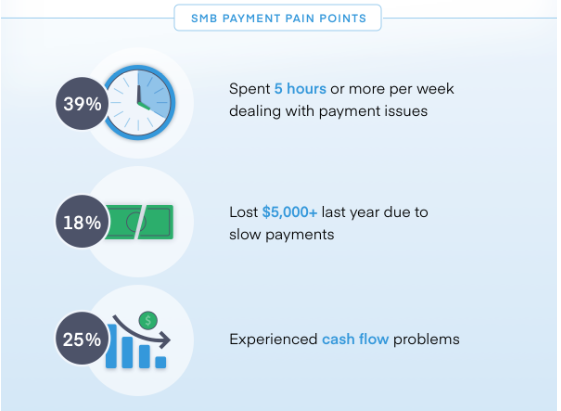

Small business owners have increased their technology spend in the past two years, but 39% say they still spend five hours or more per week dealing with payment issues, according to a survey conducted by WePay, the integrated payments business of JPMorgan Chase & Co.

WePay’s State of Small Business Payments 2020 survey provides a better understanding of the key challenges U.S. small business owners face when it comes to payments and their attitudes toward the financial industry overall. The findings help inform independent software vendors (ISVs) and Software-as-a-Service (SaaS) providers on how best to offer integrated payments solutions for small businesses to save them time and money.

The survey indicated that nearly half of respondents (49%) state they trust banks and credit card providers to handle their financial activity. However, 24% trust the combination of banks and software companies working together, showing an appetite to embrace the innovation of ISVs while maintaining the trust and confidence that comes from working with large banks.

“At WePay, we believe that payments and banking services should be seamlessly built into the software that businesses use every day,” said Bill Clerico, CEO of WePay and Head of Small Business Products at Chase Merchant Services. “Our payments expertise and the scale of JPMorgan Chase give us the ability to help ISVs and SaaS providers achieve their revenue goals and enhance small businesses’ experience – especially during these uncertain times when every sale counts a little more.”

The COVID-19 global pandemic spotlights the important role digital payments solutions play in keeping small business sales flowing. Integrating payments into business software helps small businesses pivot from in-person to digital sales or a combination of both. Watch a candid conversation about what WePay and ISVs are doing to help small businesses manage through the pandemic.

WePay surveyed 1,000 U.S. small business owners with fewer than 100 employees in February 2020 across the retail, food and beverage, field services, professional services, and e-commerce industries. Download the full State of Small Business Payments 2020 survey and infographic featuring these highlights and more:

Small businesses want a trusted partner in their payments technology

- 62% of small businesses surveyed would consider switching to a bank and software company solution, while 43% would switch solely to a software company.

- 28% of small businesses said they were “likely” or “very likely” to make a change to their online payment system in the next 12 months.

- 77% of companies with more than $1 million of annual revenue would consider working with a solution from a bank and an ISV.

- 29% of Gen Z respondents trust the bank/software combination to handle financial activity compared with 21% for Gen X and 20% for Baby Boomers.

Payment systems have challenges

- Payment speed is still the top concern for small businesses and 39% have faced speed-related payment issues in the last 12 months.

- 25% of those surveyed had cash flow issues in the last 12 months.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs