Among numerous other changes, the Tax Cuts and Jobs Act (TCJA) chipped away at several tax breaks for individuals, including the deduction for mortgage interest. But the fall-out isn’t as bad as it first seems.

Most taxpayers can continue to deduct most, if not all, of the mortgage interest that they pay during the year. Furthermore the TCJA crackdown on applies to deductions claimed in 2018 through 2025.

Background: Prior to the TCA, you could deduct the interest paid on either (1) acquisition debt or (2) home equity debt, or both, within generous limits.

- Acquisition debt: Acquisition debt is debt where you use the mortgage proceeds to buy, build or substantially improve the home. Typically, this is the biggest part of a mortgage interest deduction. To qualify for the write-off, the loan must be secured by a qualified residence, such as your principal residence or a second home. The interest is deductible on loans up to $1 million.

- Home equity debt: Previously, you could deduct the interest on home equity loans secured by a qualified residence, regardless of how the proceeds were used. With a home equity debt, deductions were limited to interest paid on the first $100,000 of debt. Furthermore, the loan amount could not exceed your equity in the home.

In addition, certain deductions—including the one for mortgage interest—were reduced for high-income taxpayers under the “Pease rule.”

Of course, the mortgage interest deduction is only available if you itemize. The TCJA temporary increased the standard deduction so more taxpayers are taking this route.

The TCJA includes the following changes relating to mortgage interest deductions.

- The threshold for deducting interest paid on acquisition debt falls from 1 million to $750,000 for loans originating after December 15, 2017 (or April 1, 2018 if there was a binding contract in place before December 16, 2017). Thus, some existing homeowners are “grandfathered ” under the old rules for acquisition debt. If you qualify, you can still deduct all the mortgage interest allowable up to the $1 million threshold.

- The deduction for interest paid on home equity debt is suspended from 2018 through 2025. It doesn’t matter when you acquired the residence.

- The Pease rule is also suspended for 2018 through 2025. It is scheduled to return in 2026, barring any new legislation.

Fortunately, the TCJA changes don’t hamper many homeowners, while others are affected only slightly. Furthermore, you might be able to take advantage of a special tax break

How it works: If you incur a new home equity loan or line of credit and use the proceeds for significant home improvements, the debt may be treated as an acquisition debt rather than a home equity debt. Reason: The debt is being incurred to “substantially improve” a qualified residence. Thus, you can add this mortgage interest to your deductible total if you still itemize deductions

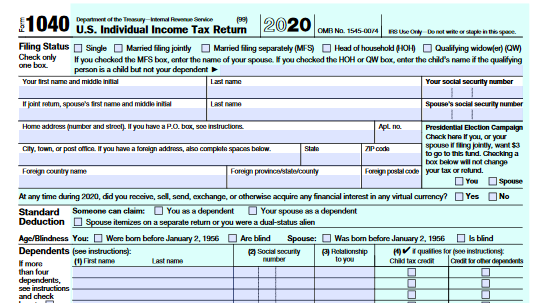

It’s important for itemizers to maximize their mortgage interest deduction under the current tax rules. This is often one of the biggest deductions on Form 1040 for homeowners. Plan accordingly.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs