Taxes October 6, 2023

Treasury Releases Guidance for New EV Tax Credits

The consumer discount is one of the significant changes to electric vehicle tax credits implemented under the Inflation Reduction Act.

Taxes October 6, 2023

The consumer discount is one of the significant changes to electric vehicle tax credits implemented under the Inflation Reduction Act.

Taxes October 5, 2023

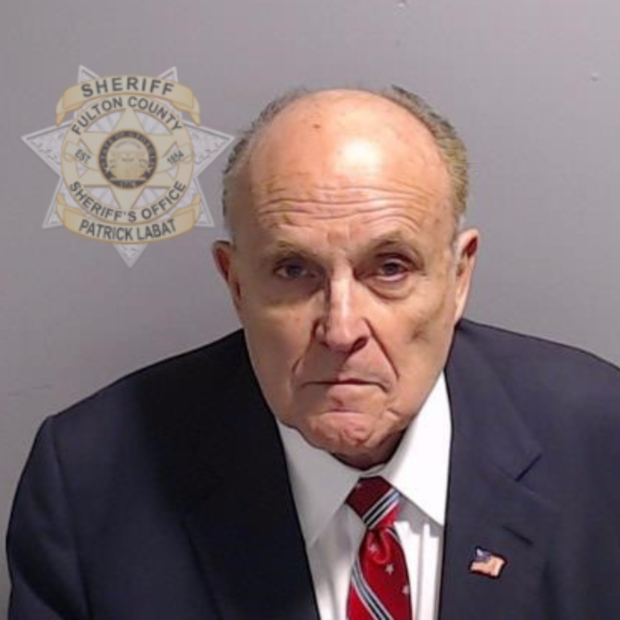

According to a report, former New York City mayor Rudolph Giuliani owes $549,435.26 in unpaid taxes and, as a result, the agency has placed a tax lien on a condo he owns in south Florida.

Taxes October 5, 2023

Taxpayers, particularly wealthy filers, were warned Thursday about scams involving exaggerated art donation deductions.

Taxes October 5, 2023

The IRS is slashing the costs for paid tax return preparers to renew their preparer tax identification numbers in 2024 by nearly 36%.

Taxes October 3, 2023

There are a myriad of challenges and changes in the tax codes affecting their business clients each tax season.

Payroll October 2, 2023

Individuals with federal student loans must begin planning to start repaying these debts for the first time in more than three years.

Taxes September 29, 2023

Spanish prosecutors claim she failed to pay $7.1 million in taxes in 2018 and is using an offshore company to avoid paying taxes.

Taxes September 29, 2023

Contingency plan calls for the IRS to furlough two-thirds of its workforce and press pause on most core tax administration functions.

Taxes September 28, 2023

The House panel voted along party lines to disclose additional documents related to the probe into the president's son's taxes.

Taxes September 28, 2023

Jack Fisher and James Sinnott designed, marketed and sold to high-income clients abusive syndicated conservation easement tax shelters based on fraudulently inflated charitable contribution tax deductions, promising them deductions 4.5 times the amount the taxpayer clients paid.

Accounting September 28, 2023

In an unexpected portion of his decision, the judge essentially stripped Trump of the ability to run his businesses in New York by canceling his certificates and any controlled by his adult sons.

Taxes September 26, 2023

Chatbots will be used to help answer basic taxpayer questions about three notices in the CP series, the IRS said on Tuesday.