September 16, 2021

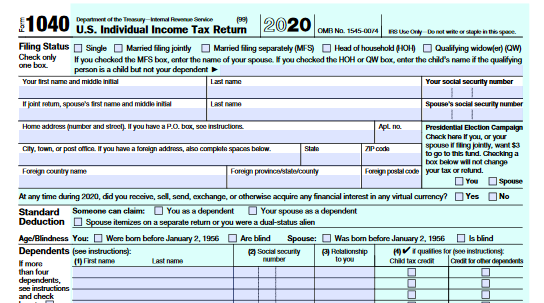

Oct. 15 is Tax Deadline for Extended 2020 Tax Returns

Taxpayers can file now and schedule their federal tax payments up to the Oct. 15 due date. They can pay online, by phone or with their mobile device and the IRS2Go app. When paying federal taxes electronically taxpayers should ...

![600full_the_dirty_dozen_poster_1_.54c1395131ce4_1_.5f11be0399807[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/06/600full_the_dirty_dozen_poster_1_.54c1395131ce4_1_.5f11be0399807_1_.60db39f070471.png)

![natural_disasters_list_1_.56117a5e5df03_1_.5f44ebd2124f1[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/05/natural_disasters_list_1_.56117a5e5df03_1_.5f44ebd2124f1_1_.60a134d43f70b.png)