August 19, 2014

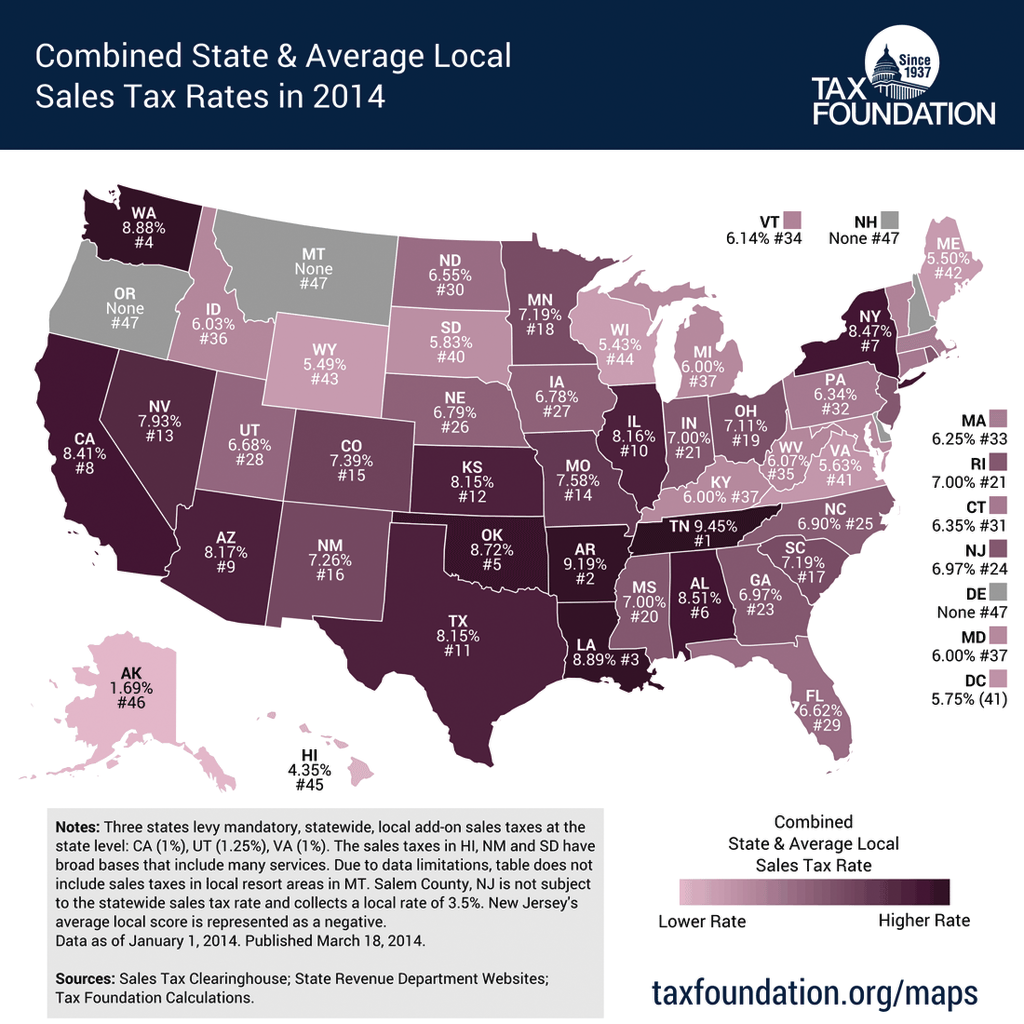

Will and Stanky T Sing the Sales Tax Blues

Many companies know the cure for the payroll blues (implementing the right technology), but now there's also a cure for the sale tax blues. Watch and learn, then take a look at the automated sales tax solutions from Avalara.