Small Business February 23, 2023

Here’s Some Crazy Things Small Business Owners Would Rather Do Than Their Taxes

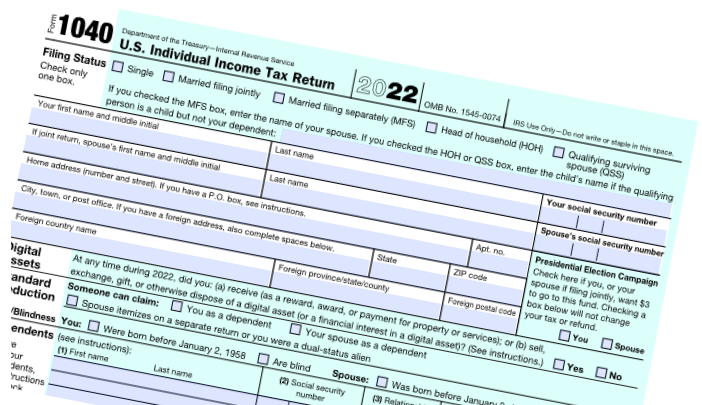

Many small business owners dislike tax time so much that they would rather get a mullet haircut or a root canal.

Small Business February 23, 2023

Many small business owners dislike tax time so much that they would rather get a mullet haircut or a root canal.

Taxes February 21, 2023

The final regulations reflect changes made by the Taxpayer First Act that strengthen e-filing requirements.

Taxes February 21, 2023

The CAMT imposes a 15% minimum tax on the adjusted financial statement income of large companies starting in 2023.

Taxes February 17, 2023

To fight identity fraud and cybercrime, tax preparers and filers must collaborate and adopt effective methods to secure their data and financial resources.

Taxes February 16, 2023

The AICPA supports the deferral of IRC Section 174 amortization requirement of the research and experimental expenditures and requests that Congress retroactively extend the effective date to ...

Taxes February 15, 2023

The CAP program began in 2005 as a way to resolve tax issues through open, cooperative and transparent interactions between the IRS and taxpayers before the filing of a return.

Taxes February 15, 2023

Under the Internal Revenue Code, the rate of interest is determined on a quarterly basis. For taxpayers other than corporations, the overpayment and underpayment rate is the federal short-term rate plus 3 percentage points.

Taxes February 14, 2023

The annotations show the locations he supposedly visited in connection with either business. For several reasons, the Tax Court didn’t find this evidence credible.

Taxes February 13, 2023

For 2023, a participating employee can contribute up to $22,500 in elective deferrals or up to $30,000 if they are age 50 or over.

Taxes February 13, 2023

To leverage a 1031 exchange, an investor has to ensure the income from a real estate investment property sale is reinvested (or “exchanged”) in like-kind property.

Taxes February 13, 2023

The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns.

Accounting February 9, 2023

“Anything that was well documented and under $4,000 our representative approved on the spot,” Southwest Airlines Chief Operating Officer Andrew Watterson told reporters.