April 12, 2016

Last Minute Tax Filing Tips

Although taxpayers have a few extra days to file their returns this year, by midnight on April 18th instead of the usual April 15th deadline, the clock is ticking for those waiting till the last minute.

April 12, 2016

Although taxpayers have a few extra days to file their returns this year, by midnight on April 18th instead of the usual April 15th deadline, the clock is ticking for those waiting till the last minute.

April 12, 2016

The TAP provides a forum for taxpayers to raise concerns about IRS service and offer suggestions for improvement. The TAP reports annually to the Secretary of the Treasury, the IRS Commissioner and the National Taxpayer Advocate.

April 6, 2016

Because PayNearMe involves a three-step process, the IRS urges taxpayers choosing this option to start the process well ahead of the tax deadline to avoid interest and penalty charges.

April 6, 2016

Pop star Iggy Azalea has not been getting a lot of good news in the audit area lately. Not only did her Twitter Audit score land at 93 percent – meaning that only 7 percent of her followers are actually real people – but the IRS determined that she owes n

April 6, 2016

As reports of phone scams as well as email phishing schemes continue across the country, the Internal Revenue Service is warning taxpayers of a new phishing scam targeting Washington D.C., Maryland and Virginia residents.

April 5, 2016

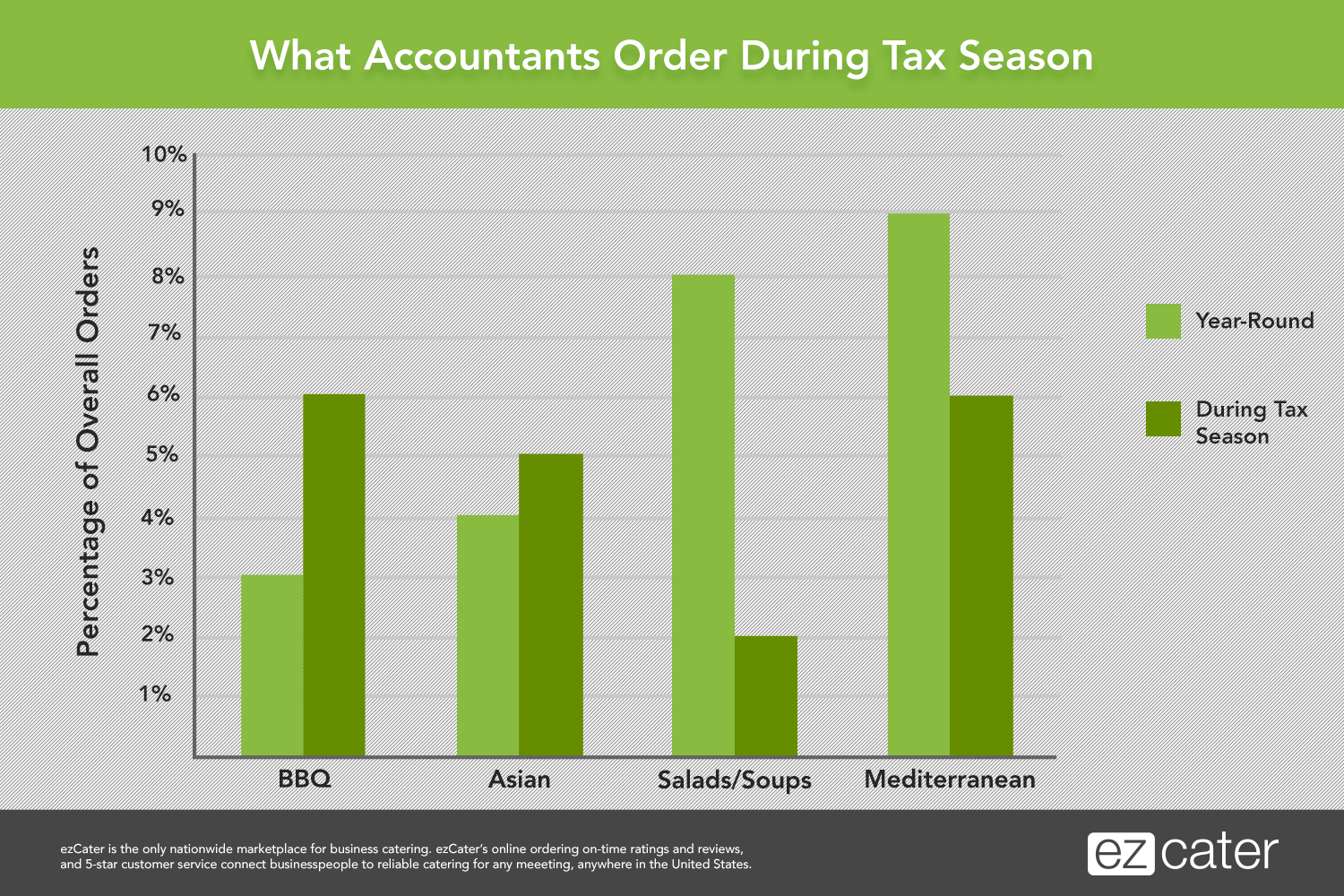

Though finance industry professionals tend to order salads and lighter Mediterranean food throughout the year, all that goes out the window during busy season. Barbecue, which makes up only 3% of total orders throughout the year, is ordered twice as ...

April 5, 2016

Among the “who’s who” of people named in the documents are friends or relatives of Russian President Vladimir Putin and leaders of Great Britain, China, Iceland, Pakistan and the Ukraine. In addition, the president of Argentina, Mauricio Macri, allegedly

March 30, 2016

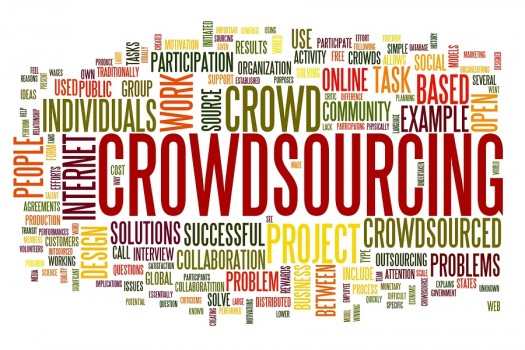

The nation's taxing agency is trying to step up its game when it comes to using technology to improve customer (aka taxpayer) interactions. The IRS wiill be hosting its first Tax Design Challenge crowdsourcing competition to encourage innovative ideas ...

March 29, 2016

The research revealed that nearly half of business owners do not know how many fines they incurred in the past 12 months or how much they cost their organizations.

March 29, 2016

No doubt, 2016 will be the most challenging year-end season in a long time. With all W-2 forms due to the Social Security Administration (SSA) by Jan. 31, 2017, and the ability to request only one for-cause filing extension from the IRS, the ...

March 25, 2016

With considerably less fanfare than the Bill of Rights ratified as the first amendments to the U.S. Constitution, the 114th Congress quietly approved the “Taxpayer Bill of Rights” as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015.

March 24, 2016

Mortgage rates declined modestly this week breaking a three-week string of increases, with the benchmark 30-year fixed mortgage rate slipping to 3.90 percent, according to Bankrate.com's weekly national survey. The 30-year fixed mortgage has an average of