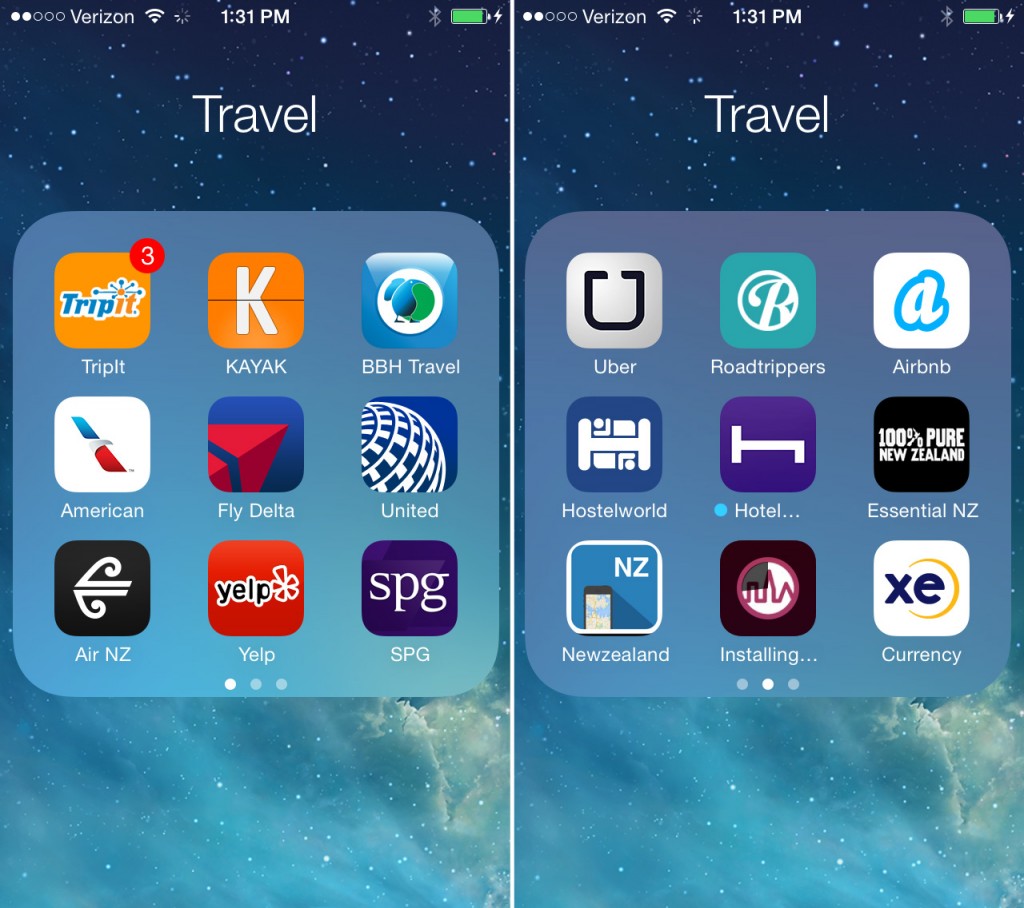

Whether you’re traveling for business or personal, alone or with colleagues or friends or family members, domestically or internationally – we all know that getting from point A to point B can cause frustration, confusion, and disorientation. We surveyed our newly minted Class of 2015 40 Under 40 honorees to find out about the apps they use to make their travel lives easier.

Brian Friedman, CPA.CITP, division sales manager for Wolters Kluwer Tax & Accounting US, is a fan of Google Maps, “The most user friendly and accurate to get me to my destination quickly while sitting in the least amount of traffic. That’s important in New York and New Jersey!”

Friedman also uses Uber instead of taxis because, “Knowing how far your ride is from picking you up, how much it will cost, and approximate time to your destination are major benefits.” Nate Hagerty, CEO of TaxProMarketer, agrees. “Uber has been transformational because of how easy it is to use, and the local insight you get from friendly (!) drivers – who are forced to attempt good customer service because their rating (and job status) depends on it.”

Roy Keely, vice president of market strategy for Xcentric, consolidates all travel plans with TripIt, “So I have one go-to spot for all my hotel, rental car, and flight information. In addition, I can share my TripIt calendar with family or co-workers so they can know my whereabouts.

TIP: Create a forwarding rule so that when you get confirmation emails re: travel plans they automatically forward to TripIt and get ingested into their system.” Keely also recommends GateGuru. “I love and need coffee…I must know where to find it at any given moment and in any given airport. GateGuru is a catalog of all the airports and all the vendors, terminals, and maps associated with each airport.”

Adam Burnett, solution design manager at Wolters Kluwer Tax & Accounting US, thrives on TV Food Maps. “I’m a Food Network addict so I use the app to find restaurants to eat at that have been featured on the shows I watch. It’s my way of embracing the time on the road and really capitalizing on the opportunity to try the local fare.”

Danielle Supkis Cheek, CPA, CFE, CVA, president of D. Supkis Cheek PLLC, reminds us that bank apps can be lifesavers for road warriors. “I am always on the move and traveling and do all my business deposits on the app. I can even deposit large retainer checks on the spot as my app deposit limit is $100K. Luckily I have never had to use it, but I can also freeze my debit card if I ever misplace it from the app.”

Danetha Doe, CEO of Danetha Doe Consulting, relies on Slack and Shazam when she travels. “Slack is a real-time messaging app that allows me to communicate with my team quickly and easily, without cluttering my inbox. Shazam identifies the media playing around you. I always hear songs playing in the hotel lobby or while I’m out in a new city, and this app helps me figure out the name of the song and the artist.”

Jeff Moskowitz, CPA, senior manager at CohnReznick, recommends Waze, the world’s largest community-based traffic and navigation app. “This app allows you to simply focus on your trip and easily navigate to your destination. The best feature of all is that it navigates while incorporating traffic so you are able to get to your destination using the quickest possible route without listening to traffic updates. It also has other great features such as enabling users the ability to navigate to the nearest gas station in the event you’re running low on gas.” Erica Brown, CPA, senior audit manager for Martin Starnes & Associates, agrees. “Waze is a social network GPS App that alerts you on local traffic, accidents, and police reports.”

Cathy Iconis, CPA, CEO of Iconis Group, recommends TripAdvisor. “You are able to search for things to do near your current location or wherever you are traveling to. You should always try to take some time out of your trips to be a tourist!” She also uses Expensify. “It allows you to track all of your travel expenses on the go. You even have an option to track your mileage via GPS.” Kristen Rampe, CPA, principal at Kristen Rampe Consulting, agrees. “Expensify seamlessly integrates with all of my credit cards and accounting software, so for any purchase under $75, I just pay and go on my way. No receipts, no typing in the date, vendor, amount, etc., it’s all taken care of!”

World traveler Brett Cooper, business strategy fellow at TaroWorks, uses AirBnB and Uber when traveling, including internationally. “When consulting in India both applications were tremendously useful. Uber allowed me to travel around major cities without having to haggle with rickshaws, and AirBnB ensured I didn’t have to scour the Internet for a place to live.”

Matt Rissell and his TSheets team has unearthed some travel app gems. “NexTravel has a ton of travel discounts, flexible cancellation options, and it integrates with expense travel apps for business travel. Plus, there is a bonus miles program where our company and the employee who traveled each get credit for the miles. TheTravelingWOD suggests workouts that can be done in a hotel room – great for fighting jet lag. “We all want to get the best deal but don’t have the time to spend searching endlessly for it. Hopper does the bargain hunting for you and tells you when it’s the best time to fly and buy.”

Footnote from TSheets: “And of course, if you’re traveling for work and want to a) know where your travel time is spent b) where your co-workers/team members are and what they are working on in real time and c) keep track of hours/employees while on the road for payroll and invoicing…. you need to make sure the big TSheets T is on your home screen!”

Kerri Gibson, vice president and general manager at Wolters Kluwer CCH Small Firm Services, relies on Concur when she is on the road. “It makes expense reporting so easy that I don’t even have to think about it anymore. She also uses TripAdvisor, as does Hector Garcia, CPA,CITP, CGMA, partner at Quick Bookkeeping and Accounting LLC, and Samantha Mansfield, director of corporate communications at CPA.com. “One of my favorite features is the selection of pre-determined itineraries that allows you to maximize your time and still experience the local culture. Never miss the best restaurant or sites again, even if you only have a few hours!” said Gibson. Mansfield uses the app to leverage the reviews for hotels, restaurants, and fun and interesting activities to try in a new city.

Mansfield also recommends Orbitz. “It makes the details of upcoming trips very accessible and easy to view, the notifications are timely, the interface is quite user friendly and who wouldn’t like Orbucks!”

Marjorie Adams, founder and CEO at Fourlane, has discovered Fancy Hands to make traveling easier. “It is like having an assistant for work or your personal life. You can leave a voicemail, text, or email a request and they take care of it for you. As an example, I wanted to find a good restaurant to take an out-of-town client to while I was visiting them. I sent a text to Fancy Hands to find a great seafood restaurant in the mid-price range and make reservations for that evening.”

——

What apps have you discovered that help you make the most of your travel experiences?

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Software, Taxes, Technology