Americans prefer using credit cards when shopping, both online and when shopping in person, according to Mercator Advisory Group’s most recent consumer survey report, Credit Cards: Still the Card of Choice, from the bi-annual North American PaymentsInsights series.

When shopping in stores, 43% of U.S. consumers prefer to use credit/charge cards, followed by 32% who prefer to use debit and 17% who opt for cash. Further, these findings are on par with last year’s results.

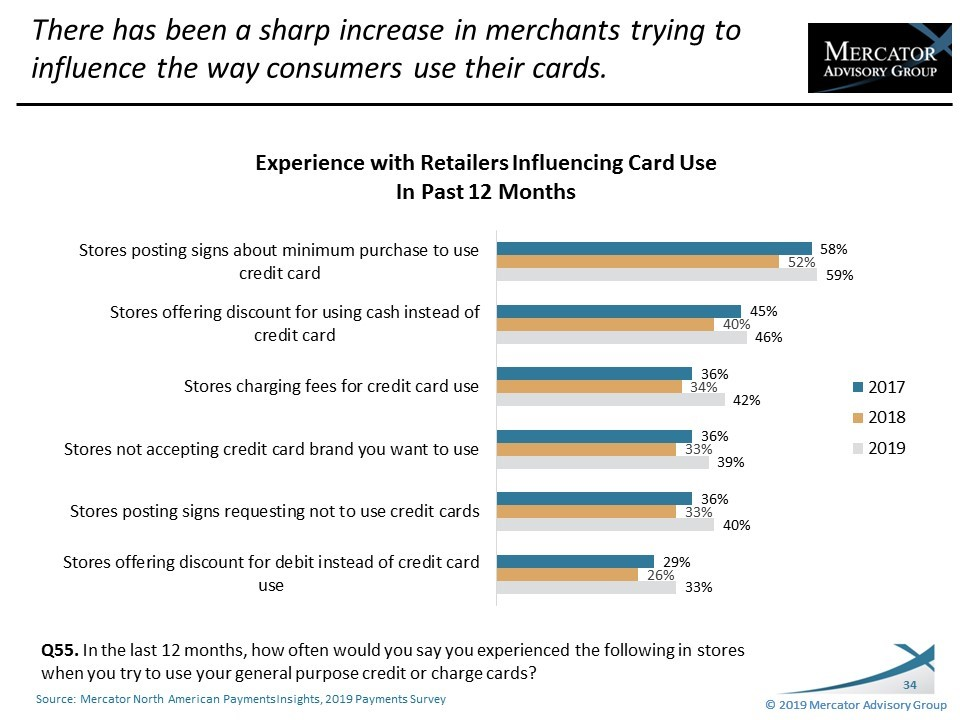

Compared to last year’s survey, more consumers report that merchants are trying to influence their method of paying. For example, this year 59% report that they have seen signs posed by merchants stating credit card minimums, up from 52% in 2018. Also, 46% report stores offering discounts for cash, a result that is up from 40% in 2018.

Consumers are reporting more fraud on their credit cards this year compared to last. In 2019 about 3 in 10 (31%) reported some kind of fraud on their credit cards compared to 24% who did so last year.

With regard to credit card rewards, cash back is still the most common reward earned by U.S. cardholders. Currently, about two-thirds of cardholders (64%) are getting cash back from at least one issuer of the credit cards they hold. Non-travel related points are the second most common reward, which 4 in 10 cardholders report receiving. These findings are consistent with the findings Mercator reported last year.

Credit Cards: Still the Card of Choice, the latest report from Mercator Advisory Group’s Primary Data Service, is based on a sample of 3,002 U.S. adults surveyed in the annual online Payments survey of Mercator’s North American PaymentsInsights series, conducted in June 2019.

The study highlights consumers’ use of credit cards, relative to other payment types, the use of credit card controls, reward programs, new account opening, among other topics.

“The credit card space in the U.S. continues to be dynamic. We see no erosion in consumers’ preference to use their credit cards when shopping. It is still the top-of-wallet payment choice. This report explores some of the key aspects of the credit card business and brings the consumers’ view of the payments world to light,” stated the author of the report, Peter Reville, director of Primary Data Services at Mercator Advisory Group, which includes the North American PaymentsInsights series.

Highlights of this report include:

- Current payment card usage in the U.S.

- How U.S. cardholders pay their credit card bills

- The incidence of fraud

- Merchant influence on card usage

- How consumers use credit card controls

- The current state of credit cards rewards

- Where consumers go when researching a new credit card

- The use of co-branded cards and the benefits they offer

- A view of the use of online lenders

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs