April 9, 2020

IRS Issues CARES Act Guidance for Taxpayers with NOLs

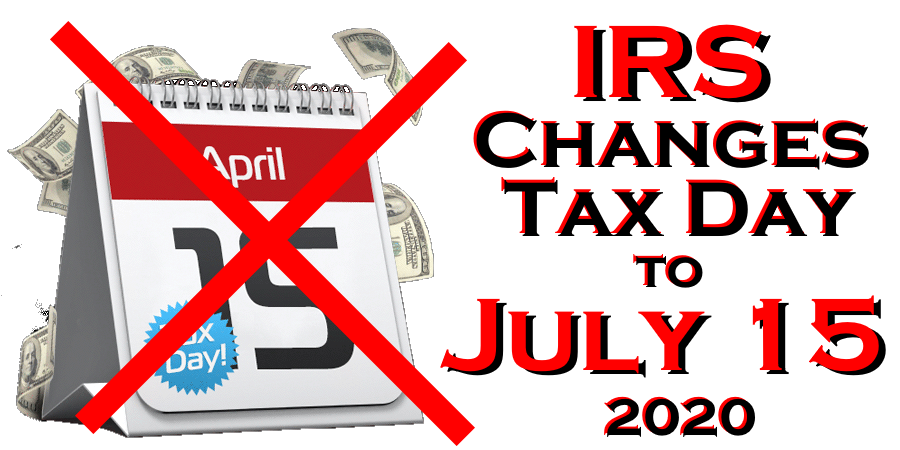

The Internal Revenue Service today has issued guidance providing tax relief under the CARES Act for taxpayers with net operating losses. Recently the IRS issued tax relief for partnerships filing amended returns.