Accounting

2017 Review of DepreciationWorks

DepreciationWorks handles book depreciation for multiple companies. The product uses a grid-style database interface modeled after Microsoft Excel that enables users to quickly enter multiple assets. A Quick Fill option is also available for those ...

May. 22, 2017

DepreciationWorks

www.depreciationworks.com

562-254-2651

From the 2017 review of asset management systems.

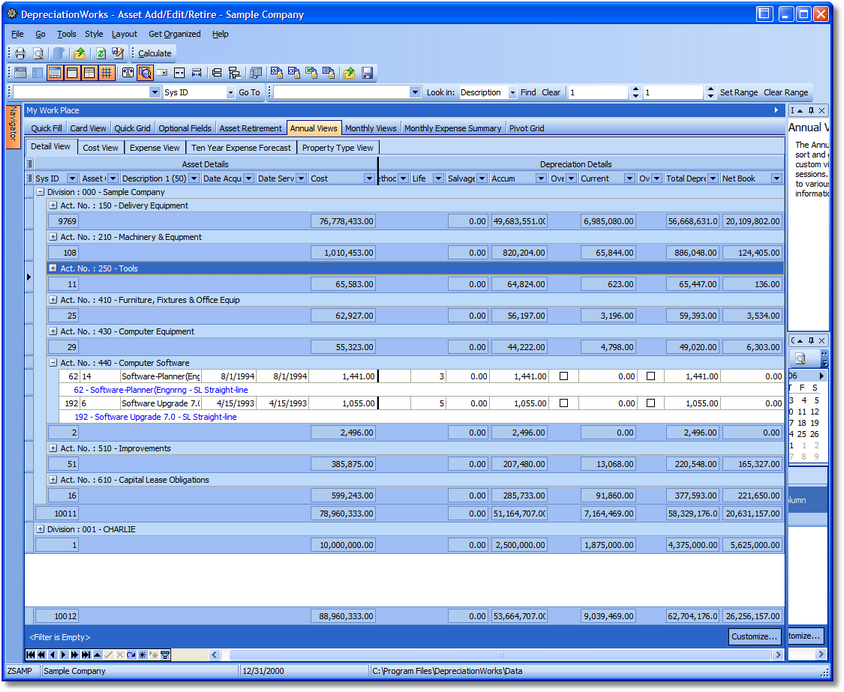

DepreciationWorks handles book depreciation for multiple companies. The product uses a grid-style database interface modeled after Microsoft Excel that enables users to quickly enter multiple assets. A Quick Fill option is also available for those entering individual assets, with multiple fields populated with default amounts entered during the initial product setup. A series of tabs at the bottom of the asset entry screen provide access to a variety of options including Quick Fill, Card View, Quick Grid, Asset Retirement, Annual Views, Monthly Views, and others.

DepreciationWorks offers an option to retire assets when they are disposed of, with the option to restore any retired assets if desired. There is also an option to delete company assets if desired. The product offers a good selection of reports including a Depreciation Schedule, Retired Asset Report, Annual Reconciliation Report, Year-to-Date Reconciliation, Cost by Property Type, Asset Detail, and Cost by Group Code.

Report options include a next year report option so that a fiscal year can remain open and next year reports can be run without closing a year. The Cost by Property Type report provides summary totals by property type and month in service for manual summary input into income tax preparation software programs. Also included is a business property tax statement worksheet. A variety of filters are available for creating reports, and users can choose to customize reports further by adding various other filters.

All DepreciationWorks reports can be emailed to recipients directly from the preview screen, printed, exported to Microsoft Word and Excel, or saved as a PDF. Most standard reports have grid view equivalents and any grid view display in DepreciationWorks can be customized, filtered, printed, and saved in various file formats. Consequently the grid view displays in DepreciationWorks are also quick visual custom report writers. Also included is a multiple user calendar for scheduling asset maintenance and service.

The Help function in DepreciationWorks offers access to a robust help system, where users can search content easily. The Help function also allows users to check for any product updates, or quickly access product support. Support is available Monday through Saturday, and can be accessed via email or telephone and support personnel are CPAs licensed in California.

DepreciationWorks is a good solution for those looking for an affordably priced asset management system. Depreciation Works offers a free thirty-day trial for those that wish to try the software out. The trial can be downloaded at any time from the vendor website, and users that wish to purchase the software can do so directly from the product interface. Users will have to dedicate significant time to setting up the product properly in order to take advantage of some of the features. DepreciationWorks will assist with setup and assets may be imported via a provided Excel style workbook. DepreciationWorks comes with sample data to aide in evaluating its suitability for various reporting needs. Concurrency is supported by record lock and data can be stored on an on premise server where no services need to run on the server to support the database.

DepreciationWorks is $389.00 for a multiple user site license, with maintenance and support free the first year and thereafter running $129.00 and billed annually.