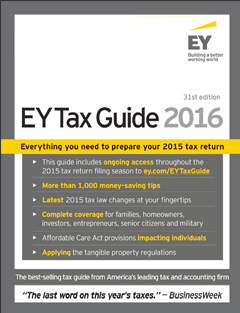

With new chapters of information on tax preparation, the EY Tax Guide 2016 is now available online and in bookstores nationwide to guide taxpayers through the tax filing season. New to the 31st edition are important updates on tax law changes, particularly two chapters related to premium tax credits (PTCs) and tangible property regulations, and how they affect people.

“Every IRS change affects somebody, whether its income earners or investors, students or retirees, renters or lessors, business owners or partners, charity workers or leading philanthropists,” said Greg Rosica, contributing author to the EY Tax Guide 2016. “Perhaps most top-of-mind is healthcare. The new chapter on premium tax credits explains how they help eligible individuals and families afford the insurance offered by the Health Insurance Marketplace before nonparticipation penalties climb in 2016. But there are many more life situations to consider as you make adjustments to your 2015 tax profile and plan ahead for 2016.”

The EY Tax Guide 2016 helps taxpayers consider tax strategies for their particular financial situation, leverage money-saving tips, streamline the filing process with the tax organizer and plot their preparation on the tax calendar to meet key deadlines. The companion website at ey.com/EYTaxGuide helps taxpayers stay up-to-date on tax law changes, which is crucial given the uncertainty surrounding certain exclusions, deductions and credits that have been available in the past.

Available in all e-book formats (eMOBI, ePUB and ePDF) as well as traditional hard copy, the EY Tax Guide 2016 provides readers with easy, on-the-go access to important 2015 tax changes. Taxpayers and professional preparers alike can sign up for the guide’s companion website to receive tax alert emails and access up-to-date information about tax law changes.

For more than three decades, the EY Tax Guide (John Wiley & Sons, Inc.; $24.95, 1056 pp.) has been recognized by critics as one of the best tax preparation resources available. It includes the official Internal Revenue Service (IRS) tax guide, Publication 17 – Your Federal Income Tax, which contains the IRS’s position on many of the questions taxpayers face and the latest 2015 tax law changes. The EY Tax Guide 2016 provides special tips from EY focused on major tax issues for families, homeowners, investors, entrepreneurs, senior citizens and military personnel. The EY Tax Guide 2016 also incorporates a number of valuable tools and lists, including how to avoid the 25 most common tax-filing errors, the 50 most overlooked tax deductions, enhanced coverage of the alternative minimum tax (AMT), green tax breaks and incentives, and more than 1,000 money-saving tax tips.

“The EY Tax Guide is an approachable yet authoritative resource that has acted as the go-to reference for individual taxpayers for years. With this text, you can understand the deductions you are entitled to and maximize your return,” said Rosica.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Taxes