Payroll December 27, 2022

Payroll-Related Issues Top List of Business Concerns in 2023

A list of the most prominent compliance-related topics employers will face in 2023.

Payroll December 27, 2022

A list of the most prominent compliance-related topics employers will face in 2023.

Taxes December 27, 2022

The Infrastructure Investment and Jobs Act amended the tax code to expand reporting rules on digital assets by brokers.

Taxes December 27, 2022

The government annually establishes a flat rate for certain “high-cost areas” such as New York, Chicago and Los Angeles and other major cities.

Firm Management December 27, 2022

While stress is difficult to avoid during this hectic time, practice leaders can mitigate the impact of stress on employees through rewarding employees who ...

Taxes December 25, 2022

At this time of year, Congress usually addresses a number of tax law provisions that are going off the books.

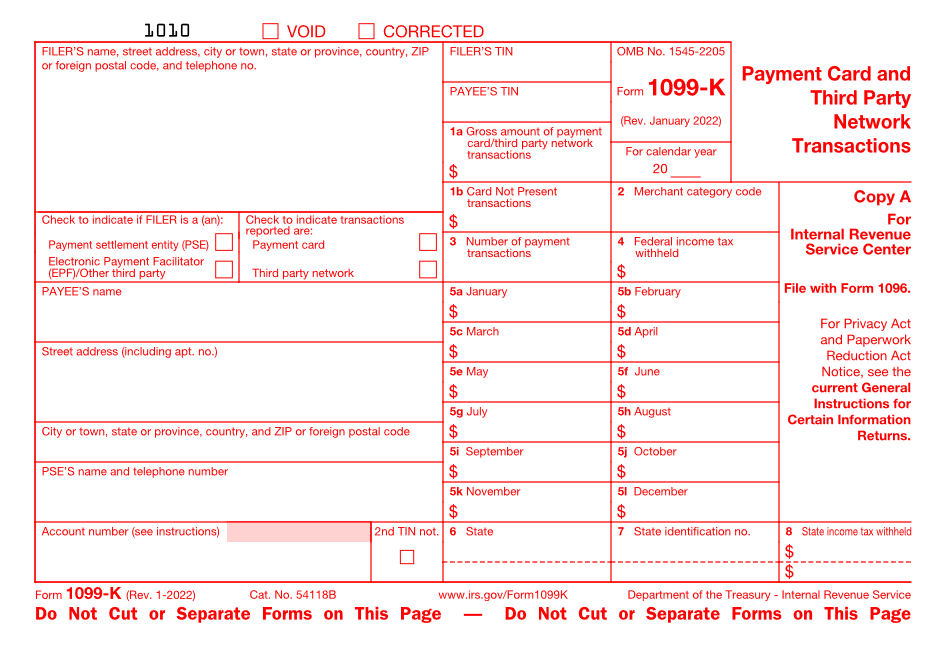

Taxes December 23, 2022

The Internal Revenue Service today announced a delay in reporting thresholds for third-party settlement organizations set to take effect for the upcoming tax filing season.

December 23, 2022

This chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on information we have now, and using projections based on previous years- and depending on when a person files their return.

Taxes December 22, 2022

This chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on the information we have now, and using projections based on previous years.

Payroll December 21, 2022

That represents an increase of 50 cents-an-hour for businesses with 26 or more employees, and $1.50 an hour for those with 25 or fewer.

Taxes December 21, 2022

Analysis shows Trump was able to use questionable deductions and aggressive tax strategies to minimize his tax bills.

Taxes December 21, 2022

The former president claimed he lost some $5 million in 2020 and therefore paid no taxes when he filed last year.

Taxes December 20, 2022

If the IRS were to change its filing dates so that 1/12 of the taxpayers had tax returns due each month, instead of 100% of the taxpayers having tax returns due in the same month...