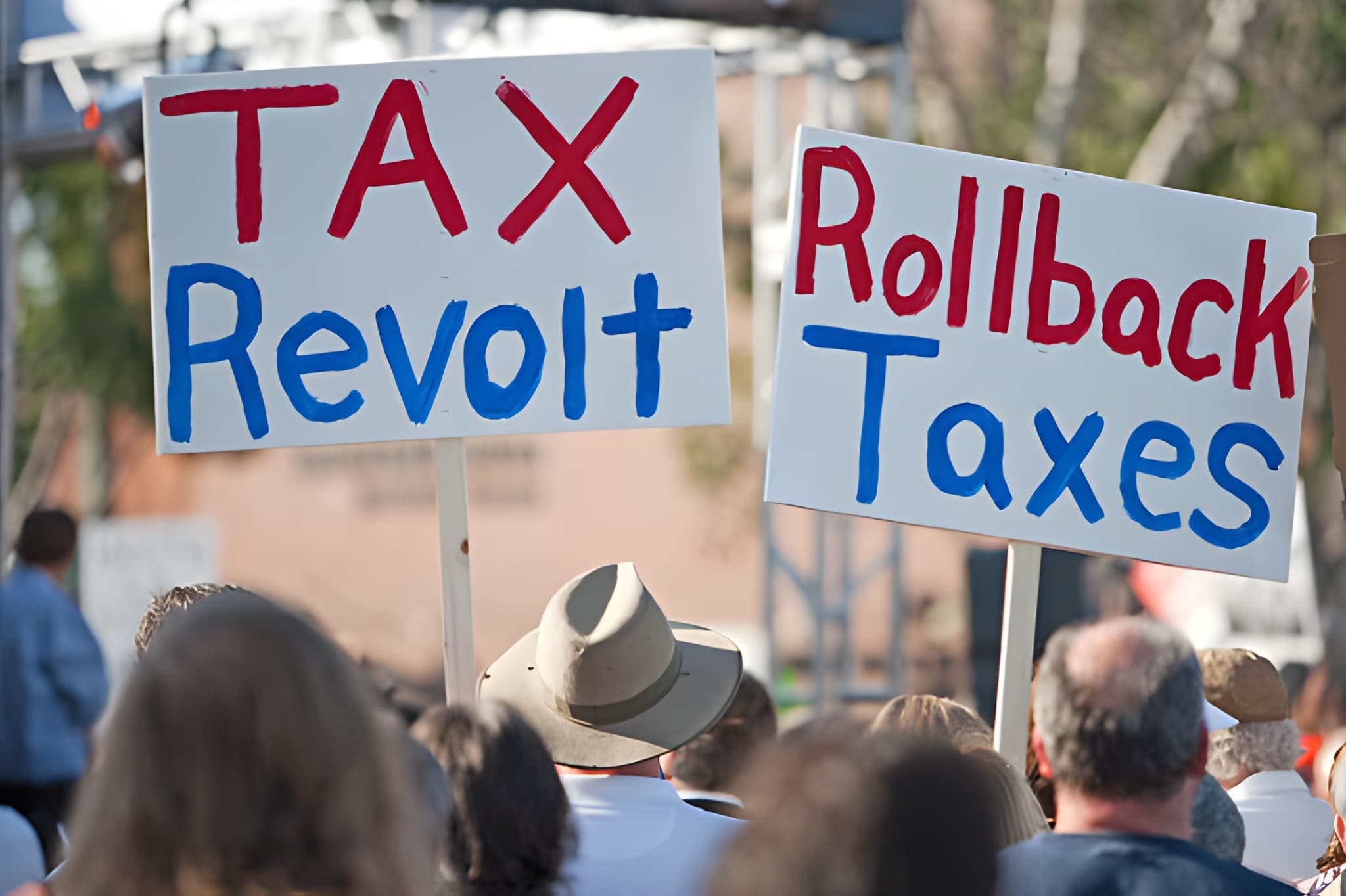

Sales Tax February 2, 2026

Here’s Why Louisiana Has the Country’s Highest Combined Sales Tax Rates

For the third year in a row, Louisiana has the highest average combined state and local sales tax rate in the country at 10.11%, according to a new report from the Tax Foundation.