Taxes February 5, 2026

Bessent Says Taxpayers Will Foot the Bill if Trump Wins $10 Billion IRS Lawsuit

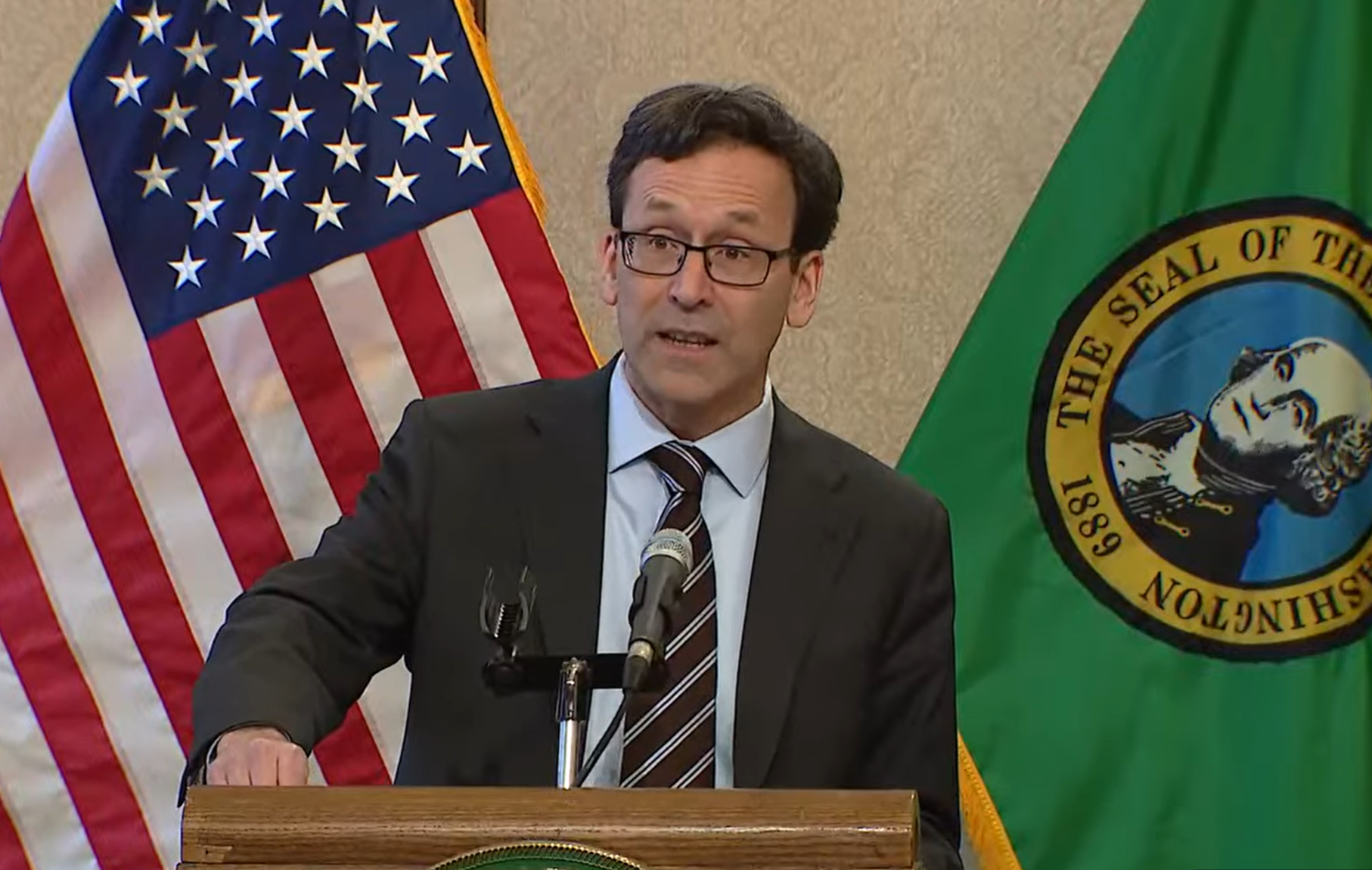

The revelation came Thursday during a Senate Banking Committee hearing where Treasury Secretary and Acting Commissioner of the Internal Revenue Service Scott Bessent testified.