April 6, 2021

States Start Taxing Digital Advertising

Digital advertising taxes have been introduced in Connecticut, Indiana, Montana, New York, and Washington, though the Montana measure has already been tabled.

March 25, 2021

Will Digital Advertising Taxes Spread in 2021?

As Maryland prepares to enforce the first digital advertising tax in the nation, Massachusetts and several other states are pursuing digital advertising taxes of their own.

March 24, 2021

Retailers Still Challenged by Wayfair and Marketplace Sales Tax Laws

The United States Supreme Court decision in South Dakota v. Wayfair, Inc. set off an avalanche of economic nexus and marketplace facilitator laws. More than two years later, retailers of all sizes are still grappling with the debris.

March 22, 2021

Alcohol Sellers Face More Complex Nexus Rules

When we talk to direct-to-consumer (DTC) shippers of alcohol, fairly consistently there’s either a lack of awareness about how economic nexus laws can impact their business or a lot of confusion about when and how nexus changes their tax compliance ...

March 22, 2021

Georgia May Start Taxing Digital Products in July

Lawmakers in Georgia are looking to extend the state’s sales and use tax to digital goods and services. If House Bill 594 is enacted as written, audiovisual works, electronic books, video games, and a host of other digital products and services would ...

March 11, 2021

Vertex and BigCommerce Partner for Streamlined Sales Tax Compliance

The partnership further expands the network of Vertex integrations connecting tax to ERP, procurement, billing and e-commerce systems, enabling retailers to seamlessly calculate tax for every transaction.

February 24, 2021

Americans Pay More Than $525,000 In Tax Over A Lifetime

The US government collects over $5.3 trillion in taxes each year, but how much will the average American pay in taxes throughout their lifetime? We used the Bureau of Labor Statistics’ expenditure numbers to see what we as Americans were spending each day to work out what taxes we would be paying until we’re no...…

December 2, 2018

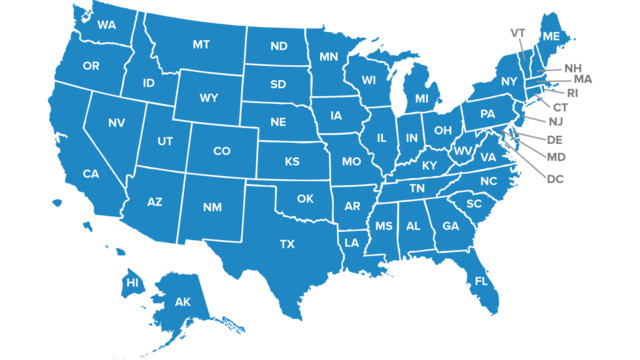

Guide to Sales and Use Taxes on Shipping for Every U.S. State

Ready or not, the holidays are here. This is the busiest time of year for most retailers — and typically involves an enormous amount of shipping. A review of state sales tax rules for shipping and delivery charges therefore seems in order.

February 6, 2018

The Secret Lives of Accountants

Over the centuries, accountants have been fashionistas, inventors, and spies. They fight crime, write books, and uphold the law. The more one learns about accountants, the more surprises one uncovers. Secret lives, indeed.

November 7, 2017

How the Digital Revolution Is Changing the Sales and Use Tax Landscape

Recently, tax authorities have begun a wholesale shift in indirect tax compliance to enhance their collections and audit processes.

August 18, 2017

The Three Most Misunderstood Tax Deductions (Even for Tax Professionals)

Each year during tax time the “most overlooked” tax deductions get a lot of press. And every year the lists include the same deductions, such as state sales tax, student loan interest, job hunting costs, and moving expenses.