May 25, 2013

New Hampshire Senate nixes tobacco & gas tax hikes

In what a key lawmaker called "retribution" for casino gambling being killed by the House, the state Senate Thursday killed the House-passed 67 percent hike in the state's gasoline tax.

May 25, 2013

In what a key lawmaker called "retribution" for casino gambling being killed by the House, the state Senate Thursday killed the House-passed 67 percent hike in the state's gasoline tax.

May 24, 2013

Some municipalities along South Carolina's Grand Strand have begun to look at fee increases as a way to bolster revenue while keeping residents' property tax rates steady.

May 23, 2013

New businesses would operate completely tax free for 10 years, including no income tax for employees, as well as no sales, property or business taxes.

May 23, 2013

May 23–Seattle Public Schools may have to repay as much as $490,000 to the federal government because state auditors say the district did not spend some of its federal grant money appropriately in the 2011-12 school year. The auditors, in one of their regular audits of the school district, questioned how the district spent funds...…

May 20, 2013

The Minnesota House has passed a tax bill that could raise revenue $2.1 billion by boosting taxes on high-wage earners, smokers and corporations.

May 17, 2013

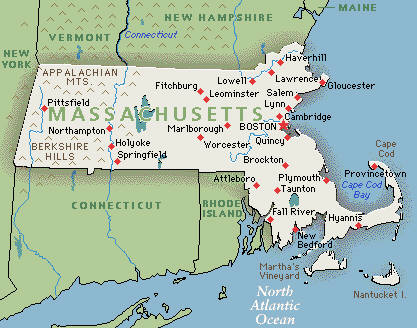

Higher payroll taxes and federal sequestration spending cuts are keeping the Bay State stuck in a "soft patch" of economic growth that could last until the end of the year unless federal fiscal policy changes are put into immediate action, experts said yesterday, as new numbers show the state losing jobs.

May 14, 2013

Lawmakers on Friday were presented with a dramatic tax reform proposal co-sponsored by bipartisan group of legislators.

May 14, 2013

Whether Missouri individuals and businesses get the first state income tax cut in 90 years is up to Gov. Jay Nixon.

May 13, 2013

Taxes collected from all retail sales grew by 5 percent in Washington state last year, the biggest jump from one year to the next since the recession began in 2008.

May 13, 2013

North Carolina's "death tax" has one foot in the grave after a Wilson lawmaker's bill passed the state House on Wednesday.

May 9, 2013

South Carolina needs to spend nearly $15 million next year to bolster cybersecurity in the wake of the largest hacking at a U.S. state agency, a consultant told state leaders Wednesday.

May 8, 2013

Under Cuccinelli's proposal, the income tax rate would drop from 5.75 percent to 5 percent over four years starting in 2014, and the corporate income tax rate would drop from 6 percent to 4 percent.