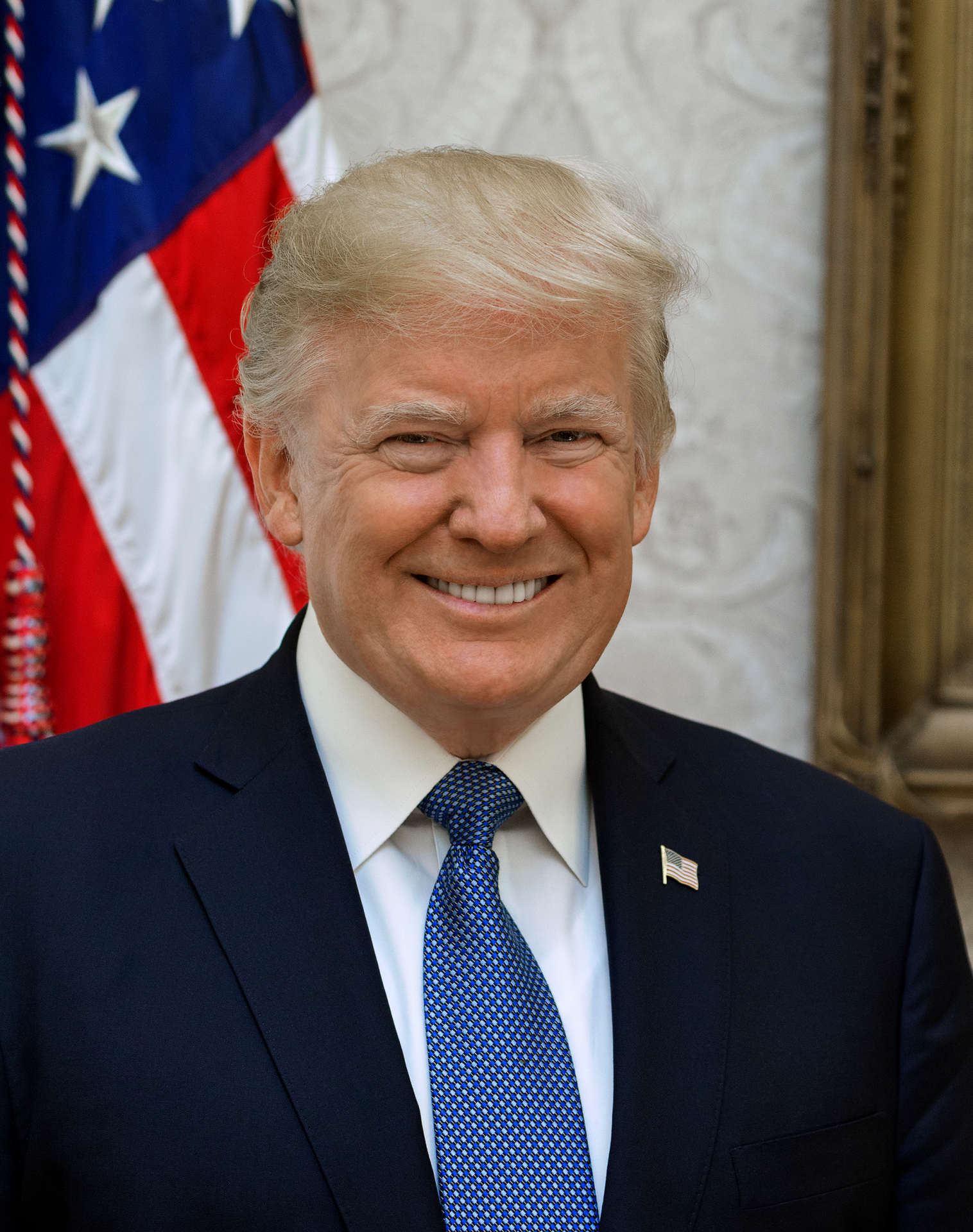

The U.S. Supreme Court put a new New York grand jury on the brink of getting eight years of Donald Trump’s tax returns and other financial records, ending months of delay by rejecting his bid to keep the information private.

The justices without explanation or public dissent refused to block a subpoena to Trump’s accounting firm while he presses a Supreme Court appeal.

The high court had deferred acting in the case for more than three months, waiting until Trump again became a private citizen to take a step that could boost Manhattan District Attorney Cyrus Vance’s probe. Vance’s investigators have already gotten hold of some of the tax records from other sources, according to people familiar with the matter.

The investigation looms as one of the biggest legal threats to Trump, though its exact parameters are unclear. In August, prosecutors suggested in court papers they may be looking into tax fraud, insurance fraud, and falsification of business records. That suggestion came in response to Trump’s contention that the probe was focused on payments to adult-film star Stormy Daniels and another woman.

Vance had agreed to hold off enforcing the subpoena while the Supreme Court considered Trump’s bid. Trump filed the request on Oct. 13, and all the briefs were submitted by Oct. 19.

The rebuff effectively shuts down the avenue the high court left open for Trump in July, when the justices rejected his claim of sweeping immunity for sitting presidents from state criminal subpoenas but said he could press more specific objections. Two lower courts rejected Trump’s contention that the subpoena was too broad and was issued in bad faith, prompting the now-former president to turn to the Supreme Court.

Trump’s accounting firm, Mazars USA, isn’t contesting the subpoena and has said it will comply with its legal obligations. Any material Vance receives would be covered by laws protecting grand jury secrecy, meaning it isn’t likely to become public anytime soon.

Trump told the Supreme Court he will suffer “irreparable harm” if the materials are turned over. “Even if the disclosure of his papers is limited to prosecutors and grand jurors, the status quo can never be restored once confidentiality is destroyed,” his lawyers said in court papers.

Vance said the year-plus delay has already hampered the investigation.

Trump “has had multiple opportunities for review of his constitutional and state law claims, and at this juncture he provides no grounds for further delay,” Vance argued. “His request for extraordinary relief should be denied, and the grand jury permitted to do its work.”

The New York Times in September published an analysis of at least two decades of Trump’s closely-guarded tax records, reporting that he paid just $750 in federal income tax in 2016 and in 2017. The Times said Trump reported huge business losses, effectively wiping out all income taxes in 10 of the previous 15 years as well.

The case is Trump v. Vance, 20A63.

========

For more articles like this, please visit us at bloomberg.com

©2021 Bloomberg L.P.

Distributed by Tribune Content Agency, LLC

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes