Nearly three quarters of all American businesses were targeted for payments fraud in 2015, according to new research by the Association for Financial Professionals. The survey’s respondents included 627 treasury and finance professionals.

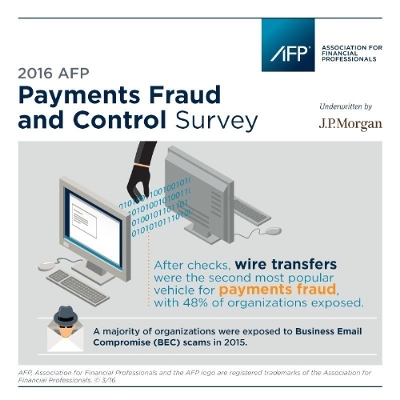

AFP’s 2016 Payments Fraud and Control Survey, underwritten by J.P. Morgan, found that 73 percent of all U.S. firms experienced a payments fraud attack last year. That matches the largest percentage since 2009, and was up from 62 percent in 2014.

Yet even without facing a direct substantial financial loss, payments fraud costs American organizations resources in the form of security, cyber insurance and training.

“Let there be no doubt: Payments fraud is an enormous challenge for all organizations,” said Jim Kaitz, president and chief executive officer of AFP. “One of the toughest payments fraud challenges we are seeing is BEC scams, which are growing increasingly sophisticated and successfully infiltrating email systems at numerous organizations.”

BEC scams, short for business email compromise, are an increasingly common type of fraud which greatly impacts wire fraud. In 2015, 64 percent of organizations were exposed to BEC scams. Though checks continue to be the payment method most targeted by fraudsters, in 2015, 48 percent of organizations were exposed to wire fraud, an increase from 27 percent in 2014 and 14 percent in 2013.

“Each year, payments and cyber fraud schemes grow in sophistication and knowing how to recognize and manage these threats is critical to protecting your organization,” said Nancy McDonnell, Managing Director and Treasury Executive for J.P. Morgan. “Investing in the appropriate data protection tools, infrastructure controls and employee education is essential for all businesses.”

Though treasury and finance professionals are pinning their hopes on EMV chip cards to alleviate at least some payments fraud, 90 percent believe that criminals will shift their focus to other payment methods if EMV chip cards are successful in mitigating fraud, an increase of 10 percentage points from 2014.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes