Some Pre-Retirees’ Accounts Top $250,000, Nearly Doubling in Four Years

BOSTON – There’s good news for Americans with 401(k) retirement accounts. With the rebound of the stock market from the lows of 2008-2009 recession, to record highs in 2013, those with market-based retirement accounts are seeing their retirement funds rebuild.

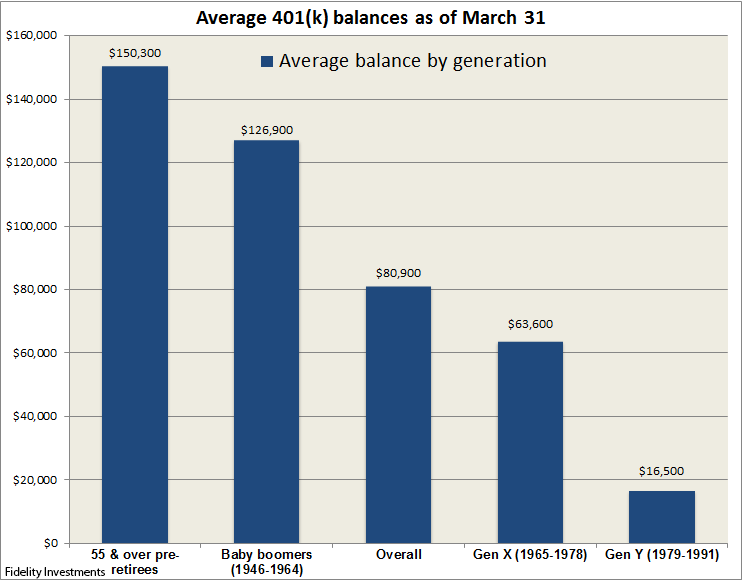

In its most recent quarterly anlysis of its customers’ 401(k) accounts, Fidelity Investments found that the overall average account balance hit another record high, reaching $80,900 at the end of the first quarter. This represents an 8.4 percent increase over one year prior when the average balance stood at $74,600, and shows 75 percent growth since the market low during the first quarter 2009 when it accounts averaged only $46,200. Continued contributions from the employee and employer as well as the strong equity markets contributed to the overall gains.

New analysis of 401(k) accounts of pre-retirees (age 55 or older) who had an employment history of 10 years or more with their current employer– and most vulnerable during the last market downturn given their short timeframe to retirement – showed very strong growth over the last four years. The average balance for this group reached $255,000 by the end of the first quarter of 2013, nearly double since the market low during the first quarter of 2009 when their balance dipped to $130,700.

“The basic savings principles we encourage workers to adopt, such as saving consistently and holding a balanced portfolio with an appropriate exposure to equities – even when close to retirement – were key factors in driving better outcomes since 2009,” said James M. MacDonald, president, Workplace Investing, Fidelity Investments. “It’s important to continually remind employees that sticking to this savings philosophy may not always reward in the short-term but may over the long-term.”

Unlike pre-retirees that stayed the course, the small percentage of pre-retirees (1.6 percent) who abandoned equities in reaction to market volatility in either late 2008 or early 2009 and never rebalanced experienced much more modest growth. Their balance grew 25.9 percent over the same time period with balances reaching $101,000 by the end of the first quarter from $80,200 at the end of the first quarter 2009.

“There is a valuable lesson to be learned from the minority of pre-retirees who abandoned equities altogether and experienced significantly less progress,” said MacDonald. “It underscores the combined importance of a proper asset allocation and savings behavior as they planned for retirement within all that life entails.”

It’s significant to note that nearly two-thirds (65 percent) of the overall average balance increase over the past year was due to gains in equities – underscoring the important role they play in saving for retirement. Just as important were continued contributions made by both the employee and employer which accounted for one-third of the increase in account balance.

Pre-Retirees’ Average Savings Rate Reach Nearly 15 Percent

In addition to maintaining a diversified asset allocation, pre-retirees contributedan average of 10.3 percent of their annual salaries in their 401(k) accounts during the first quarter – more than two percentage points higher than the average 8.0 percent for all workers. These contributions – combined with a pre-retirees’ average employer contribution of 4.5 percent – brought their average total contribution rate to 14.8 percent.

Furthermore, 14.4 percent of pre-retirees made catch-up contributions during the first quarter. Employees can make catch-up contributions beginning at age 50 of up to $5,500 per year to their 401(k) accounts which the IRS permits once they have reached their 402(g) limit of $17,500 for 2013.

Guidance and Education Key to Retirement Savings

Fidelity continues to enhance its financial education and guidance experience, Plan for Life, a comprehensive approach to helping people plan for retirement while they move through many of life’s significant events such as starting a new job, the birth of a baby or saving for a child’s education. Guidance topics include diversification, age-appropriate asset allocation and the use of target date funds; when to utilize catch-up contributions or Roth options; plus focused workshops such as those for women or pre-retirees.

The Plan for Life experience includes dedicated workplace phone representatives; onsite seminars and access to the company’s more than 180 investor centers nationwide; NetBenefits®, Fidelity’s participant portal available online or over an innovative smartphone app; workplace editions of Fidelity Viewpoints; and interactive tools such as Income Simulator that provides a snapshot of how much monthly income a savings strategy may generate relative to retirement goals.

New Fidelity Viewpoint Discusses Recent Stock Market Rally

To better understand the recent stock market rally and affects of quantitative easing, or QE, read Fidelity’s latest Viewpoint and watch a short video with Jurrien Timmer, director of global macro and co-manager of Fidelity Global Strategies Fund.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits