicators (KPIs) to overcome resistance to change, and consolidate data into a single source for truth and clarity.

The report is available now and additional insights are shared in the blog, “How finance digital transformation is saving businesses—and preparing them for the future.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits