Dedicated accounting firm executives, not unreasonably perhaps, may not be able to imagine the firm without them. Nor do they want to tempt fate and think too heavily about losing critical colleagues or direct reports.

On the corporate side, nearly half of CFOs in a Robert Half Management Resources survey reported they have not identified a successor, primarily because they’re not planning to leave soon. You may see similar trends in public accounting — and even at your own firm.

A strong dedication to the organization is admirable, of course, but using it as an excuse to not engage in succession planning is misguided. Even if you expect to stay for the foreseeable future, you never know what you’d do if an irresistible opportunity came your way. If you are up for an internal promotion, your firm may want assurance someone can quickly step in before they make a final decision. What about your colleagues and staff? Not all employees share the same commitment to the firm. Failing to plan for every possibility imposes a major self-induced risk to your business.

Why your firm needs a succession plan

Succession planning isn’t something to be left to chance. Here’s why:

- Staffing continuity — The departure of a leader disrupts workflow, productivity and customer service. On the other hand, when you codify processes and ensure someone else has the know-how to take over a role, the firm can weather transitions more smoothly.

- Institutional knowledge — Each employee who leaves your firm departs with a wealth of experiences and skills that can’t be quickly passed on. By recognizing this ahead of time and taking action, leaders will be ready to transfer critical legacy knowledge — as opposed to finding themselves in a panic.

- Business strategy — Companies facing an unplanned departure might be forced to put key decisions on hold, and this has a negative effect on major initiatives, including client service, business development and the introduction of new technology. Succession planning ensures important projects don’t get derailed.

- Employee retention — Talented CPAs know their skills are hot in today’s job market. If they’re uncertain about their advancement opportunities in-house, they might seek them elsewhere. Succession planning gives key performers another reason to stay on, and you another way to reward their hard work and retain them.

7 Tips for identifying and preparing successors

Understanding the need for succession planning is one thing, but how do you go about it? Here are seven tips:

- Plan for each position. You need a succession plan only for senior roles, right? Wrong. Management should have a strategy in place so they know what to do when anyone leaves.

- Know your options. Sometimes the succession answer is a series of promotions, while for other roles you could divide responsibilities among existing staff until a new employee can be hired.

- Prepare early. Succession planning doesn’t happen overnight, and you certainly don’t want to be doing it under pressure. Prepare promising candidates as soon as you’ve identified them, which can be as early as a new hire’s first months on the job.

- Provide growth opportunities. For future leaders to expand their skill set, they need the right conditions. Assign them to head up progressively larger teams with progressively more responsibilities. Give them more opportunities for working with your firm’s leaders and for public speaking. Have them back up senior managers on leave or vacation. The more they can hone their skills before being in the spotlight, the greater their chances of success.

- Institute formal mentoring. An excellent way to transfer institutional knowledge and train future leaders is to pair them with a current one. This master-apprentice model has worked well throughout history. A mentor can also help mentees grow their network, which is crucial for collaboration and professional support.

- Give them formal training. On-the-job learning is essential, but that may not be enough for certain executive roles. Some may require another certification, while others would benefit from an MBA. A good succession plan budgets for professional development resources and education costs.

- Review the plan regularly. Market conditions, clients, technology, business expansions and contractions — nothing remains the same. That’s why you need to keep your succession strategy updated. Good times to re-evaluate the plan include the start of the financial year and after performance reviews.

You’ve frequently managed clients’ business risk as part of your job. Now it’s time to minimize internal risk by making sure retirements, resignations and other staff departures won’t get in the way of your firm’s success.

======

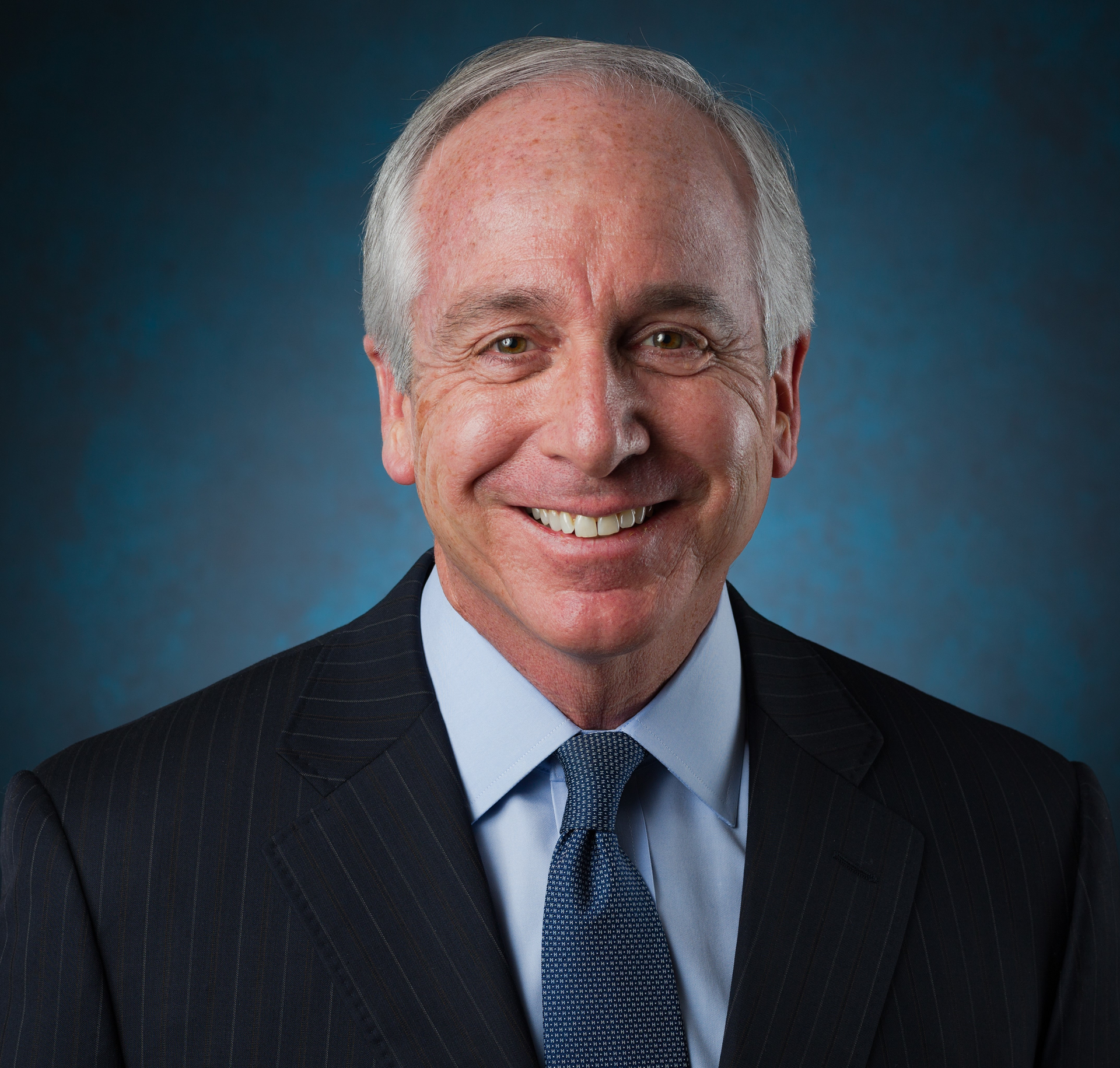

Paul McDonald is senior executive director at Robert Half, the world’s first and largest specialized staffing firm. He writes and speaks frequently on hiring, workplace and career-management topics. Over the course of 35 years in the recruiting field, McDonald has advised thousands of company leaders and job seekers on how to hire and get hired.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs