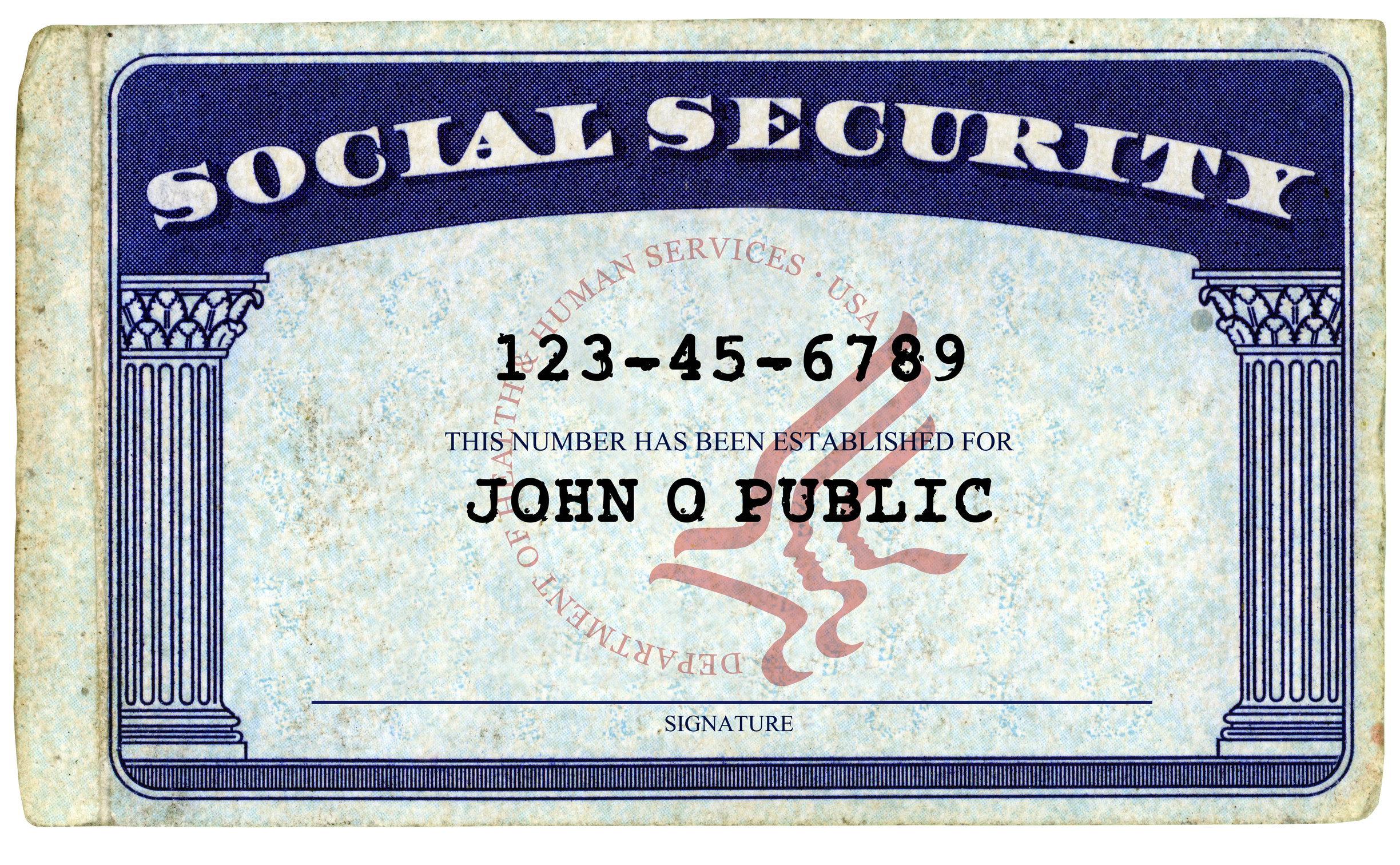

The Internal Revenue Service (IRS) has made limited progress reducing the unnecessary use of Social Security Numbers (SSNs) on forms, letters, and notices, according to a report by the Treasury Inspector General for Tax Administration (TIGTA).

In Fiscal Year 2014, the IRS mailed more than 141 million notices and 37 million letters to taxpayers for various reasons, to help them understand and meet their tax obligations. In a prior review, TIGTA reported that the IRS had not made significant progress in redacting or masking taxpayers’ SSNs from systems, notices, and forms. This audit was initiated to assess the IRS’s progress in eliminating taxpayer SSNs from correspondence.

TIGTA found that as of January 2015, the IRS estimates that it has removed SSNs from 58 (2 percent) of the 2,749 types of letters and 93 (48 percent) of the 195 types of notices it issues.

“A person’s Social Security Number is the most valuable piece of personal data identity thieves can obtain.” said J. Russell George, Treasury Inspector General for Tax Administration. “The fact that the IRS does not have processes and procedures to accurately identify all correspondence that contain Social Security Numbers remains a concern.”

An Office of Management and Budget mandate required the IRS to eliminate the unnecessary use of SSNs by March 2009. However, the IRS suspended work on the forms, letters, and systems components of its SSN Elimination and Reduction Program in September 2011, so that it could focus on other components of the program with its limited funding. Funding needed to upgrade computer systems to process barcoded notices will not be available in Fiscal Year 2016 because the IRS has deemed other projects more critical.

TIGTA also found that processes are needed to identify the universe of taxpayer correspondence with unnecessary SSNs and to ensure that SSNs are excluded when creating new correspondence. For example, TIGTA’s statistically valid review of 65 forms created since Calendar Year 2009 found that 14 (22 percent) require taxpayers to provide their SSNs. Finally, processes are needed to monitor the use of barcode scanners which are used to track correspondence. TIGTA identified scanners that were not being used in one function while another function did not have enough scanners.

TIGTA recommended that the IRS: 1) update the SSN Elimination and Reduction Program strategy to include specific time frames and describe how implementation of the proposed digital communication project would affect the IRS’s SSN elimination and reduction plans, 2) develop a Service-wide strategy to identify and compile a list of all correspondence issued to taxpayers, 3) develop processes to ensure that newly created correspondence is designed to omit the unnecessary use of an SSN, and 4) develop processes and procedures to monitor and track barcode scanners to ensure that their use is maximized.

The IRS agreed with three of TIGTA’s four recommendations and plans to take corrective actions. The IRS disagreed with the recommendation to compile a list of all correspondence issued to taxpayers and stated that implementing the recommendation is a more costly endeavor than it appears. TIGTA continues to believe that without identifying the universe of correspondence, the IRS cannot measure its progress in reducing the unnecessary use of SSNs.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs