Are you or someone in your family—say, a child who recently graduated from college—embarking on a new career? It’s not too early to start saving for retirement. In fact, it’s generally recommended that you begin retirement planning once you’re entrenched in your first job.

Fortunately, the tax law provides some help in the form of a “retirement saver’s credit.” Subject to certain limits, you can claim this credit on the 2020 tax return you’ll be filing in 2021.

The retirement saver’s credit is available for the first $2,000 of voluntary contributions made to qualified retirement plan or IRA. (If they choose, taxpayers can still contribute up to the allowable annual limits.) This includes:

- Contributions to a traditional or Roth IRA;

- Elective salary deferral contributions to a 401(k), 403(b), governmental 457(b), SARSEP or SIMPLE plan;

- Voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan;

- Contributions to a 501(c)(18)(D) plan; and

- Contributions made to an ABLE account for which you are the designated beneficiary (beginning in 2018).

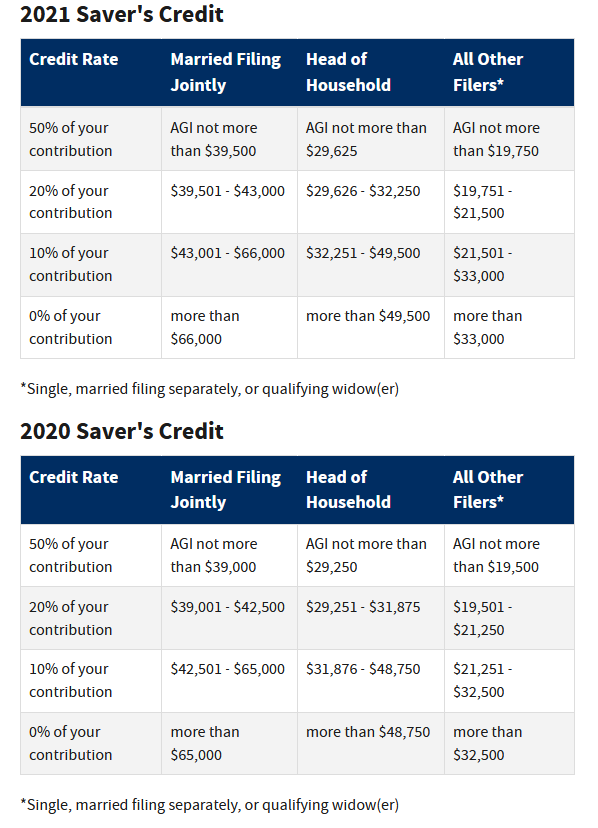

The amount of the credit is 50

This tax credit has often flown under the radar in the past. For instance, it may be overlooked or not known by wage-earners fresh out of school. But any taxpayer may qualify for the credit if he or she meets these three requirements.

- The taxpayer claiming the credit is at least 18 years old.

- Anyone who is claimed as a dependent on someone else’s return can’t take the credit.

- A full-time student (i.e., someone enrolled in school during any part of five calendar months during the year) isn’t eligible for the credit.

Assuming you or another family member qualify, the deadline for claiming the retirement saver’s credit for IRA contributions is the tax return due date for the year of the contribution, Therefore, you have until April 15, 2021 to set up a new IRA for the 2020 tax year or to contribute to an existing one.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, IRS