SavingsBonds.com has revealed a little known financial strategy for reporting interest earned on savings bonds. By reporting the interest earned annually, bond owners can avoid having to report a large amount of interest income in the year the bonds are cashed in.

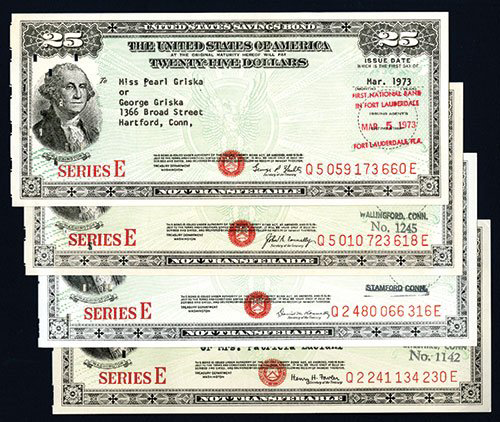

Currently over 50 million individuals own nearly $178 billion worth of U.S. Savings Bonds. Many don’t realize that savings bonds are subject to federal income taxes when they are either cashed in or reach final maturity, whichever comes first. The difference between the purchase price and the cash-in value is considered reportable interest. When savings bonds are cashed in, a 1099-INT is normally issued for any interest earned amount over $10. Savings Bonds are free from state and local taxes.

“Unfortunately, for millions of bond owners, especially retirees, the amount of interest income from cashing in savings bonds, along with additional income generated from other investments, such as 401K’s and pensions, could negatively affect their tax bracket,” says Jack Quinn, Founder of SavingsBonds.com. “Individuals must also consider additional income amounts from spouses, if filing jointly.”

To start the process of reporting interest earned annually, an individual must first determine if it makes financial sense to report all of the interest earned to date on their federal income tax return for their entire portfolio of bonds in a specific year. Then each year thereafter, they must report the interest earned for all of their bonds in that year on their tax return, every year until redemption. In the year an individual cashes in their bonds, they will include the previous year's tax returns (which indicates the annual interest income reported for that year), and thus may result in not having to owe any large amount of taxes.

SavingsBonds.com offers a complimentary Savings Bond Inventory Report that will indicate both the lifetime, as well as the year-to-date, interest earned amounts. If an individual would like to elect to report interest annually, it is important to review their Inventory Report any time in December of every year, which indicates the total interest earned amounts accumulated in that year.

For most people, savings bonds may seem like a very simple and easy investment. They are often stashed away for education, retirement or rainy day needs. However, savings bonds, like most other investments, need financial planning too.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Financial Planning, Income Taxes