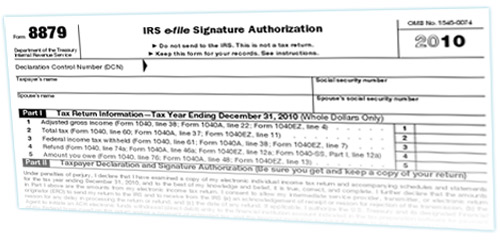

The Hassles of Obtaining Manual Signatures on Form 8879

Most tax and accounting firms spend countless hours chasing their clients for manual signatures on Form 8879. Once signed, the client can return the completed form in a number of ways. They might mail or drop off a hard copy, they might fax it back, or they might scan and email you a PDF copy. Your staff then spends more time tracking the status for each taxpayer and notifying the professionals so they can e-File the return. And finally, hard copies and faxed copies often need to be converted back to PDF format for storage in your Document Management System or network shared drive. Simply put, this manual process is cumbersome, time consuming and extremely inefficient for all parties involved. When using E-Signatures on Form 8879, the above hassles are a thing of the past.

The IRS and Form 8879

Effective March 11, 2014, the IRS approved E-Signatures on Form 8879 through an online revision to Publication 1345. Details of the guidance can be viewed at http://www.irs.gov/uac/Electronic-Signature-Guidance-for-Forms-8878-and-8879. From my perspective, compliance is met be adhering to the following E-Signature guidance and requirements:

- Use one of the acceptable electronic signature methods defined in the revision

- Ensure the software records the required information in some sort of audit log so it can be provided upon request

- Ensure the electronic signature process separately identifies and authenticates each taxpayer on the form with an acceptable level of assurance. Knowledge Based Authentication (KBA) is the most widely used. KBA is a question and answer based method of authentication that pulls questions from sources such as credit reporting agencies

- For in-person transactions, the ERO must inspect a valid government issued picture ID and record various information such as name, SS#, address and DOB

- For remote transactions, the ERO must record the name, SS#, address and DOB of the taxpayer and ensure it is consistent with the KBA agency providing the authentication process

- Require a manual signature in the event the taxpayer fails the identity verification process after three attempts

- A copy of the tax return needs to be sent with the Form 8879 and be a part of the final signed document

- The final signed document must be tamper proof, so it must be locked to prevent tampering

- The final signed document should be delivered to the client through an encrypted process to ensure confidentiality and compliance with Breach of Privacy laws

Unfortunately, most of the broad based E-Signature solutions do not conform to these requirements without significant modifications or configuration changes.

Top Considerations When Choosing an E-Signature Solution

Every industry vertical has its own set of document types and workflow requirements surrounding the E-Signature process. E-Signatures are growing in popularity through broad based E-Signature solutions such as Adobe EchoSign, DocuSign, RightSignature, and AssureSign. These solutions were designed for mass markets and do not meet the needs, demands, workflow, security or IRS requirements of the tax & accounting industry.

Your firm should look for a solution that is tax & accounting specific. For example, your staff should be able to quickly send documents for E-Signature while classifying each document with accounting specific workflow and reporting data such as Document Type, Engagement Type, Tax Year and Partner. Your solution should provide firm wide reports that are accessible by all members of your firm and provide for centralized management of the E-Signature process. For example, firm administrators and partners should have complete visibility over every document sent for E-Signature within their firm. They should be able to quickly sort, filter and search to send reminders, view documents and download final signed documents of other users. And finally, your solution should meet the requirements of the IRS as defined above and ensure security in the delivery of the final signed documents to your client.

Accounting firms often need to mail merge and batch process documents requiring signatures. Examples include annual engagement letters and §7216 consent for clients, and annual independence surveys for staff. Your solution should provide the tools necessary to mail merge and batch process hundreds of documents for E-Signature with the click of a button.

Finally, be careful of monthly subscription fees. Most providers have “reasonable use clauses” which restrict the number of documents that can be sent monthly per licensed user. Accounting firms tend to have seasonal demands and can quickly surpass the reasonable use clauses, resulting in higher monthly fees. To obtain the full benefits of your E-Signature solution, you should license all members of your firm so they have access to the real time reporting, tracking and management features. As a result, we recommend solutions that allow free licenses to all members of your firm, and then bill based on the actual number of documents sent for E-Signature.

Using E-Signatures on Other Document Types

The hassles of the manual process explained for Form 8879 equally apply to other documents requiring signature. As for client facing documents, firms are sending engagement letters, management and audit representation Letters, §7216 consent forms, A/R and A/P confirmations, new client acceptance forms, payroll processing forms, W-9 and Form 4506-T for E-Signature. As for internal documents, firms are sending annual independence surveys, IT policy documents, partnership agreements and a wide variety of human resource related documents including offers of employment, Forms W-4 and I-9, employee handbooks, medical, dental, insurance and 401k forms for E-Signature. Firms are reporting that they can process these documents at a fraction of the cost of mailing hard copies. They are also receiving E-Signed documents back from their clients and staff in less than seven minutes and the overall workflow process is significantly improved.

————————–

Steve Dusablon is the President and CEO of cPaperless, LLC, a software company that develops paperless solutions for tax and accounting firms. cPaperless partnered with Adobe EchoSign to develop CPA SafeSign with SignatureFlow, the first to market IRS compliant E-Signature solution designed specifically for the tax and accounting industry. To learn how SignatureFlow can help your firm leverage E-Signature technology, please send inquiries to sales@cpaperless.com, call (800) 716-2558 Ext. 100 or attend a Free CPE Webcast on E-Signatures.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Technology