January 22, 2018

How to Choose an Income Tax Preparer: Which Tax Pros Can Represent Taxpayers Before the IRS?

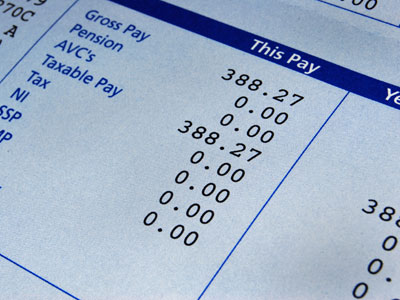

Participants in the program who are not attorneys, CPAs or EAs do not have unlimited rights. Their rights are limited to representing clients whose returns they prepare and sign, but only before revenue agents, customer service agents and the taxpayer ...