February 23, 2015

Avalara Names Patrick Falle as Chief of North American Channel

In his new capacity, Falle will report directly to Pascal Van Dooren, who oversees global channel efforts in his role as Avalara’s Chief Revenue Officer.

February 23, 2015

In his new capacity, Falle will report directly to Pascal Van Dooren, who oversees global channel efforts in his role as Avalara’s Chief Revenue Officer.

February 20, 2015

About 800,000 HealthCare.gov customers got the wrong tax information from the government, the Obama administration said Friday, and officials are asking those affected to delay filing their 2014 returns.

February 19, 2015

29 people have been nominated to serve on the nationwide Taxpayer Advocacy Panel (TAP). The TAP is a federal advisory committee charged with providing taxpayer suggestions to improve IRS customer service.

February 19, 2015

For federal tax purposes, the IRS recognizes a marriage of same-sex individuals if the marriage occurs in a state that has legalized same-sex marriage, even if the couple resides in a state that considers it unlawful.

February 19, 2015

The IRS is warning return preparers and other tax professionals to be on guard against bogus emails making the rounds seeking updated personal or professional information that in reality are phishing schemes.

February 19, 2015

New guidelines issued by the IRS authorize electronic signatures on Form 8878 (IRS e-file Signature Authorization for Form 4868 or Form 2350) and Form 8879 (IRS e-file Signature Authorization).

February 19, 2015

Transaction data from over 27 million Concur users shows Starbucks is the most commonly expensed restaurant and the top location for out-of-office business meetings.

February 18, 2015

In a February 13 comment letter from the American Institute of CPAs (AICPA) to the Internal Revenue Service (IRS), the organization addresses two interpretive issues related to the treatment of advance payments deferred under Rev. Proc. 2004-34 ...

February 18, 2015

It’s that time of year for part-time help at the local tax-preparation location, when drivers can see seasonal staff standing at busy intersections wearing costumes of the Statue of Liberty or Uncle Sam. But they’re not the only ones who are hired part ti

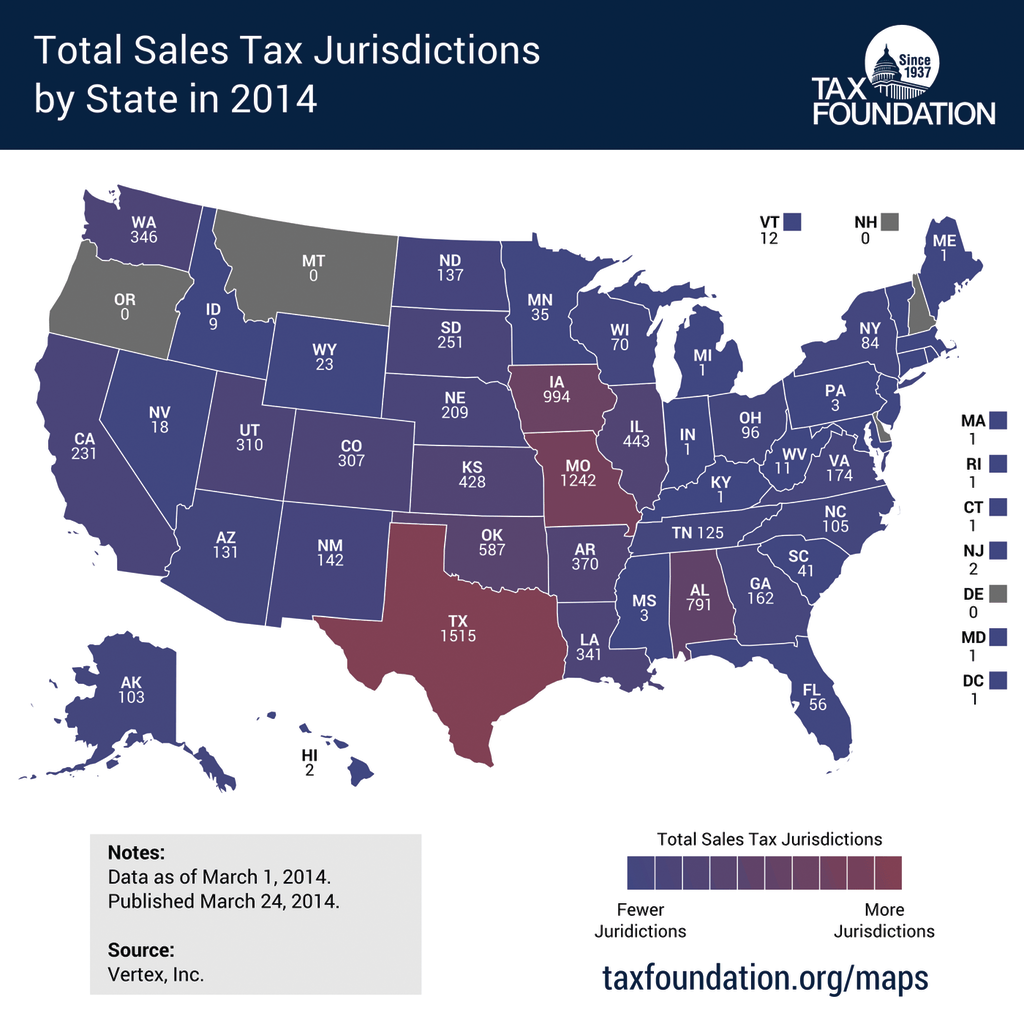

February 13, 2015

State and local taxes are constantly changing. As the most trusted financial and business advisor to your clients, it's your job to keep up with them. At CPA Practice Advisor, we're here to help you - so here's a roundup of some of the latest changes.

February 13, 2015

The Internal Revenue Service has changed some procedures that it says will make it easier for small business owners to comply with the final tangible property regulations.

February 12, 2015

If you move to Puerto Rico, you can retain your U.S. citizenship while saving taxes, not an option in some other so-called tax havens. Although the tropical island is just a little more than 1,000 miles from Florida, it might as well be halfway around ...