Taxpayers are ill-informed about changes to the tax law that may impact them personally, according to a survey of enrolled agents, who are federally-licensed tax professionals.

The survey, conducted by the National Association of Enrolled Agents (NAEA), presented a series of statements and asked NAEA members to choose the statements with which they agreed most strongly. The statements were grouped into three broad categories: Government operations (what impact does IRS operations have on the filing season), tax code and regulations (the Tax Cuts and Jobs Act), and taxpayer behavior (who is likely to seek the services of tax professionals this tax season).

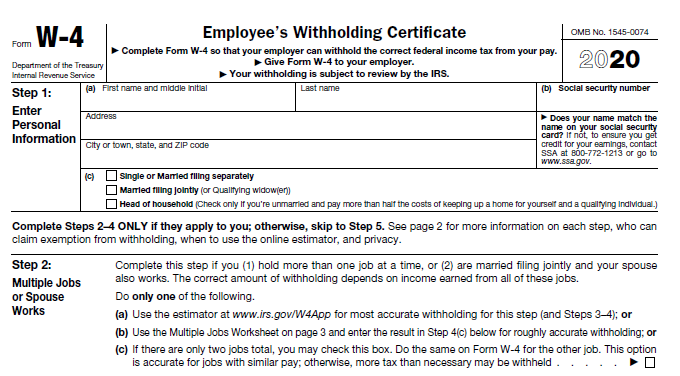

Withholding Miscalculations

Even though many taxpayers were surprised to receive smaller refunds for the 2019 tax year, it is likely many still did not heed warnings about adjusting their withholding before the current tax filing season. According to this survey, 56 percent of enrolled agents believe that taxpayers did not check their tax year 2019 withholding.

SECURE Act

Much of the buzz is still on the Tax Cuts and Jobs Act (TCJA). Fifty-seven percent of those surveyed do not believe that taxpayers are knowledgeable about changes to the tax law. The NAEA membership also believes (56 percent) that taxpayers, in general, are not knowledgeable about the impact of the SECURE Act on retirement savings, which increases access to tax-advantaged accounts and prevents older Americans from outliving their assets.

Lessons Learned

When asked to compare the 2019 filing season to the 2020 filing season, 51 percent of enrolled agents believe the 2020 filing season should run more smoothly. For the 2020 filing season, enrolled agents have been proactive in mitigating these major issues which were challenging in 2019:

1. Taxpayers unaware of changes in withholding

2. Clients misinformed about tax law changes

3. Taxpayers confused about choosing between itemizing or taking the standard deduction

4. Increasing rates to deliver tax returns that took much longer to prepare

5. Taxpayers unprepared for impact of SALT deductions.

Actions taken by enrolled agents to better prepare clients for the 2020 filing season include the use of engagement letters, reinforcing year-round financial planning, and educating clients about recent legislation.

Taxpayers, Be Prepared

According to NAEA Executive Vice President Robert Kerr, EA, “Beware of offers that seem too good to be true—guaranteed refunds, “secret” deductions, and the like. The key metric for your tax return isn’t the size of the refund but the degree of accuracy. Does it accurately reflect your circumstances? We all sleep better at night knowing our returns are accurate and defensible if IRS comes knocking.”

“This filing season, NAEA encourages you to find a federally-licensed enrolled agent in your area today by using the free ‘Find a Tax Expert’ directory at www.eaTax.org,” says Kerr. “With recent tax law changes, we continue to see tax prep becoming more, not less, complicated. Enrolled agents are uniquely positioned to help during this tax season and throughout the year.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs