Taxes February 27, 2025

5 Security Questions CPA Firms Should Ask Tax Automation Vendors

With the current staffing shortage in the accounting profession, more and more firms are turning to technology to maintain productivity and service quality.

Taxes February 27, 2025

With the current staffing shortage in the accounting profession, more and more firms are turning to technology to maintain productivity and service quality.

Taxes February 26, 2025

The tax data was stolen and leaked to the media by Charles Littlejohn, a former government contractor who was convicted and sentenced last year to five years in prison.

Taxes February 26, 2025

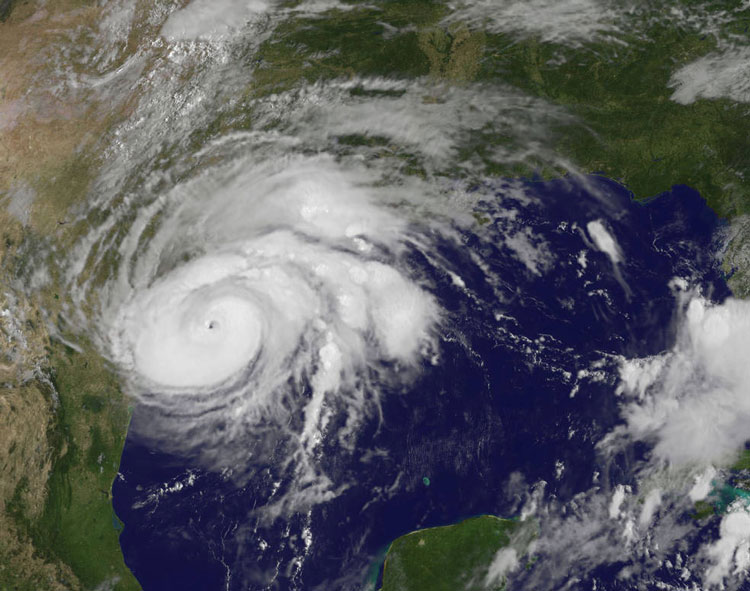

The Filing Relief for Natural Disasters Act would expedite the issuance of federal tax relief and provide the IRS with authority to grant tax relief once the governor of a state declares a disaster or state of emergency.

AICPA February 26, 2025

The AICPA’s recommendations were submitted to clarify the proposed revisions to the Treasury’s standards, as well as other rules that tax and valuation practitioners must follow.

Taxes February 26, 2025

Chances for early action on Donald Trump's tax cut plans improved as House Republicans passed a budget blueprint Tuesday calling for deep cuts in safety-net programs such as Medicaid.

Taxes February 25, 2025

Governments can look to streamline tax administration to support transparent tax administration for constituents and businesses, while remaining budget conscious.

Taxes February 25, 2025

WalletHub released a new study of the states with the highest property tax rates to give prospective homebuyers a better understanding of how much they can expect to pay each year.

Taxes February 25, 2025

Curious what your paycheck would look like if President Trump actually does get rid of the federal income tax? Recently, GOBankingRates compiled data to determine what checks and income would look like, state by state.

AICPA February 25, 2025

The AICPA cites the need for these updates to ease the confusion created by disaster relief due to the multiple deadlines for various actions necessary to be eligible for the qualified disaster loss.

Taxes February 25, 2025

Generally, self-employed individuals are required to pay annual self-employment tax, the equivalent of FICA tax for employees, on most business earnings.

Taxes February 24, 2025

If you get paid through Venmo, PayPal, Cash App or another payment app, you may receive an IRS Form 1099-K this year. Here's what you need to know.

Taxes February 24, 2025

A quick glance at the latest 2025 tax refund numbers may be cause for concern for those who haven’t filed yet, but the IRS says there’s a good reason why certain numbers are down.