For many business owners, managing the backend of a business is often as much work as providing their own services and products. Simply streamlining these processes can alleviate many of their pain points, but it can be a hassle to get all of their programs to play nice.

Insert QuickBooks Workhub. Now, business owners can manage all of their backend processes from one central hub. Workhub is powered by Intuit’s QuickBase platform, but is designed from the ground up to meet the unique needs of small- to medium-sized business owners. Similar to every other app in the QuickBooks Online ecosystem, Workhub will deeply integrate with QBO, eliminating the need for double and manual entry.

“We build and update our solutions based on the feedback we receive from our customers to ensure we are effectively solving their biggest pain points. In talking with our customers, we found that they are constantly piecing together a number of software and paper solutions to run their business. Some business owners use up to 17 different solutions,” said Gideon Ansell, who is leading the Workhub project.

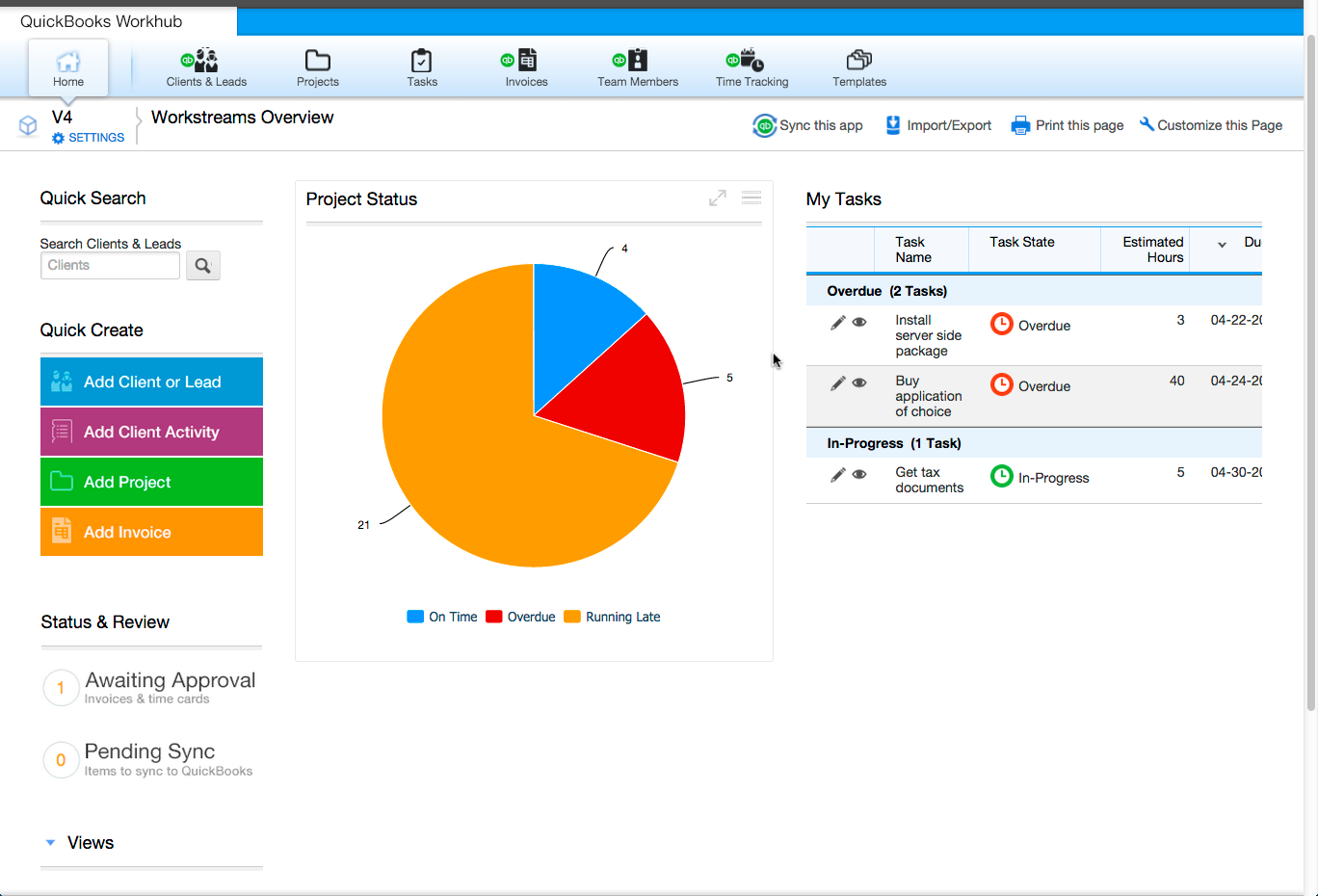

With the new QuickBooks Workhub business owners can easily manage prospecting and sales, plan and schedule jobs, track staff activity and time, draft invoices and more. Users can create custom fields, charts and reports, allowing them to tailor the solution to their specific business needs. The solution also offers a role-based user interface that ensures each person has access to everything they need, but only the things they need access to. This helps eliminate issues that may arise when unauthorized personnel manage important data.

“Workhub helps maximize business owners’ internal control by allowing users to get meaningful insight into their business, such as what their team is doing, the status of their prospect pipeline and estimates versus actuals. We know that we’re not going to solve every problem for every business, so Workhub lets our customers to expand upon our solutions. And the integration with QuickBooks ensures we deliver a single solution for running their whole practice,” said Ansell.

Intuit is focusing on small-mid-sized professional services companies with the rollout of its Workhub app. The accountant version is targeted directly to accounting firms that already use QBO or QBOA. The company has spent the past year making sure to build out only functionality that is crucial to successfully running a small business. Oftentimes, the needs of small business differ greatly from those of larger businesses. As a result, many one-size-fits-all solutions contain a lot of features that are generally useless to small businesses.

“There are a lot of expensive solutions in the marketplace today with bloated features that companies don’t need, while also missing what they do need. It creates a lot of time-consuming busy work for business owners. Our philosophy is that the solution ought to work for you, not the other way around. And, that’s what we’ve created with Workhub – a solution that works the way business owners work,” said Ansell.

Workhub gives users the flexibility to add any information that is important to their business. They can add simple definitions to categories and pin data to their customizable homepage. Search functions allow users to filter by client leads and see current projects, tasks and status for each client. Client information also syncs with QuickBooks and users can add additional information that isn’t available in QBO, such as authorized client logins and the accounting software used in their business. Users can also add information that isn’t related to a business’ finances, such as T-Shirt sizes or client appreciation gifts.

Users can track team members, assigning specific roles and different priorities. Roles such as user, manager and owner all have different authorizations and access levels. Business owners can also track work status, timecards and accreditations for each team member, as well as billing and budgets for project and client. The system automatically notifies team members of any uncompleted tasks still waiting for them. Drilling even further down, users can see where their clients are located, which tasks are waiting for approval or pending synchronization with QuickBooks Online.

One feature designed to really eliminate repetitious data entry is the project template functionality. Users can create templates for similar or frequent tasks. Timelines, budgets, and tasks can all be defined and saved as a template. In addition, tasks can be automatically assigned to a staff member and saved under the project template, eliminating the need to assign the same task each time.

Workhub is completely integrated in one system – the QB ecosystem – allowing business owners to have more insight into their profitability. They can quickly see which tasks are assigned to various team members and how they are performing on time and against their budget. Since everything is handled from one central hub, the business’ most important data is kept secure. Automated processes and access authorization ensures owners don’t have to worry about keying in the wrong data or spreadsheets being sent to the wrong people.

The solution will be available in two versions – an accountant version and a professional services version. Accountants with professional service clients will be able to rollout that version to their clients and help them streamline their own processes.

Availability of QuickBooks Workhub will be announced in June at the annual Scaling New Heights. Intuit will also offer two sessions to introduce the solution to accountants and help them get setup. Users will be ready to roll out the new solution for their practice and to their clients once they leave the conference. Intuit will hold several webinars following the conference to help train accountants and their clients.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management, Small Business, Software, Technology